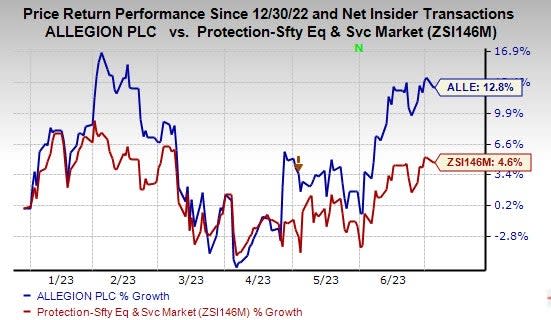

Allegion (ALLE) Rises 12.8% YTD: Will the Momentum Continue?

Shares of Allegion plc ALLE have gained 12.8% in the year-to-date period compared with the industry’s 4.6% growth. The upside can be linked to strengthening end-market demand and effective pricing actions. Shareholder-friendly policies further drove the stock.

What’s Aiding ALLE?

Strengthening demand in end markets and effective pricing policies are benefiting Allegion. Strength in non-residential, residential and electronics end markets are aiding ALLE’s Allegion Americas segment. The Access Technologies acquisition also bodes well for the segment.

ALLE’s bullish full-year outlook holds promise. For 2023, Allegion predicts revenues to increase 11.5-13.5% compared with 9-10.5% mentioned earlier. The company anticipates organic sales of 5.5-7.5% compared with 2.5-4.5% stated earlier. Adjusted earnings per share are anticipated to be $6.55-$6.75. This compares favorably with the 2022 figure of $5.69.

Image Source: Zacks Investment Research

The company’s portfolio-reshaping actions have been beneficial. Allegion acquired Plano Group through one of its subsidiaries in January 2023. The acquisition expands ALLE’s Interflex portfolio and AWFM business with new capabilities in SaaS models and recurring revenue solutions. In the first quarter of 2023, acquisitions had a positive impact of 14.1% on the company’s revenues.

Allegion’s commitment to rewarding shareholders through dividend payments and share buybacks also drove its shares. The company paid out dividends of $39.4 million in the first three months of 2023, reflecting an increase of 10.1% from the previous year’s level. In February 2023, ALLE hiked its quarterly dividend rate by 10%.

Will the Trend Last?

Improving supply chains are expected to drive Allegion’s performance going forward. Due to the late cycle nature of the business, ALLE expects its Allegion Americas segment’s end market strength to continue for the rest of 2023, which in turn will benefit the company.

Zacks Rank & Other Stocks to Consider

ALLE currently carries Zacks Rank #2 (Buy). Some other top-ranked companies from the Industrial Products sector are discussed below:

Alamo Group Inc. ALG currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

ALG delivered a trailing four-quarter earnings surprise of 17.7%, on average. In the past 60 days, estimates for Alamo’s 2023 earnings have increased 12.7%. The stock has gained 30.5% in the year-to-date period.

Axon Enterprise AXON sports a Zacks Rank of 1 at present. The company has a trailing four-quarter earnings surprise of 44.4%, on average.

In the past 60 days, estimates for Axon’s 2023 earnings have increased 12.6%. The stock has rallied 17.3% in the year-to-date period.

A. O. Smith Corporation AOS presently carries a Zacks Rank of 2. AOS’ earnings surprise in the last four quarters was 8%, on average.

In the past 60 days, estimates for A. O. Smith’s 2023 earnings have increased 0.6%. The stock has gained 26.4% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report