Allot: A Sleeping Cybersecurity Stock

Opportunity in misery

The shares of cybersecurity company Allot Ltd. (NASDAQ:ALLT) are taking a beating. That creates a potential value opportunity at or below its current price of $8.30, by my estimates.

In mid-February, the share price was $10.40. It fell to $7.45 one month later following fourth-quarter results. Few investors follow the stock and blog about it. Fewer analysts follow Allot or write about it.

About the company

Allot designs and sells network security solutions worldwide. The company offers a secure management platform: Allot NetworkSecure, Allot HomeSecure, Allot DNSecure, EndPoint Secure, Allot BusinessSecure, Allot IoTSecure and Allot Secure Cloud. The DDoS Secure/5G Protect offers attack detection and mitigation services, integrated network intelligence solutions and centralized management solutions. Allot NetXplorer has a central access point for network-wide monitoring, reporting, analytics, troubleshooting, accounting and quality of service policy provisioning.

The company markets its products through direct sales, distributors, resellers, original equipment manufacturers and system integrators. They sell to carriers, mobile and fixed service providers, cable operators, satellite service providers, private networks, data centers, financial and educational institutions and governments.

The company was incorporated in 1996 and is based in Israel.

Positives

Positive factors underpinning Allots long-term potential appeal to me.

First, the consensus among Wall Street analysts is bullish. The average price target over the next 12 months is $13. That is an implied upside of approximately 54.5% from the current price.

Second, hedge funds topped off their holdings a year ago, then steadily sold shares over the next six months. In January, hedge funds began accumulating shares. Then the price dived to under $8. Funds bought 11,300 shares in the last quarter.

Corporate insiders own almost 4% of outstanding shares, while institutions own 22.54%. The public and others own about 70%. As GuruFocus notes, Peter Lynch prefers buying companies with low institutional ownership.

More attractive features about Allot: there is the potential for growth in the information technology and systems software business. Allot is financially stable. I believe the shares are at low risk for any deep slide. I forecast sales will continue growing, but management must do better in meeting investor expectations.

Sales might pop to over $300 million in 2024. If sales stagnate at or below the fourth-quarter gain of 5%, when they were up 10% in the prior-year quarter, shareholders might abandon the stock. Perhaps the increasing market demand for Allots kind of cloud security services will provide heft to the momentum and profitability by the end of 2022.

Vulnerabilities

Allot has its vulnerabilities. The company is not an influencer and the stock is subject to whips from tech industry tailwinds. Some big tech stocks crumbled 75% from their earlier highs, and that was before the Russian invasion of Ukraine. The market for tech stocks is fraught at this time, especially for cloud software.

Protecting data in the cloud worries many people. Hackers have compromised the cloud before. As CPOMagazine reported, Google attributed the hacking of Google Cloud accounts to poor security hygiene, including weak or no passwords and misconfigurations. Attackers exploited poor security practices or vulnerable third-party software in (75%) of the incidents.

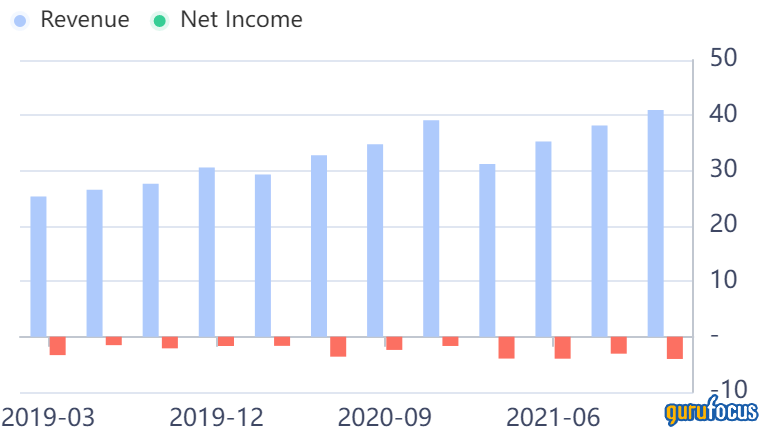

In regard to its financials, its fourth-quarter non-GAAP earnings loss of 6 cents per share was in line with forecasts. The number is disappointing because in the same quarter year over year, the company posted earnings of 1 cent. Revenue increased nearly 5% in the quarter, but it looks to me that the next earnings report due in May will meet the consensus forecast of a loss of 23 cents per share.

The Lynrock Lake Master Fund is the largest shareholder with 21.8% of Allot's outstanding shares. The fund announced it is providing $40 million in private financing. Cash holdings are healthy, giving the company a long runway compared to its burn rate. Revenue growth and the market cap at $304.34 million strengthen my positive outlook. Short interest is low at 1.74%.

A flagging share price never instills confidence in investors or board members. Lynrock Lake recently filed a notice with the SEC that management, the board of directors and investors are discussing changes in board membership, among other matters. Allot trades on the Nasdaq and Tel Aviv Stock Exchange.

The inextricable part of this pantheon is shareholders want value creation. Lynrock paid a higher price for shares. The second-largest shareholder bought 7.8% of the company, paying $14 to $19 per share. This event is not a downside, but a heartening portent of confidence that big players see a rainbow over the stock. They want to spark momentum and boost profits in line with other IT companies.

Takeaway

Allot is a minor player in the tech business, but it has a global footprint and respected products. Founders still run the company despite changes in the tech landscape. Investors might tell management they have confidence, but need fresh blood to pick up the pace.

The shooting war has everyones attention. The IT industry and Allot are getting short shrifted despite hackers and enemies waging fierce cyber battles. They are no less threatening to national security and public safety. Allot is in the thick of it and has the potential to be an influencer. There is a light in the attic for risk-taking investors, but any accumulation ought to be moderate.

This article first appeared on GuruFocus.