AllianceBernstein Holding LP Reports Solid Earnings Amid Market Gains

GAAP Diluted Net Income: Increased to $0.71 per Unit in Q4 2023, up from $0.59 in Q4 2022.

Adjusted Diluted Net Income: Rose to $0.77 per Unit in Q4 2023, compared to $0.70 in the same quarter last year.

Cash Distribution: Set at $0.77 per Unit for Q4 2023, reflecting a 10% increase year-over-year.

Assets Under Management (AUM): Grew to $725.2 billion by the end of 2023, marking a 12.2% increase from the previous year.

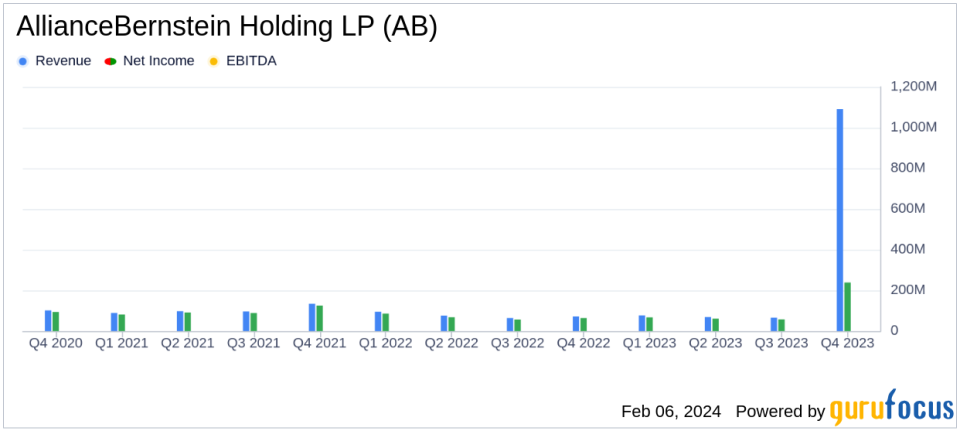

Net Revenues: Increased by 10.2% in Q4 and 2.5% for the full year, driven by higher investment advisory base fees and investment gains.

Operating Income: Improved by 17.1% in Q4, with a slight increase of 0.3% for the full year.

On February 6, 2024, AllianceBernstein Holding LP (NYSE:AB) released its 8-K filing, detailing its financial and operating results for the fourth quarter and the full year ended December 31, 2023. The company, a leading global investment management firm, reported a robust end to the year, buoyed by a strong market performance and strategic growth in key areas.

Company Overview

AllianceBernstein provides comprehensive investment management services to a diverse set of clients, including institutional, retail, and private clients. As of the end of October 2023, AB managed $652 billion in assets, primarily across fixed-income and equity strategies. The company also offers research and brokerage services through its Sanford Bernstein subsidiary, which is currently in an available-for-sale status following a joint venture agreement with Societe Generale.

Performance and Challenges

AB's performance in 2023 was marked by strong gains in equity and fixed income markets, with the company benefiting from the early wave of fixed income allocations. However, the demand for Active Equities was lower, which was largely offset by organic growth in Municipals and Taxable Fixed Income. Despite these positive developments, AB faced challenges, including a decrease in adjusted earnings and unitholder distributions by 9% year-over-year, reflecting the competitive and volatile nature of the investment management industry.

The importance of AB's performance lies in its ability to navigate market conditions and maintain growth in assets under management, which is crucial for sustaining revenue streams and profitability in the asset management sector. The challenges AB faces, such as fluctuations in demand for various asset classes and the potential impact of macroeconomic and geopolitical factors, could pose risks to the company's future growth and profitability.

Financial Achievements

AB's financial achievements in the fourth quarter and full year of 2023 underscore the company's resilience and strategic positioning. The growth in AUM to $725.2 billion represents a significant milestone, reflecting the firm's ability to attract and retain client assets in a competitive landscape. This growth is particularly important for AB, as assets under management are a key driver of revenue in the asset management industry.

Income Statement and Key Metrics

AB's income statement for Q4 2023 showed a 10.2% increase in net revenues compared to Q4 2022, and a 2.5% increase for the full year. Operating income for the quarter rose by 17.1%, with a slight increase of 0.3% for the full year. The operating margin for Q4 improved by 60 basis points to 20.6%, although there was a decrease in the full-year operating margin by 240 basis points to 19.1%. Adjusted operating income for Q4 was $253.9 million, a 5.6% increase from the previous year, and the adjusted operating margin was 29.2%.

These metrics are critical as they reflect the company's profitability and efficiency in generating income from its managed assets. A higher operating margin indicates better cost management and profitability, which is a positive sign for investors and stakeholders.

Commentary from Leadership

"Our fixed income investment performance was strong, with 75% of assets outperforming in 2023. Equity assets lagged with 26% of assets outperforming, reflecting stock selection and concentrated index returns driven by a small number of mega-cap technology stocks. Firmwide gross sales decreased 12% in FY23, primarily attributed to slower Institutional sales as compared with a strong FY22, offsetting 8% sales growth in Retail and 6% in Private Wealth."

"Entering 2024, we maintain a balanced perspective in managing our business. While we enter 2024 with an AUM base 12% above the prior year period, we anticipate markets will continue to reflect a volatile macroeconomic and geopolitical environment. We are committed to investing in select profitable growth opportunities to serve our clients changing needs."

Analysis of Performance

AB's performance in 2023 reflects a strategic balance between growth and risk management. The increase in AUM and net revenues, coupled with a solid operating income, suggests that AB has effectively capitalized on market opportunities while maintaining operational efficiency. However, the decrease in adjusted earnings and distributions indicates that the company must continue to innovate and adapt to the evolving financial landscape to sustain growth and deliver value to unitholders.

For more detailed information and to view the full earnings report, please visit AllianceBernstein's 8-K filing.

Explore the complete 8-K earnings release (here) from AllianceBernstein Holding LP for further details.

This article first appeared on GuruFocus.