Allegiant Travel Co (ALGT) Posts Mixed Q4 and Robust Full-Year 2023 Financial Results

Q4 Revenue: Remained stable at $611.0 million compared to the prior year.

Q4 Operating Income: Experienced a significant decrease to $10.6 million, down 88.1% YoY.

Full-Year Revenue: Increased by 9.0% to $2.5 billion compared to 2022.

Full-Year Net Income: Excluding special charges, net income soared to $136.6 million, a 311.4% increase YoY.

Earnings Per Share (EPS): Full-year diluted EPS, excluding special charges, was $7.31, up from $1.81 in 2022.

Liquidity and Debt: Total available liquidity at year-end was $1.1 billion, with a net debt position of $1.4 billion.

Operational Highlights: Achieved a controllable completion of 99.8% and an airline-only operating margin, excluding specials, of over 11%.

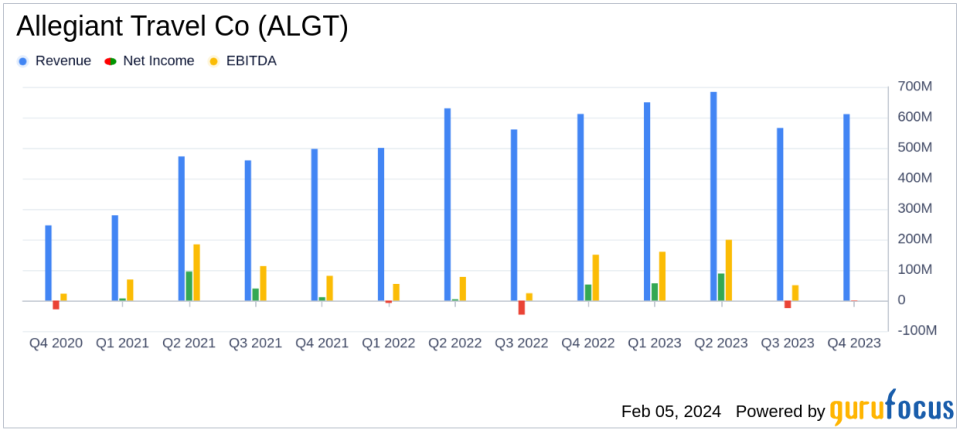

On February 5, 2024, Allegiant Travel Co (NASDAQ:ALGT) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. The company, known for providing travel services in the United States, including air transportation, charter service, and travel-related products, faced a challenging fourth quarter but demonstrated resilience with a strong annual performance.

Fourth Quarter Financials

For the fourth quarter, ALGT reported a slight year-over-year (YoY) decrease in total operating revenue, which remained virtually flat at $611.0 million. However, the company faced a substantial decline in operating income, which plummeted by 88.1% to $10.6 million. This was primarily due to an increase in total operating expenses, up 14.9% YoY. The GAAP diluted loss per share for the quarter was $(0.13), but when excluding special charges, the diluted earnings per share stood at $0.11.

Annual Performance Highlights

ALGT's full-year results painted a brighter picture. Total operating revenue for 2023 increased by 9.0% to $2.5 billion, compared to $2.3 billion in 2022. The company's focus on operational efficiency and strategic initiatives led to a significant improvement in net income, which, excluding special charges, reached $136.6 million, marking a 311.4% increase from the previous year. The full-year GAAP diluted earnings per share was $6.29, with a notable rise to $7.31 when excluding special charges.

Operational and Strategic Achievements

Allegiant's operational performance in 2023 was commendable, with a controllable completion rate of 99.8% and an airline-only operating margin, excluding special charges, of more than 11%. The company's unique business model and strategic focus on being a profitable leisure-focused carrier (PLFC) have proven effective. The opening of the Sunseeker Resort on December 15, 2023, marked a significant milestone in the company's history, offering a world-class leisure destination to customers. Early bookings for the resort have been encouraging, with expectations to be EBITDA positive during 2024.

Financial Health and Future Outlook

ALGT's balance sheet remains solid, with total available liquidity at the end of 2023 standing at $1.1 billion. The company managed its debt levels effectively, with total debt at $2.3 billion and net debt at $1.4 billion. Looking ahead, ALGT provided guidance for the first quarter of 2024, projecting an airline-only system available seat miles (ASMs) year-over-year change of approximately 1.0% and an operating margin between 8.0% to 10.0%. The company's focus for 2024 will be on optimization and operational excellence, with the induction of Boeing MAX aircraft expected to enhance operational reliability and customer experience.

Allegiant's leadership expressed pride in the company's 2023 achievements and is committed to restoring margins to historical levels while continuing to integrate Sunseeker Resort into its business model. The company's Allways Rewards program and Allegiant credit card continue to grow, adding value for customers and strengthening the brand.

For detailed financial information and a complete analysis of ALGT's performance, investors and interested parties are encouraged to review the full 8-K filing.

Allegiant Travel Co (NASDAQ:ALGT) will host a conference call to discuss these results and provide further insights into the company's strategy and outlook.

Explore the complete 8-K earnings release (here) from Allegiant Travel Co for further details.

This article first appeared on GuruFocus.