Allison (ALSN) Unveils E-Hybrid Propulsion for Combat Vehicles

Allison Transmission Holdings ALSN recently introduced the eGen Force, a company-first electric hybrid propulsion system for tracked combat vehicles. The eGen Force caters to the needs of the U.S. Army’s Optionally Manned Fighting Vehicle (OMFV) program, as the system is designed for 50-ton tracked vehicles. It can also be extended to 70-ton tracked vehicles, thereby enabling it to meet requirements for future Main Battle Tank models.

The product acts like a power distribution system equipped with an electric motor and inverter for onboard vehicle power and parallel hybrid operation. This will reduce enemy detection, both auditory and thermal, by engine-off mobility, increasing the survival rate of soldiers.

While manufacturing the eGen Force System, Allison has blended its technical expertise in combat vehicles and electric hybrid propulsion solutions. Before designing the framework of the eGen Force, ALSN conducted a comprehensive trade study based on more than 70 years of cross-drive development to choose the optimal architecture for an electric hybrid combat vehicle that can optimize efficiency, performance, reliability and manufacturability. To reduce developmental risk, the renowned OEM combined established parts from its X1100-3B1 transmission, used in the Abrams Main Battle Tank, with new components built on tested design strategies.

Allison said that the eGen Force has begun dyno and engine stand testing that will be followed by vehicle testing in early 2023.

The company is partnering with American Rheinmetall Vehicles, LLC, (“ARV”) to integrate the eGen Force into the latter’s OMFV offering. The ARV vehicle delivers premium mobility and power solutions in a modern chassis that greatly benefits soldiers and squads in their mission.

ARV provides tracked and wheeled combat vehicle platforms and sub-systems to the U.S. Forces.

Allison is a proven player in the propulsion system domain. It is driven to expand its eGen Power portfolio. Recently, it formed a strategic cooperation agreement with Anadolu Isuzu, Turkey’s top manufacturer of buses and trucks, to expand propulsion solutions. Per the agreement, Allison will supply its eGen Power 100S electric axles to Anadolu Isuzu. These will be integrated with Anadolu Isuzu’s light-duty truck and midibus platforms for application in refuse, distribution and public transportation.

In another stride in its eGen Power products portfolio, the Germany-based vehicle manufacturer, Quantron, recently integrated Allison’s 130D e-Axle into its new fuel-cell electric vehicle. It is a heavy-duty truck capable of tractor and chassis derivatives and made its debut at the IAA Transportation 2022, which was held in Hanover, Germany, a while ago.

After a steady success in the eGen Power portfolio, the latest launch of its first electric hybrid propulsion system further contributes to its innovative product launches.

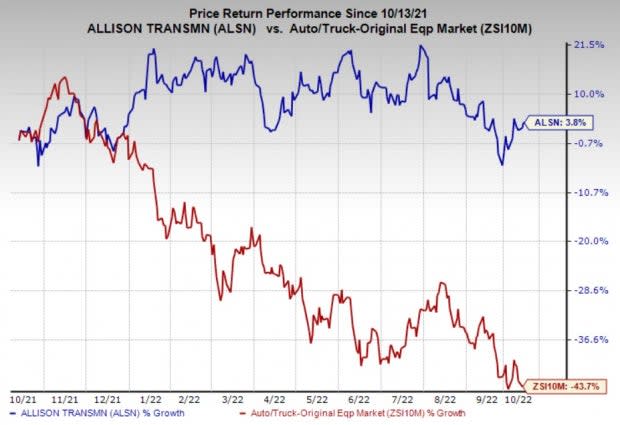

Shares of Allison have inched up 3.8% over the past year against its industry’s decline of 43.7%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ALSN currently has a Zacks Rank #4 (Sell).

Some better-ranked players in the auto space are Cummins Inc. CMI, CarParts.com PRTS and Driven Brand Holdings DRVN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Cummins has an expected earnings growth rate of 17.9% for the current year. The Zacks Consensus Estimate for CMI’s current-year earnings has been revised 0.23% upward in the past 30 days.

Cummins’ earnings beat the Zacks Consensus Estimate in two of the trailing four quarters and missed in the other two. CMI posted a trailing four-quarter earnings surprise of 1.49%, on average. The CMI stock has declined 4.9% in the past year.

CarParts has an expected earnings growth rate of 45% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant over the past 30 days.

CarParts’ earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once. PRTS reported a trailing four-quarter earnings surprise of 70%, on average. The PRTS stock has declined 65.7% in the past year.

Driven has an expected earnings growth rate of 35.2% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant in the past 30 days.

Driven’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. DRVN pulled off a trailing four-quarter earnings surprise of 21.18%, on average. The DRVN stock has increased 5.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cummins Inc. (CMI) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

CarParts.com, Inc. (PRTS) : Free Stock Analysis Report

Driven Brands Holdings Inc. (DRVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research