Allied Healthcare Products (NASDAQ:AHPI) Is Making Moderate Use Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Allied Healthcare Products, Inc. (NASDAQ:AHPI) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Allied Healthcare Products

What Is Allied Healthcare Products's Net Debt?

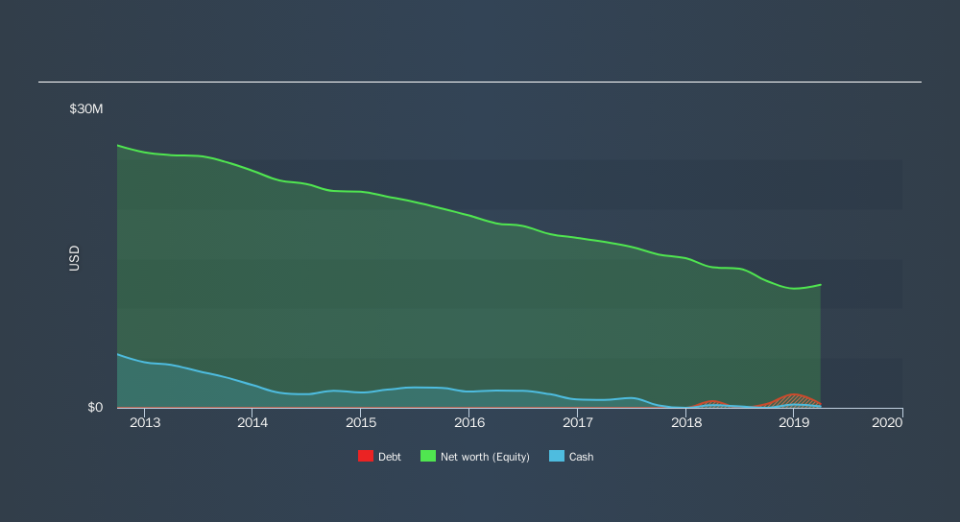

As you can see below, Allied Healthcare Products had US$410.7k of debt at March 2019, down from US$682.8k a year prior. On the flip side, it has US$135.8k in cash leading to net debt of about US$274.9k.

How Strong Is Allied Healthcare Products's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Allied Healthcare Products had liabilities of US$4.11m due within 12 months and no liabilities due beyond that. On the other hand, it had cash of US$135.8k and US$3.44m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$527.9k.

Given Allied Healthcare Products has a market capitalization of US$5.78m, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is Allied Healthcare Products's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Allied Healthcare Products actually shrunk its revenue by 2.8%, to US$32m. We would much prefer see growth.

Caveat Emptor

Importantly, Allied Healthcare Products had negative earnings before interest and tax (EBIT), over the last year. Its EBIT loss was a whopping US$2.4m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. We would feel better if it turned its trailing twelve month loss of-US$1.8m into a profit. So we do think this stock is quite risky. For riskier companies like Allied Healthcare Products I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.