Allakos (ALLK) Plummets 60% on Ending Development of Lead Drug

Shares of Allakos ALLK plunged 60.2% on Tuesday after management announced disappointing results from two mid-stage studies evaluating its lead pipeline drug lirentelimab (AK002) in two inflammatory conditions.

Allakos reported top-line data from two studies — the phase II ATLAS study and phase IIb MAVERICK study — which evaluated lirentelimab in atopic dermatitis (AD) and chronic spontaneous urticaria (CSU) indications, respectively. Both studies failed to achieve their primary endpoints.

Following the two back-to-back study failures, Allakos decided not to pursue further clinical development of lirentelimab. Instead, the company will now shift its focus to its early-stage clinical candidate AK006 and other preclinical candidates in its pipeline. These factors were likely responsible for the significant drop in share price.

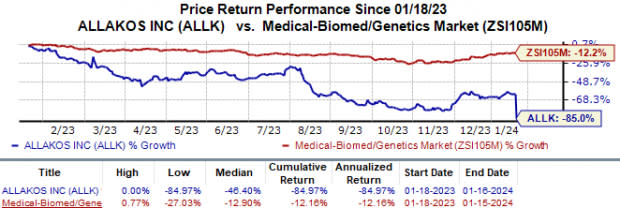

In the past year, Allakos’ stock has plunged 85% compared to the industry’s 12.2% growth.

Image Source: Zacks Investment Research

The decision to terminate lirentelimab has led Allakos to restructure its business operations to reduce costs. In this regard, management plans to reduce its workforce by nearly half. Management believes that this action will likely extend its cash runway into mid-2026. In this regard, Allakos expects to incur around $30 million in restructuring costs, most of which will be spent before the first half of 2024.

Per management, Allakos’ unaudited cash and cash equivalents balance as of Dec 2023-end stood at $171 million. It expects to close 2024 with a cash and cash equivalents balance in the range of $81-$86 million.

Devoid of marketed drugs, Allakos is entirely dependent on AK002 for growth prospects. The candidate is currently being evaluated in an early-stage study of healthy volunteers in two cohorts — a single ascending dose (SAD) and multiple ascending dose (MAD). It expects to complete dosing in both cohorts by the end of this quarter and intends to report data from these cohorts by June-end.

Allakos also intends to start an early-stage study on AK006 in CSU patients before the end of June 2023. It plans to report top-line data from this study before this year’s end.

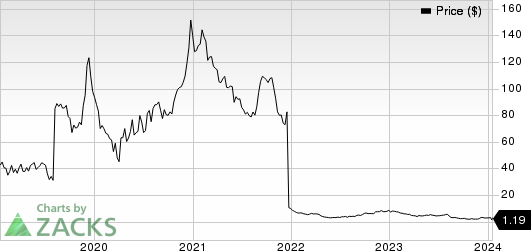

Allakos Inc. Price

Allakos Inc. price | Allakos Inc. Quote

Zacks Rank & Other Key Picks

Allakos currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector include CytomX Therapeutics CTMX, Novo Nordisk NVO and Sarepta Therapeutics SRPT. While CytomX sports a Zacks Rank #1 (Strong Buy), Novo Nordisk and Sarepta carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CytomX Therapeutics for 2023 have swung from a loss of 10 cents per share to earnings of 2 cents. During the same period, estimates for 2024 have narrowed from a loss of 22 cents to a loss of 6 cents. Shares of CytomX have lost 34.2% in the past year.

CytomX Therapeutics’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 45.44%. In the last reported quarter, CytomX Therapeutics’ earnings beat estimates by 123.53%.

In the past 60 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $2.62 to $2.63. During the same period, the earnings estimates for 2024 have risen from $3.07 to $3.12. Shares of NVO have surged 52.5% in the past year.

Novo Nordisk’s earnings beat estimates in two of the last four quarters while meeting the mark on one occasion and missing the estimates on another. On average, the company witnessed an average surprise of 0.58%. In the last reported quarter, Novo Nordisk’s earnings beat estimates by 5.80%.

In the past 60 days, Sarepta’s loss estimates for 2023 have improved from a loss of $6.95 per share to $6.55 per share. During the same period, earnings estimates per share for 2024 have risen from 96 cents to $2.01. Sarepta’s shares have lost 10.4% in the past year.

Sarepta’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 48.67%. In the last reported quarter, Sarepta’s earnings beat estimates by 72.29%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

Allakos Inc. (ALLK) : Free Stock Analysis Report