Alkermes PLC (ALKS) Reports Strong 2023 Financial Results and Sets Positive Outlook for 2024

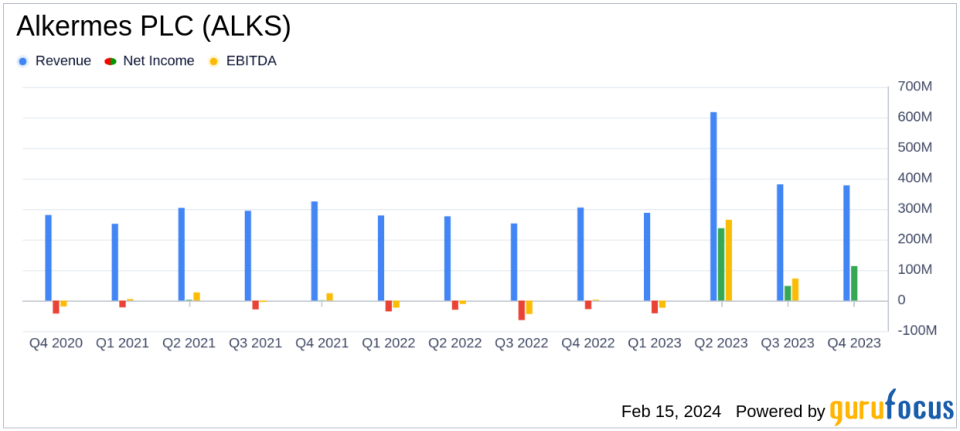

Total Revenues: Increased to $1.66 billion in 2023, up from $1.11 billion in 2022.

Net Sales of Proprietary Products: Grew approximately 18% year-over-year.

GAAP Net Income: Reported at $356 million for 2023, a significant improvement from a net loss in 2022.

Diluted GAAP Earnings per Share: Reached $2.10 for 2023.

EBITDA Margin: Company expects to generate a 30% EBITDA margin in 2024.

On February 15, 2024, Alkermes PLC (NASDAQ:ALKS) released its 8-K filing, announcing its financial results for the fourth quarter and year ended December 31, 2023, and providing financial expectations for 2024. Alkermes, a fully integrated biotechnology company, focuses on developing pharmaceutical products for therapeutic areas with unmet medical needs, leveraging collaborative arrangements to access a variety of resources.

2023 Performance and Future Outlook

Alkermes reported a substantial increase in total revenues to $1.66 billion in 2023, up from $1.11 billion in the previous year. The net sales of proprietary products, including LYBALVI, ARISTADA, and VIVITROL, saw an approximate 18% increase year-over-year. This growth is a testament to the company's strategic focus on its neuroscience portfolio and the successful commercialization of its products.

GAAP net income stood at $356 million, with diluted GAAP earnings per share of $2.10 for 2023, marking a significant turnaround from the net loss reported in 2022. The company's Chief Executive Officer, Richard Pops, highlighted the transition into a pure-play neuroscience company and the positioning for sustained profitability and growth. Pops emphasized the importance of maintaining momentum in product launches and advancing the development pipeline, including the clinical development of ALKS 2680 for narcolepsy treatment.

Financial Achievements and Challenges

The company's financial achievements in 2023 are crucial for Alkermes, as they reflect the successful execution of its strategic initiatives and the strength of its commercial product portfolio. The growth in proprietary product sales is particularly important for a biotechnology firm like Alkermes, as it underscores the company's ability to innovate and meet market demands in the competitive drug manufacturing industry.

However, Alkermes also faces challenges, such as the upcoming expiration of the U.S. royalty related to INVEGA SUSTENNA in August 2024, which is expected to impact total revenues. The company's ability to navigate these challenges and capitalize on its strategic focus will be critical for its future success.

Key Financial Metrics and Commentary

Alkermes reported key financial metrics that provide insights into the company's operational efficiency and profitability. The EBITDA margin expectation of 30% for 2024 signals strong operational performance and the potential for significant cash flow generation. The company's balance sheet remains healthy, with cash, cash equivalents, and total investments of $813.4 million as of December 31, 2023, compared to $740.1 million at the end of the previous year.

"We entered 2024 as a pure-play neuroscience company and are well positioned to deliver on our strategic priorities to drive growth of our proprietary commercial products, advance the clinical development of ALKS 2680 for the treatment of narcolepsy, and generate significant cash flow," said Richard Pops, Chief Executive Officer of Alkermes.

Alkermes' share repurchase program, authorized by the board of directors, allows for the repurchase of up to $400 million of the company's ordinary shares, demonstrating confidence in the company's value and future prospects.

Analysis of Alkermes' Performance

The company's performance in 2023 indicates a robust financial health and a strategic alignment with its core focus on neuroscience. The significant increase in net income and earnings per share, along with the growth in sales of proprietary products, positions Alkermes for a positive outlook in 2024. The company's expectations for the upcoming year, including a projected EBITDA of $445 to $485 million, reflect a continuation of this positive trajectory.

Alkermes' strategic decisions, such as the separation of its oncology business and the sale of its manufacturing facility in Athlone, Ireland, are aligned with its focus on neuroscience and are expected to streamline operations and enhance profitability.

For more detailed information on Alkermes PLC (NASDAQ:ALKS)'s financial results and future expectations, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Alkermes PLC for further details.

This article first appeared on GuruFocus.