Allegion (ALLE) Beats on Q3 Earnings, Raises 2023 EPS View

Allegion plc’s ALLE third-quarter 2023 adjusted earnings of $1.94 per share beat the Zacks Consensus Estimate of adjusted earnings of $1.71 cents per share. The bottom line improved 12.1% year over year.

Revenue Details

In the quarter under review, Allegion’s revenues were $917.9 million, increasing 0.5% from the year-ago quarter. However, organic sales in the quarter decreased 0.6% due to lower volumes in the mechanical portfolio. Allegion’s revenues missed the Zacks Consensus Estimate of $919 million.

Acquired assets boosted sales by 0.1%. Forex woes left a positive impact of 1% on revenues.

ALLE reported revenues under two segments. A brief discussion of the quarterly results is provided below:

Revenues from Allegion Americas decreased 0.1% year over year to $740.9 million. The figure accounted for 80.7% of the quarter’s sales. Our estimate for segmental revenues was $744.8 million.

Forex woes left a positive impact of 0.1% on revenues. Operating income was $200.2 million for the quarter, up 12.2% year over year. Our estimate for the quarter was $188.8 million.

Revenues from Allegion International were $177.0 million in the quarter, up 3% year over year. The metric accounted for 19.3% of the quarter’s sales. Our estimate for segmental revenues was $174.6 million.

Organic sales decreased 2.8% year over year while foreign currency translation had a negative impact of 5.2% on sales. Operating income was $15.7 million for the quarter, up 6.1% year over year. Our estimate for the quarter was $14.8 million.

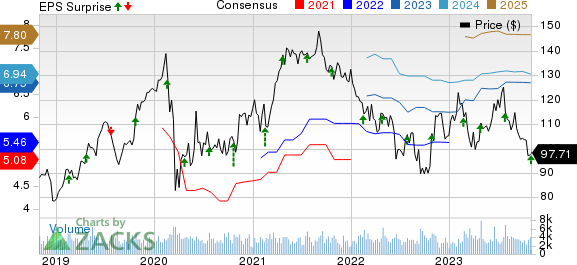

Allegion PLC Price, Consensus and EPS Surprise

Allegion PLC price-consensus-eps-surprise-chart | Allegion PLC Quote

Margin Profile

In the reported quarter, Allegion’s cost of sales decreased 5.7% year over year to $514.6 million. The gross profit increased 9.6% year over year to $403.3 million while the gross margin jumped 360 basis points (bps) to 43.9%.

Selling and administrative expenses increased 2.5% year over year to $210.2 million. Adjusted EBITDA was $219.1 million, reflecting a year-over-year increase of 5%. The margin grew 150 bps year over year to 29.6%.

The adjusted operating income in the quarter increased 11.7% year over year to $215.9 million. The adjusted margin was 23.5%, up 230 bps. The results were attributable to the positive price and productivity net of inflation and investments.

Interest expenses were $22.9 million, down 0.9% year over year due to lower outstanding indebtedness. The effective tax rate in the quarter was 8.1%, down from 14.3% in the year-ago quarter.

Balance Sheet and Cash Flow

While exiting the third quarter of 2023, Allegion had cash and cash equivalents of $364.3 million compared with $288.0 million at the end of fourth-quarter 2022. Long-term debt was $2,005.1 million compared with $2,081.9 million reported at the end of fourth-quarter 2022.

In the first nine months of 2023, ALLE generated net cash of $381.1 million from operating activities, increasing 42.7% from the previous year’s level. Capital expenditure was $60.7 million, increasing 46.3% year over year. The free cash flow was $320.4 million for the first nine months of 2023.

In the same period, Allegion repurchased shares for $19.9 million, down 67.4% year over year. Dividends paid out totaled $119.2 million, reflecting an increase of 10.3% from the previous year’s level.

Outlook

ALLE has affirmed its sales guidance for 2023. Allegion now expects revenues of 11.5-12.5%. The company anticipates organic sales of 5.5-6.5%.

However, the company has increased its 2023 earnings guidance. Earnings are predicted to be $6.10-$6.20 per share. Adjusted earnings are likely to be $6.80-$6.90 per share compared with $6.70-$6.80 per share stated before. The Zacks Consensus Estimate for the same is $6.75 per share.

The company expects a free cash flow of $500-$520 million. The tax rate in the year is expected to be 15%.

Zacks Rank & Stocks to Consider

Allegion currently carries a Zacks Rank #3 (Hold). Some better-ranked companies from the Industrial Products sector are discussed below:

Applied Industrial Technologies, Inc. AIT presently carries a Zacks Rank #2 (Buy) and has a trailing four-quarter earnings surprise of 13.9%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AIT’s earnings estimates have increased 2.8% for fiscal 2024 (ending June 2024) in the past 60 days. Shares of Applied Industrial have risen 16.7% in the past year.

Axon Enterprise, Inc. AXON currently carries a Zacks Rank of 2. The company delivered a trailing four-quarter earnings surprise of approximately 60.2%, on average.

In the past 60 days, estimates for Axon’s earnings have remained steady for 2023. The stock has soared 36.6% in the past year.

Caterpillar Inc. CAT presently carries a Zacks Rank of 2. CAT’s earnings surprise in the last four quarters was 18.5%, on average.

In the past 60 days, estimates for Caterpillar’s 2023 earnings have increased 1.5%. The stock has gained 10.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report