Allogene (ALLO) Down 20% on Strategic Changes in Pipeline

Shares of Allogene Therapeutics ALLO fell 20% in pre-market trading on Jan 5 after management announced its business plans for 2024 and beyond, with major pipeline changes.

As part of its business update, Allogene announced that it is deprioritizing two pivotal mid-stage studies, namely ALPHA2 and EXPAND, evaluating its CAR-T cell therapy candidate ALLO-501A, now known as cemacabtagene ansegedleucel (cema-cel), in third-line large B cell lymphoma (LBCL).

Allogene will focus on developing cema-cel as a frontline treatment for LBCL patients. In this regard, management initiated start-up activities for the phase II ALPHA3 study evaluating cema-cel as a potential first-line treatment for newly diagnosed and treated LBCL patients who are likely to relapse and need further therapy.

Management intends to administer cema-cel to those patients who, despite having completed six cycles of R-CHOP, still have minimal residual disease (MRD). Management estimates that nearly 30% of patients who respond to R-CHOP treatment eventually relapse. The company intends to position cema-cel as the standard seventh cycle.

The ALPHA3 study will enroll nearly 230 patients who are MRD-positive at the end of first-line therapy. These patients will then be randomized to either consolidation with cema-cel or the current standard of care (observation). The primary endpoint of the study is event-free survival (EFS). The study has also been designed to include two lymphodepletion regimens — one combining standard fludarabine and cyclophosphamide with ALLO-647 and another without ALLO-647.

Following this announcement, share prices started to drop in pre-market trading. Though Allogene’s pivot to frontline treatment opens up access to a wider and more lucrative target market, it also delays the company’s plans to bring the product to market by at least a couple of years.

Initially, Allogene had plans to complete enrolment in the ALPHA2 study by the first half of this year, with a data readout planned before this year’s end. It had plans to secure a potential marketing approval in the next year. However, with the company’s change in business plans and a fresh new study in the works, a potential filing is not expected up until 2026/2027. This was likely one of the main reasons for the share price drop.

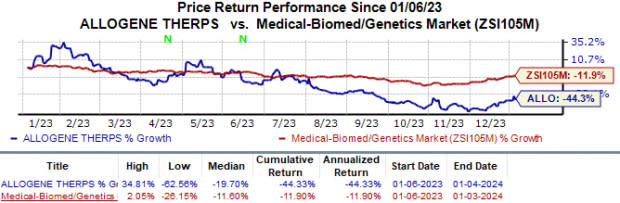

In the past year, Allogene’s shares have lost 44.3% compared with the industry’s 11.9% fall.

Image Source: Zacks Investment Research

Despite the decision to deprioritize the ALPHA2 study, management intends to start a new cohort that will evaluate cema-cel in patients with chronic lymphocytic leukemia (CLL) based on investigator enthusiasm. This new cohort will enroll 12 patients beginning this quarter and intends to report initial data by the year-end.

Allogene is also planning to explore the potential of allogenic CAR-T cell therapies in autoimmune diseases. In this regard, it plans to start an early-stage study with a new candidate, ALLO-329, in lupus/systemic lupus erythematosus (SLE) indication next year. The candidate has been designed to reduce or eliminate the need for standard chemotherapy.

Allogene’s business plans also include a planned restructuring of resources in first-quarter 2024. Per management, these activities are being undertaken to reduce the company’s cash burn and extend its cash runway into 2026. It intends to provide guidance for this full year when it reports its fourth-quarter and full-year 2024 earnings results.

Allogene Therapeutics, Inc. Price

Allogene Therapeutics, Inc. price | Allogene Therapeutics, Inc. Quote

Zacks Rank & Other Key Picks

Allogene currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector include Aquestive Therapeutics AQST, CytomX Therapeutics CTMX and Sarepta Therapeutics SRPT, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, Aquestive Therapeutics’ loss estimates for 2023 have improved from 25 cents per share to 7 cents. During the same period, loss estimates per share for 2024 have narrowed from 56 cents to 34 cents. Shares of Aquestive have surged 153.5% in the past year.

Aquestive Therapeutics’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 70.58%. In the last reported quarter, Aquestive’s earnings beat estimates by 72.73%.

In the past 60 days, estimates for CytomX Therapeutics’ 2023 have improved from a loss of 37 cents per share to earnings of 2 cents. During the same period, the loss estimates per share for 2024 have narrowed from 51 cents to 6 cents. Shares of CytomX have lost 38.5% in the past year.

CytomX Therapeutics’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 45.44%. In the last reported quarter, CytomX Therapeutics’ earnings beat estimates by 123.53%.

In the past 60 days, Sarepta’s loss estimates for 2023 have improved from a loss of $7.53 per share to $6.79 per share. During the same period, earnings estimates per share for 2024 have risen from 46 cents to $1.72. Sarepta’s shares have lost 22.9% in the past year.

Sarepta’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 48.67%. In the last reported quarter, Sarepta’s earnings beat estimates by 72.29%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

Aquestive Therapeutics, Inc. (AQST) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report