Allegion (ALLE) Signs Agreement to Acquire Plano Group Assets

Allegion plc ALLE has signed a definitive agreement to acquire assets of software-as-a-service (SaaS) workforce management solutions company, Plano Group, through one of its subsidiaries. Terms of the agreement were not disclosed.

Plano has long been a development partner for Allegion’s European workforce management brand, Interflex, and its SP-EXPERT software platform. As part of the Interflex portfolio, Plano will continue to serve advanced workforce management (AWFM) customers after the closure of the acquisition, expected in the first quarter of 2023.

The acquisition will expand the Interflex portfolio and its AWFM business with new capabilities in SaaS models and recurring revenue solutions. It will help Allegion expand its presence in lucrative end markets such as healthcare, banking and insurance, call centers, retail and municipal government services.

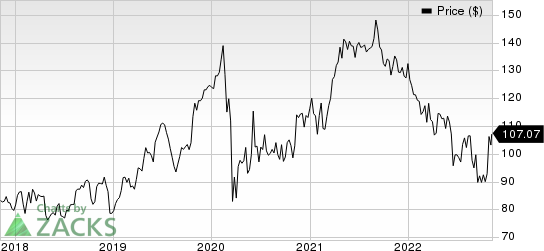

Allegion PLC Price

Allegion PLC price | Allegion PLC Quote

Post completion of the transaction, Plano’s founder, Robert Schüler, will join Interflex. Bernhard Sommer, general manager of Interflex said, "This strategic acquisition represents a significant expansion of our position as a market leader in workforce management while underscoring our commitment to growth and meeting customer needs through investment in software solutions."

Zacks Rank & Key Picks

Allegion currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies within the broader Industrial Products sector are as follows:

Enerpac Tool Group Corp. EPAC delivered an average four-quarter earnings surprise of 3.4%. EPAC presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

Enerpac Tool’s estimated earnings growth rate for the current fiscal year is 44.6%. Shares of the company have jumped approximately 30% in the past six months.

Applied Industrial Technologies, Inc. AIT presently flaunts a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 24.8%, on average.

Applied Industrial has an estimated earnings growth rate of 14.3% for the current fiscal year. Shares of the company have gained 19.6% in the past six months.

IDEX Corporation IEX presently has a Zacks Rank of 2 (Buy). IDEX pulled off a trailing four-quarter earnings surprise of 5.7% on average.

IDEX has an estimated earnings growth rate of 28.3% for the current year. Shares of the company have rallied 19.4% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research