Allegion PLC (ALLE) Delivers Record Full-Year Results Amidst Market Challenges

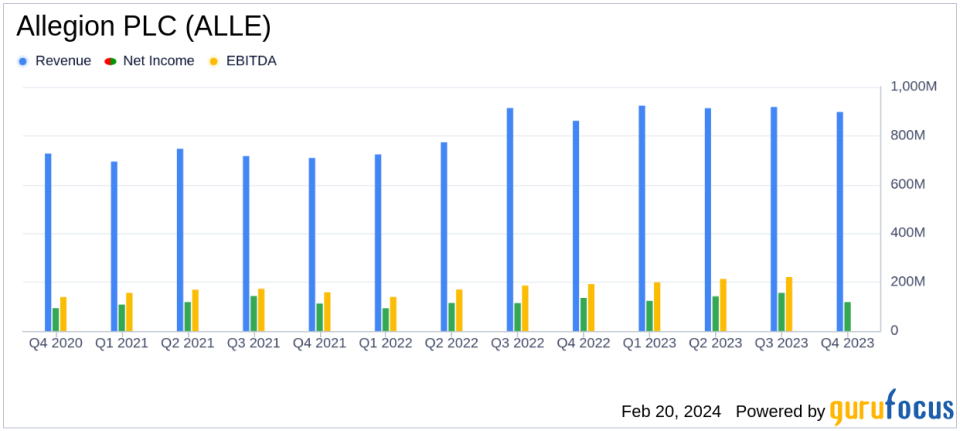

Revenue: Full-year revenue increased by 11.6% to $3.65 billion, with organic growth of 5.2%.

Net Earnings: Net earnings for the year rose to $540.4 million, with a 17.9% increase in EPS to $6.12.

Adjusted Operating Margin: Improved by 160 basis points to 22.1% for the full year.

Available Cash Flow: Grew by 30.6% to $516.4 million in 2023.

2024 Outlook: Anticipates revenue growth of 1.5% to 3.5% and adjusted EPS of $7.00 to $7.15.

On February 20, 2024, Allegion PLC (NYSE:ALLE) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, known for its leading security products and solutions, including brands like Schlage and Von Duprin, has reported solid performance despite market challenges.

Financial Performance and Challenges

For the fourth quarter, Allegion reported a slight decrease in net earnings per share (EPS) by 12.4% to $1.34, while adjusted EPS saw a marginal decline of 0.6% to $1.68. The company's revenues for the quarter rose by 4.2% to $897.4 million, with an organic increase of 2.6%. The adjusted operating margin saw a notable improvement, increasing by 130 basis points to 22.0%. However, the company faced challenges in its residential and Allegion International businesses, which saw declines.

The full-year results were more robust, with a significant 17.9% increase in EPS to $6.12 and an adjusted EPS increase of 16.2% to $6.96. Full-year revenues climbed by 11.6% to $3.65 billion, with organic growth contributing 5.2%. The adjusted operating margin for the year improved by 160 basis points to 22.1%. The company's available cash flow also saw a substantial increase of 30.6% to $516.4 million.

Financial Achievements and Importance

Allegion's financial achievements in 2023, particularly the growth in revenue and adjusted EPS, underscore the company's ability to navigate a challenging market environment effectively. The improvements in operating margin and available cash flow demonstrate Allegion's operational efficiency and financial discipline, which are crucial for sustaining growth and shareholder value in the competitive business services industry.

Key Financial Metrics

Allegion's balance sheet reflects a strong financial position, ending the year with $468.1 million in cash and cash equivalents. The company's total debt stood at $2.015 billion. The increase in available cash flow is attributed to higher net earnings and more efficient working capital management, despite higher capital expenditures.

The company's effective tax rate for the fourth quarter was 13.4%, up from 3.4% in the previous year, with an adjusted effective tax rate of 16.4%, compared to 6.2%. For the full year, the adjusted effective tax rate was 14.3%, up from 12.7% in 2022.

Analysis of Company's Performance

Allegion's performance in 2023 reflects a company that has successfully leveraged its product portfolio and market position to deliver growth. The company's focus on electronics and software solutions, which saw approximately 20% global organic growth, indicates a strategic pivot towards high-growth areas. The increase in dividends, up 7% from the previous dividend, signals confidence in the company's financial health and its commitment to returning value to shareholders.

Looking ahead to 2024, Allegion anticipates continued growth, albeit at a more modest pace, with full-year reported revenue growth estimated to be between 1.5% and 3.5%, and organic revenue growth estimated to be between 1% and 3%. The company's full-year adjusted EPS is estimated to be between $7.00 and $7.15, and available cash flow is projected to be between $540 to $570 million.

Allegion's solid financial performance and positive outlook for 2024 are a testament to its strategic execution and market resilience. As the company celebrates its 10th anniversary as a standalone entity, it remains focused on delivering growth and value in the evolving security products and solutions market.

For more detailed information, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Allegion PLC for further details.

This article first appeared on GuruFocus.