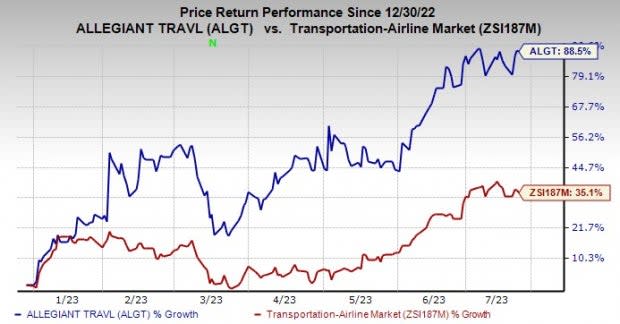

Allegiant (ALGT) Shares Rise 88.5% in YTD Period: Here's Why

Allegiant Travel Company ALGT is being aided by upbeat air-travel-demand scenario in the United States. Owing to increased passenger volumes ALGT recently reported buoyant traffic data for June.

In June 2023, revenue passenger miles (a measure of traffic) and available seat miles (a measure of capacity) increased 2.3% and 2.1%, respectively, from the year-ago levels. Also, scheduled departures rose 2.3% year over year. Moreover, load factor (percentage of seats filled by passengers) grew 0.2 point to 90.1% in June 2023 as the traffic increase was more than the capacity expansion.

Capacity (systemwide) improved 2.6% year over year for June 2023. Departures (systemwide) improved 2.9% from the year-ago actuals. The estimated average fuel cost per gallon for June was $2.64 (systemwide).

Image Source: Zacks Investment Research

Apart from the upbeat traffic report, Allegiant’s second-quarter 2023 earnings have increased 24.5% in the past 60 days. The stock has gained 88.5% in the year-to-date period compared with 35.1% growth of the industry it belongs to.

Zacks Rank & Other Stocks to Consider

ALGT currently carries Zacks Rank #2 (Buy).

Some other top-ranked stocks for investors interested in the Zacks Transportation sector are Copa Holdings, S.A. CPA and Kirby Corporation KEX.

Copa Holdings, which presently carries a Zacks Rank #2, is aided by improved air-travel demand. We are encouraged by the company’s initiatives to modernize its fleet. CPA's focus on its cargo segment is also impressive. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For second-quarter and full-year 2023, CPA’s earnings are expected to register 915.6% and 89% surge, respectively, on a year-over-year basis.

Kirby currently carries a Zacks Rank #2. Strong segmental performances are boosting Kirby’s top line. The distribution and services segment is benefiting from increased demand for products and services.

For second-quarter and full-year 2023, KEX’s earnings are expected to register 69.4% and 70.5% rise, respectively, on a year-over-year basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report