Allogene's (ALLO) Q1 Loss Wider Than Expected, Sales Miss

Allogene Therapeutics, Inc. ALLO incurred a loss of 68 cents per share in first-quarter 2023, wider than the Zacks Consensus Estimate and our model estimate of a loss of 63 cents and 60 cents, respectively. In the year-ago quarter, the company reported a loss of 56 cents.

ALLO recorded revenues of $0.05 million during the quarter, missing the Zacks Consensus Estimate and our model estimate both of which were pegged at $0.1 million. Revenues were down 14.8% year over year.

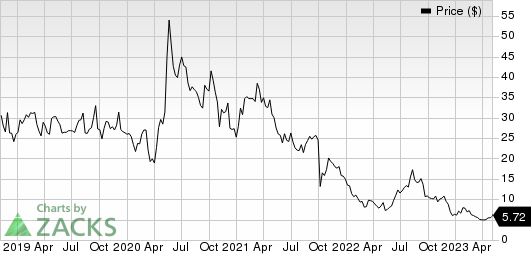

Shares of Allogene have lost 9.1% in the year-to-date period compared with the industry’s 6.4% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Research & development (R&D) expenses were $80.2 million, up 33.4% from the year-ago quarter’s level.

General and administrative (G&A) expenses declined 5.1% year over year to $18.9 million.

Allogenehad $514.0 million of cash, cash equivalents and investments as of Mar 31, 2023, compared with $576.5 million as of Dec 31, 2022.

2023 Guidance

Allogene anticipates operating expenses for the full year to be approximately $340 million, down from the previous guidance of $350 million.

Cash burn for 2023 is expected to be approximately $230 million, down from the previous guidance of $250 million. Based on these projections, management expects the existing cash runway to be sufficient to fund operations into second-quarter 2025.

Pipeline Update

Allogene has six pipeline candidates in early-stage of clinical development, including five AlloCAR T cell product candidates, namely ALLO-501, ALLO-501A, ALLO-715, ALLO-605 and ALLO-316 and a monoclonal antibody (mAB) ALLO-647.

The mAB candidate, ALLO-647, is part of the lymphodepletion regimen, which is likely to increase the potency of allogeneic CAR T cell therapies. During the first-quarter, management started the phase II EXPAND study to demonstrate the contribution of ALLO-647 to the standard fludarabine and cyclophosphamide lymphodepletion regimen. Allogene plans to utilize ALLO-647 in all its clinical studies to enable the expansion and persistence of AlloCAR T product candidates.

Lead candidate, ALLO-501 is being evaluated in a phase I ALPHA study for relapsed/refractory (r/r) non-Hodgkin lymphoma (NHL) subtypes. A second-generation version of ALLO-501, ALLO-501A is also being developed for NHL in the phase I/II ALPHA2 study.

Allogene started the pivotal phase II portion of the ALPHA2 study in October 2022, which is evaluating ALLO-501A in patients with r/r large B cell lymphoma (LBCL). The company is currently enrolling patients in this pivotal portion of the ALPHA2 study and expects to complete enrolment in first-half 2024. Following the completion of the ALPHA2 study, management intends to initiate a biologics license application (BLA) submission for ALLO-501A.

ALLO-316 is being evaluated in a phase I TRAVERSE study for advanced or metastatic clear cell renal cell carcinoma (ccRCC). Last month, Allogene presented interim data from the TRAVERSE study wherein patients treated with ALLO-316 showed early anti-tumor activity with deepening responses over time. The anti-tumor activity was primarily observed in patients with tumors confirmed to express CD70.

Allogene Therapeutics, Inc. Price

Allogene Therapeutics, Inc. price | Allogene Therapeutics, Inc. Quote

Zacks Rank & Other Stocks to Consider

Allogene currently has a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector include Adaptimmune Therapeutics ADAP, Lisata Therapeutics LSTA and Spero Therapeutics SPRO, While Lisata Therapeutics and Spero Therapeutics sport a Zacks Rank #1 (Strong Buy), Adaptimmune Therapeuticscarriesa Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Spero Therapeutics’ stock has risen 4.6% in the year-to-date period. SPRO’s loss estimates for 2023 have narrowed from $1.45 to $1.02 per share in the past 60 days. During the same period, the loss estimates per share for 2024 have narrowed from $2.45 to 95 cents.

Spero Therapeutics beat earnings estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed an earnings surprise of 56.37%. In the last reported quarter, SPRO delivered an earnings surprise of 237.50%.

In the past 60 days, estimates for Lisata Therapeutics’ 2023 loss per share estimates have narrowed from $3.81 to $3.58. During the same period, the loss estimates per share for 2024 have improved from $4.01 to $3.12. Shares of Lisata Therapeutics have gained 28.5% in the year-to-date period.

Earnings of Lisata beat estimates in two of the last four quarters, while missing the mark on the other two occasions. On average, the company’s earnings witnessed a negative surprise of 5.63%. In the last reported quarter, Lisata’s earnings beat estimates by 20.83%.

In the past 60 days, estimates for Adaptimmune Therapeutics’ 2023 loss per share estimates have narrowed from 78 cents to 63 cents. During the same period, the loss estimates per share for 2024 have improved from $1.10 to 59 cents. Shares of Adaptimmune Therapeutics have declined 4.1% in the year-to-date period.

Earnings of Adaptimmune beat estimates in two of the last four quarters, while missing the mark on the other two occasions. On average, the company’s earnings witnessed a negative surprise of 5.63%. In the last reported quarter, Adaptimmune’s earnings beat estimates by 20.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Adaptimmune Therapeutics PLC (ADAP) : Free Stock Analysis Report

Spero Therapeutics, Inc. (SPRO) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Lisata Therapeutics, Inc. (LSTA) : Free Stock Analysis Report