Allogene's (ALLO) Q4 Loss Narrower Than Expected, Sales Miss

Allogene Therapeutics, Inc. ALLO incurred an adjusted loss (excluding impairment of long-lived asset) of 43 cents per share in fourth-quarter 2023, narrower than the Zacks Consensus Estimate of a loss of 47 cents.

Inclusive of impairment charges, the company posted a loss of 51 cents in the fourth quarter. In the year-ago quarter, the company reported a loss of 67 cents. There was no impairment charge recorded in the year-ago period.

ALLO recorded revenues of $0.02 million during the quarter, missing the Zacks Consensus Estimate of $0.05 million. Revenues were down 19% year over year.

Quarter in Detail

Research & development (R&D) expenses were $54.7 million, down 28% from the year-ago quarter’s level.

General and administrative (G&A) expenses declined 18% year over year to $17.2 million.

Allogenehad $448.7 million of cash, cash equivalents and investments as of Dec 31, 2023, compared with $497.7 million as of Sep 30, 2023.

Full-Year Results

In 2023, Allogene recorded total revenues of $0.1 million, down 39% year over year.

The company reported a loss of $2.09 per share for full-year 2023, narrower than the year-ago period’s loss of $2.38.

2024 Guidance

Allogene anticipates operating expenses for the full year to be around $280 million, including non-cash stock-based compensation expenses of nearly $60 million.

Cash burn for 2024 is expected to be approximately $190 million. Management expects the cash runway to be sufficient to fund operations into 2026.

Following the earnings announcement, shares of Allogene rose 5% in after-market trading on Mar 14, likely due to the lower-than-expected operating expenses and cash burn compared with 2023 levels.

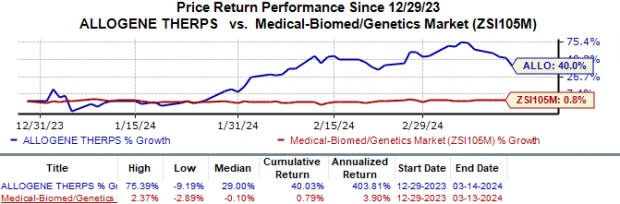

Year to date, the stock has surged 40% in the year-to-date period compared with the industry’s 0.8% growth.

Image Source: Zacks Investment Research

Pipeline Update

In January, Allogene made major changes to its pipeline when it announced its business plans for 2024 and beyond. As part of its business update, management announced that it is deprioritizing two pivotal mid-stage studies, namely ALPHA2 and EXPAND, evaluating its CAR-T cell therapy candidate ALLO-501A, now known as cemacabtagene ansegedleucel (cema-cel), in third-line large B cell lymphoma (LBCL).

Allogene will focus on developing cema-cel as a frontline treatment for LBCL patients. In this regard, management initiated start-up activities for the phase II ALPHA3 study evaluating cema-cel as a potential first-line treatment for newly diagnosed and treated LBCL patients who are likely to relapse and need further therapy. The study is expected to begin in mid-2024.

Despite the decision to deprioritize the ALPHA2 study, management intends to start a new cohort that will evaluate cema-cel in patients with chronic lymphocytic leukemia (CLL) based on investigator enthusiasm. This new cohort started enrolling study participants and intends to report initial data by the year-end.

Allogene is also planning to explore the potential of allogenic CAR-T cell therapies in autoimmune diseases. In this regard, the company partnered with privately-held Arbor Biotechnologies to utilize the latter’s proprietary CRISPR gene-editing technology. Management intends to start an early-stage study with a new candidate, ALLO-329, in lupus/systemic lupus erythematosus (SLE) indication next year. The candidate has been designed to reduce or eliminate the need for standard chemotherapy.

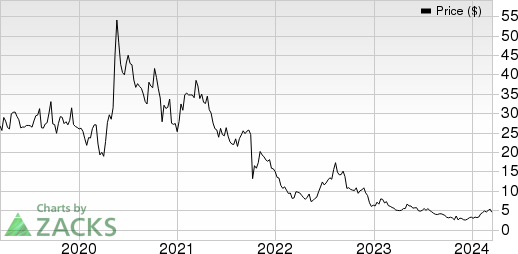

Allogene Therapeutics, Inc. Price

Allogene Therapeutics, Inc. price | Allogene Therapeutics, Inc. Quote

Zacks Rank & Key Picks

Allogene currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include ADMA Biologics ADMA, ANI Pharmaceuticals ANIP and GSK plc GSK. While ADMA and ANI each sport a Zacks Rank #1 (Strong Buy), GSK carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 22 cents to 30 cents. During the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have risen 33.2%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 EPShave risen from $4.06 to $4.40. In the same period, EPS estimates for 2025 have improved from $4.80 to $5.01. Year to date, shares of ANIP have risen 19.8%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

In the past 60 days, estimates for GSK’s 2024 EPS have risen from $3.87 to $4.03. During the same period, EPS estimates for 2025 have improved from $4.20 to $4.39. Year to date, shares of GSK have risen 16.2%.

GSK's earnings beat estimates in three of the trailing four quarters while missing the mark on one occasion. On average, GSK’s four-quarter earnings surprise was 7.59%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report