AllianceBernstein L.P. Reduces Stake in Silk Road Medical Inc.

On July 31, 2023, AllianceBernstein L.P., a prominent investment firm, executed a significant transaction involving Silk Road Medical Inc. (NASDAQ:SILK). The firm reduced its holdings in the medical device company by 2,415,071 shares, a change of -98.10%. This article provides an in-depth analysis of the transaction, the profiles of both AllianceBernstein L.P. and Silk Road Medical Inc., and the potential implications for value investors.

Details of the Transaction

The transaction took place on July 31, 2023, with AllianceBernstein L.P. reducing its stake in Silk Road Medical Inc. by a substantial 98.10%. This resulted in a decrease of 2,415,071 shares, leaving the firm with a total of 46,800 shares in the company. The transaction was executed at a trade price of $22.84 per share and had a -0.02% impact on AllianceBernstein L.P.'s portfolio. Following the transaction, the firm's position in Silk Road Medical Inc. stands at 0.10%.

Profile of AllianceBernstein L.P.

AllianceBernstein L.P. is a globally recognized investment firm with roots dating back to 1967 and 1971. The firm was established through the merger of Sanford C. Bernstein and Alliance Capital in 2000, combining their respective expertise in value equity and growth equity. Today, AllianceBernstein L.P. manages nearly half a trillion in assets, with institutional assets making up about half of its total assets under management. The firm's top holdings include Amazon.com Inc(NASDAQ:AMZN), Alphabet Inc(NASDAQ:GOOG), Microsoft Corp(NASDAQ:MSFT), UnitedHealth Group Inc(NYSE:UNH), and Visa Inc(NYSE:V). The firm's equity stands at $232.6 billion, with a strong focus on the Technology and Healthcare sectors.

Profile of Silk Road Medical Inc.

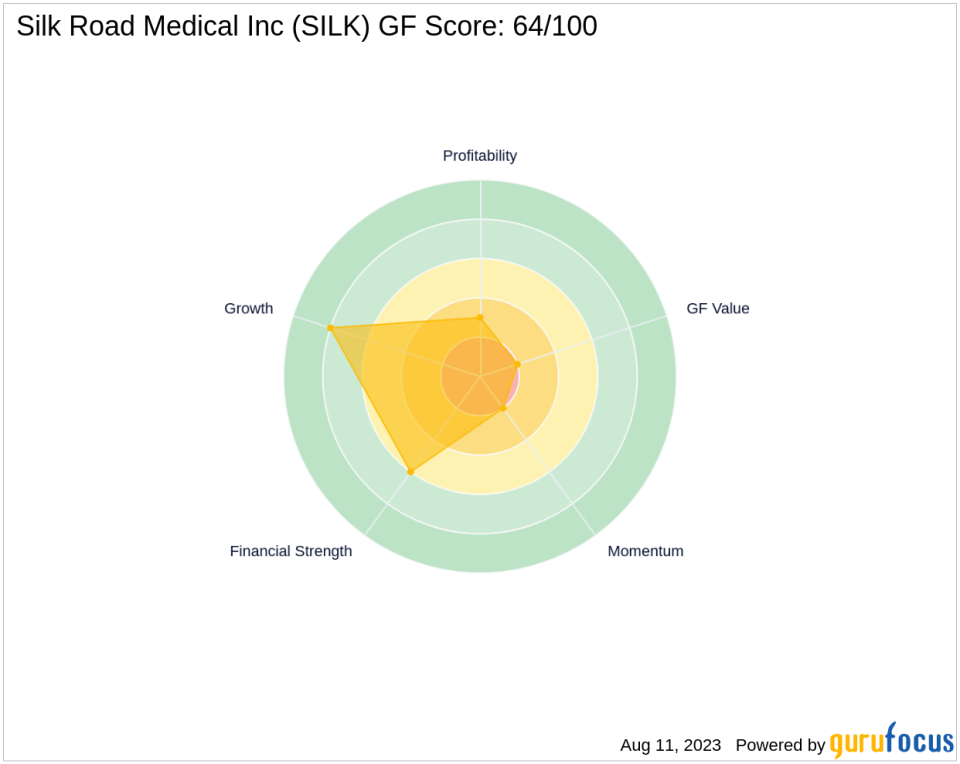

Silk Road Medical Inc., a U.S.-based medical device company, was established in 2019. The company is known for its innovative approach to the treatment of carotid artery disease, known as transcarotid artery revascularization (TCAR). As of August 11, 2023, the company's market capitalization stands at $766.563 million, with a stock price of $19.74. However, the company's GF Value is listed as a possible value trap, indicating that investors should exercise caution. The company's GF-Score is 64/100, suggesting poor future performance potential.

Analysis of Silk Road Medical Inc.'s Financial Performance

Silk Road Medical Inc.'s financial performance reveals a mixed picture. The company's Financial Strength is ranked 6/10, while its Profitability Rank is 3/10. The company's Growth Rank is 8/10, indicating a strong growth potential. However, its GF Value Rank and Momentum Rank are both 2/10, suggesting a potential value trap and weak momentum, respectively. The company's Piotroski F-Score is 3, indicating a poor financial health.

Comparison with the Largest Guru Holder of Silk Road Medical Inc.

The largest guru holder of Silk Road Medical Inc. is Baron Funds. However, the exact share percentage held by Baron Funds is not available. A comparison of Baron Funds' position in Silk Road Medical Inc. with that of AllianceBernstein L.P. would provide a more comprehensive understanding of the stock's potential.

Conclusion

AllianceBernstein L.P.'s recent transaction involving Silk Road Medical Inc. represents a significant shift in the firm's investment strategy. While the firm's reduction in its stake in the company may raise questions among investors, it's important to consider the broader financial performance and market conditions. As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.