Alliant Energy (LNT) Q2 Earnings Top Estimates, Revenues Fall Y/Y

Alliant Energy Corporation LNT reported second-quarter 2023 operating earnings of 64 cents per share, which surpassed the Zacks Consensus Estimate of 59 cents by 8.5%. The bottom line also improved 1.6% from the year-ago quarter’s figure of 63 cents.

Revenues

Revenues totaled $912 million, which missed the Zacks Consensus Estimate of $1,049 million by 13.1%. The top line also decreased 3.3% from the year-ago quarter’s level of $943 million.

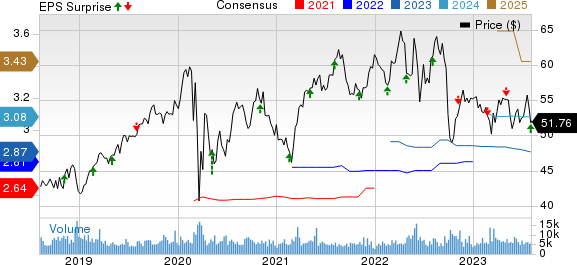

Alliant Energy Corporation Price, Consensus and EPS Surprise

Alliant Energy Corporation price-consensus-eps-surprise-chart | Alliant Energy Corporation Quote

Operational Highlights

Total operating expenses amounted to $695 million for the quarter, down 4.9% from $731 million in the year-ago period. This was due to lower electric production fuel and purchased power and reduced cost of gas sold.

Operating income totaled $217 million, up 2.4% from $212 million reported in the year-ago quarter. Our model predicted operating income of $247.4 million for the second quarter.

Interest expenses amounted to $96 million, 23% higher than that recorded in the prior-year period.

The company’s retail electric customers increased 0.7% year over year.

LNT reported total utility electric sales of 7,778 thousand megawatt-hour (MWh), up 2.4% from the year-ago quarter’s figure. Our model predicted total utility electric sales of 7,577 thousand MWh for the same period.

Total utility gas sold and transported were 32,081 thousands of dekatherms, up 7% year over year. Our model projected the same to be 30,277 thousands of dekatherms in the reported quarter. LNT’s retail gas customers increased 0.6% year over year.

Financial Update

Cash and cash equivalents amounted to $13 million as of Jun 30, 2023, compared with $20 million as on Dec 31, 2022.

Long-term debt (excluding the current portion) totaled $8,186 million as of Jun 30, 2023, higher than $7,668 million as of Dec 31, 2022.

For the first six months of 2023, cash flow from operating activities totaled $311 million compared with $300 million in the year-ago period.

Guidance

Alliant Energy reaffirmed its 2023 earnings guidance in the range of $2.82-$2.96 per share. The projection takes into account normal temperature in its service territories, execution of cost controls and consolidated effective tax rate of 2%. The Zacks Consensus Estimate for 2023 earnings is pegged at $2.87 per share, marginally lower than the midpoint of the company’s guided range.

Zacks Rank

Currently, Alliant Energy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Release

WEC Energy Group WEC reported second-quarter 2023 earnings of 92 cents per share, which beat the Zacks Consensus Estimate of 85 cents by 8.24%.

WEC’s long-term (three to five years) earnings growth rate is 5.76%. It delivered an average earnings surprise of 6.6% in the last four quarters.

Upcoming Releases

Duke Energy DUK is scheduled to report second-quarter results on Aug 8, before market open. The Zacks Consensus Estimate for earnings is pinned at 98 cents per share.

DUK’s long-term earnings growth rate is 6.12%. The consensus mark for 2023 EPS is pinned at $5.61, implying a year-over-year improvement of 6.5%.

NRG Energy, Inc. NRG is scheduled to report second-quarter results on Aug 8, before market open. The Zacks Consensus Estimate for earnings is pegged at $1.07 per share.

NRG’s long-term earnings growth rate is 4.03%. The consensus mark for 2023 EPS is pegged at $4.66, implying a year-over-year improvement of 77.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report