Alkami Technology Inc (ALKT) Reports Growth in Revenue and Adjusted EBITDA Despite Net Loss ...

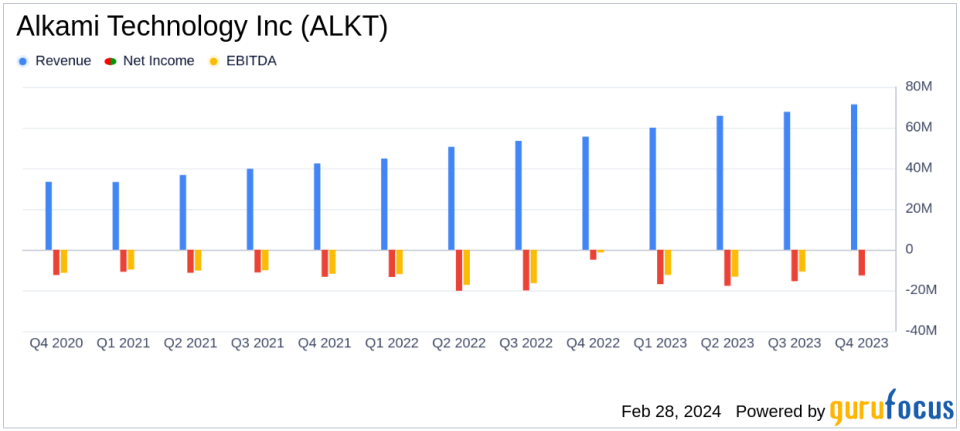

Revenue Growth: Q4 GAAP total revenue increased by 29% year-over-year to $71.4 million, with full-year revenue up 30% to $264.8 million.

Gross Margin Improvement: Q4 GAAP gross margin improved to 56%, with non-GAAP gross margin reaching 60%.

Net Loss: GAAP net loss widened to $(12.7) million in Q4 from $(4.9) million in the year-ago quarter, with full-year net loss at $(62.9) million.

Adjusted EBITDA: Q4 adjusted EBITDA turned positive at $3.1 million, a significant improvement from a $(4.0) million loss in the year-ago quarter.

User Growth: Registered users on the Alkami platform increased to 17.5 million, with annual recurring revenue (ARR) growing by 29%.

On February 28, 2024, Alkami Technology Inc (NASDAQ:ALKT) released its 8-K filing, announcing financial results for the fourth quarter and full year ending December 31, 2023. The company, a leading provider of cloud-based digital banking solutions, reported a significant increase in revenue and adjusted EBITDA, alongside a widened net loss for the quarter and full year.

Alkami's platform, which supports financial institutions (FIs) in onboarding, engaging users, and improving operational efficiency, has continued to see strong adoption, as evidenced by the growth in registered users and ARR. The company's focus on expanding its client base and retaining existing clients has been fruitful, with 39 new logos added in 2023 and a retention rate of 100% for clients on its digital banking platform.

Financial Performance and Challenges

Alkami's revenue growth is a testament to the company's ability to attract new clients and expand its services among existing clients. The improvement in gross margins, both GAAP and non-GAAP, reflects Alkami's efficiency gains. However, the company's net loss has expanded, primarily due to increased operating expenses and investments in growth. This widening loss underscores the challenges Alkami faces in balancing growth investments with profitability.

Financial Achievements and Industry Significance

The increase in Alkami's revenue and user base is particularly significant in the competitive software industry, where ongoing innovation and client expansion are critical for success. The company's ability to grow its ARR by 29% year-over-year to $291 million is indicative of the strong demand for its digital banking solutions and the scalability of its business model.

Key Financial Metrics

Alkami's balance sheet shows a decrease in cash and cash equivalents from $108.7 million in 2022 to $40.9 million in 2023, reflecting the company's investments in growth. The company's total assets decreased to $399.8 million from $488.9 million in the previous year, while total liabilities decreased to $74.9 million from $154.8 million, improving the company's overall financial position.

"In the fourth quarter, we continued to drive strong growth, fueled by operational and financial execution," said Alex Shootman, CEO of Alkami. "As we look ahead to the remainder of 2024, we will sharpen our focus on helping our clients get to market faster, driving more effective integration across sales and service capabilities, cultivating and converting our bank pipeline, and building and scaling our leadership to achieve our objectives."

"We added 3 million registered users to our digital banking platform, ending the year with 17.5 million digital banking users," said Bryan Hill, CFO of Alkami. "Our remaining purchase obligation reached $1.1 billion at December 31, 2023, providing substantial visibility into our future operating and financial performance."

Analysis of Performance

Alkami's performance in 2023 reflects a company in a growth phase, investing heavily in expanding its market share and product offerings. The increase in net loss is a concern but is offset by the strong growth in revenue and user base, which are key drivers of future profitability. The company's focus on integration and market speed, as mentioned by CEO Alex Shootman, suggests a strategic approach to maintaining its growth trajectory while addressing operational efficiency.

For investors, Alkami's growing ARR and user base, along with its substantial future purchase obligations, offer a clear picture of the company's potential for sustained growth. However, the challenge remains for Alkami to translate this growth into profitability in the competitive digital banking solutions market.

For more detailed insights and financial analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Alkami Technology Inc for further details.

This article first appeared on GuruFocus.