Allstate (ALL) Continues Auto Rate Hikes to Boost Profits

The Allstate Corporation ALL recently announced rate hikes of auto insurance in November, coupled with homeowners' insurance rate adjustments. This strategy aligns well with current macroeconomic trends, reinforcing the company's commitment to navigating challenging market conditions.

Inflationary pressure has compelled insurers to increase their rates to maintain a decent level of profitability. The company’s estimated catastrophe losses for November were below the $150 million reporting threshold, implying effective risk management. The company's shares lost 0.1% on Dec 15, replicating a broader decline in markets

Last month, Allstate hiked auto rates by 7.9% in 10 locations, which provided a total premium impact of 1%. The auto rate hikes since the start of 2023 had a premium impact of 11.4%, which is likely to boost annualized written premiums by around $2.97 billion. It estimates the homeowners’ insurance segment's average gross written premium for November to witness a 12.6% year-over-year increase.

The high inflation environment is expected to keep driving insurance prices higher for auto and homeowners insurance. Last month, it increased homeowners’ rates by 4.6% in 10 locations, which offered a total premium impact of 0.5%. The company recently got approval from the Department of Insurance in New York, California and New Jersey for auto insurance rate increases of 14.6%, 30% and 20%, respectively. The new rates will be implemented this month and are effective through February 2024. Increased rates are expected to lead to increased annualized written premiums worth $1 billion.

Apart from implementing higher rates, ALL is likely to improve profitability through cost-curbing measures with the help of digitization, improving efficiency, leveraging scale with strategic partnerships and stricter underwriting requirements. Reducing distribution expenses will also support its margins.

Allstate's limited catastrophe losses in November provide relief, especially in light of the substantial $5.6 billion incurred in the first nine months of 2023, marking a significant 138.7% year-over-year increase. Comparatively, 2021 and 2022 saw catastrophe losses of $3.3 billion and $3.1 billion, respectively, showcasing a challenging trend in 2023.

Allstate remains firm on lowering losses by its catastrophe management strategies and reinsurance programs and restricting exposure to riskier geographic markets by expanding premiums. However, this is likely to affect the growth rate of policies in force for Allstate Protection Homeowners. Moreover, the first three quarters witnessed a 2.9% decline in policies in force for Allstate Protection Auto, reflecting some challenges.

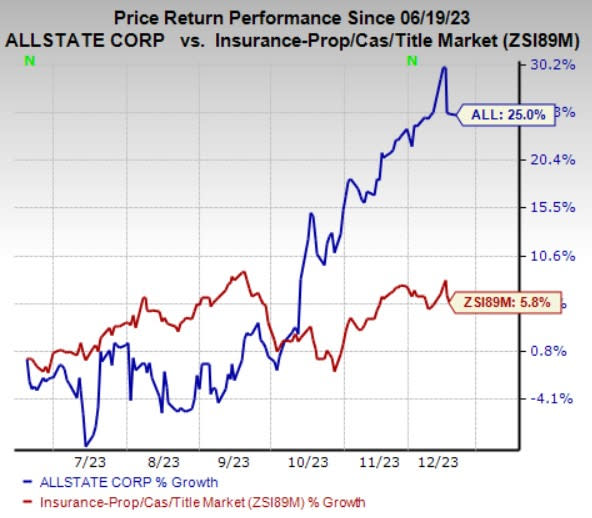

Price Performances

Allstate shares have gained 25% in the past six months compared with the industry’s 5.8% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ALL currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the property and casualty insurance industry are Mercury General Corporation MCY, CNA Financial Corporation CNA and HCI Group, Inc. HCI. Each of these companies sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Mercury General beat estimates in two of the last four quarters and missed in the other two, the average being 2,833.05%.

The Zacks Consensus Estimate for MCY’s 2023 and 2024 earnings per share (EPS) indicates a year-over-year increase of 65.2% and 343.7%, respectively.

CNA Financial has a solid track record of beating earnings estimates in three of the last four quarters, missing once, the average being 9.2%.

The Zacks Consensus Estimate for CNA’s 2023 and 2024 earnings has moved 0.5% and 0.6% north, respectively, in the past 30 days, reflecting analysts’ optimism.

HCI Group surpassed earnings in each of the last four quarters, the average being 519.6%.

The Zacks Consensus Estimate for HCI’s 2023 and 2024 EPS indicates a year-over-year increase of 194.9% and 51.4%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Allstate Corporation (ALL) : Free Stock Analysis Report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

Mercury General Corporation (MCY) : Free Stock Analysis Report