Allegro MicroSystems (ALGM) Affected by United Auto Workers Strike

Chartwell Investment Partners, LLC, an affiliate of Carillon Tower Advisers, Inc., released the “Carillon Chartwell Small Cap Value Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. Information technology and industrials were the top-performing sectors in the Carillon Chartwell Small Cap Growth Fund, with alpha production coming from well-chosen stocks. In contrast, poor stock selection hindered the materials sector's performance. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Carillon Chartwell Small Cap Value Fund highlighted stocks like Allegro MicroSystems, Inc. (NASDAQ:ALGM) in the third quarter 2023 investor letter. Headquartered in Manchester, New Hampshire, Allegro MicroSystems, Inc. (NASDAQ:ALGM) manufactures and markets sensor integrated circuits (ICs) and application-specific analog power ICs. On December 26, 2023, Allegro MicroSystems, Inc. (NASDAQ:ALGM) stock closed at $31.20 per share. One-month return of Allegro MicroSystems, Inc. (NASDAQ:ALGM) was 13.25%, and its shares gained 6.81% of their value over the last 52 weeks. Allegro MicroSystems, Inc. (NASDAQ:ALGM) has a market capitalization of $6.005 billion.

Carillon Chartwell Small Cap Value Fund made the following comment about Allegro MicroSystems, Inc. (NASDAQ:ALGM) in its Q3 2023 investor letter:

"Within the Carillon Chartwell Small Cap Growth Fund, information technology and industrials were the strongest-performing sectors, with strong stock selection leading to alpha generation. Conversely, the performance of the materials sector was challenged due to weak stock selection. Allegro MicroSystems, Inc. (NASDAQ:ALGM) was a weak performer as there are concerns that the strike by the United Auto Workers (UAW) will affect sales of Allegro’s integrated circuits (ICs) to the auto industry in the fourth quarter."

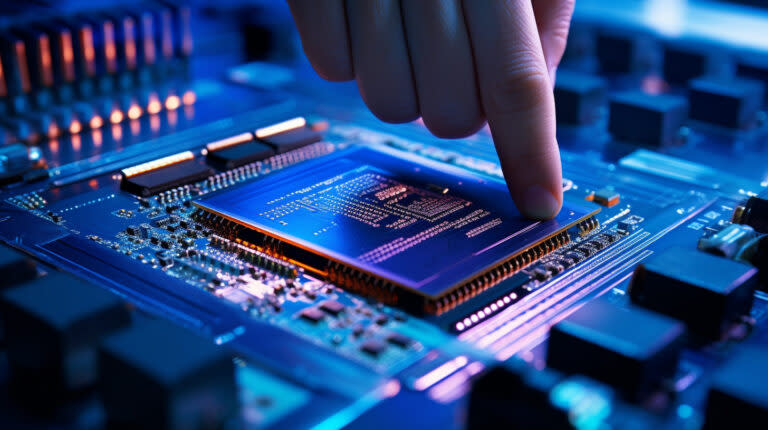

A close up view of mmWave Integrated Circuits with a technician pointing out the intricate components.

Allegro MicroSystems, Inc. (NASDAQ:ALGM) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 24 hedge fund portfolios held Allegro MicroSystems, Inc. (NASDAQ:ALGM)at the end of third quarter which was 26 in the previous quarter.

We discussed Allegro MicroSystems, Inc. (NASDAQ:ALGM) in another article and shared the list of high-growth semiconductor stocks that are profitable. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

Disclosure: None. This article is originally published at Insider Monkey.