Ally Financial (ALLY) Up on Q4 Earnings Beat Despite Cost Hike

Shares of Ally Financial ALLY gained 20% following its fourth-quarter and 2022 results. Adjusted earnings of $1.08 per share for the quarter surpassed the Zacks Consensus Estimate of 98 cents. However, the bottom line reflects a decline of 46.5% from the year-ago quarter. Our estimate for earnings was $1.

Results were primarily aided by an improvement in net financing revenues. An increase in loans was another tailwind. However, a decline in other revenues, along with higher expenses and provisions, were the undermining factors.

After considering non-recurring items, net income available to common shareholders (on a GAAP basis) was $251 million or 83 cents per share, down from $624 million or $1.79 per share in the prior-year quarter. Our estimate for the metric was $305.4 million.

For 2022, adjusted earnings per share were $6.06, down from $8.61 in 2021. Our estimate for 2022 earnings was $5.91 per share. Net income available to common shareholders (on a GAAP basis) was $1.60 billion or $5.03 per share, down from $3 billion or $8.22 per share in 2021. Our estimate for net income was $1.66 billion.

Revenues Improve Marginally, Expenses Rise

Total quarterly GAAP net revenues were $2.20 billion, up marginally year over year. The top line beat the Zacks Consensus Estimate of $2.04 billion. Our estimate for revenues was $1.99 billion.

GAAP net revenues for 2022 were $8.43 billion, up 2.7% year over year. Our estimate for revenues was $8.21 billion.

Quarterly net financing revenues were up 1.2% from the prior-year quarter to $1.67 billion. The rise was driven by an increase in interest and fees on finance receivables and loans, interest on loans held for sale, total interest and dividends on investment securities, interest-bearing cash and other earning assets. Our estimate for net financing revenues was $1.61 billion.

The adjusted net interest margin was 3.68%, down 14 basis points year over year.

Total other revenues were $527 million, down 3.3% from the prior-year quarter. We had projected other revenues of $373.5 million.

Total non-interest expenses were up 16.1% year over year to $1.27 billion. The upswing stemmed from higher compensation and benefits expenses, insurance losses and loss-adjustment expenses, and other operating expenses. Our estimate for expenses was $1.20 billion.

The adjusted efficiency ratio was 50.6%, up from 44.4% in the year-ago period. A rise in the efficiency ratio indicates a deterioration in profitability.

Credit Quality Worsens

Non-performing loans of $1.45 billion as of Dec 31, 2022, were up 1.3% year over year. Our estimate for the metric was $1.74 billion.

In the quarter under review, the company recorded net charge-offs of $390 million, up significantly from $103 million in the prior-year quarter. We had projected net charge-offs of $116 million. The company also reported a provision for loan losses of $490 million, up significantly from $210 million in the prior-year quarter. Our estimate for provisions was $346.1 million.

Loans & Deposit Balances Increase

As of Dec 31, 2022, total net finance receivables and loans amounted to $132.04 billion, up 2.5% from the prior quarter. Deposits increased 4.5% from the prior-quarter end to $152.30 billion.

Capital Ratios Deteriorate

As of Dec 31, 2022, the total capital ratio was 12.2%, down from 13.5% in the prior-year quarter. Tier I capital ratio was 10.7%, down from 11.9% as of Dec 31, 2021.

Share Repurchase Update

In 2022, the company repurchased $1.7 billion worth of shares.

Our View

Ally Financial’s initiatives to diversify its revenue base will likely keep aiding profitability. Given a solid balance sheet, the company is well-poised to expand through acquisitions. However, persistently rising expenses (mainly due to the company’s inorganic growth efforts) and higher provisions will likely hurt bottom-line growth in the near term.

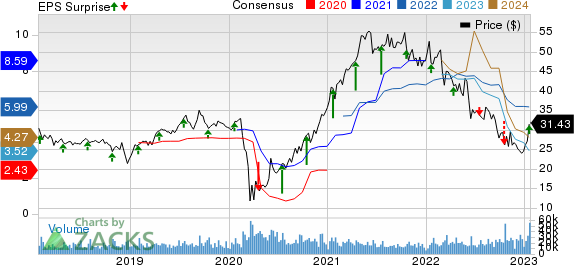

Ally Financial Inc. Price, Consensus and EPS Surprise

Ally Financial Inc. price-consensus-eps-surprise-chart | Ally Financial Inc. Quote

Currently, Ally Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Hancock Whitney Corporation’s HWC fourth-quarter 2022 earnings of $1.65 per share surpassed the Zacks Consensus Estimate of $1.63. The bottom line rose 6.5% from the prior-year quarter’s earnings of $1.55.

HWC’s results benefited from higher net interest income, supported by a rise in loan balance and increasing interest rates. However, lower non-interest income mainly due to higher mortgage rates was an undermining factor. Higher expenses and a rise in provisions were other concerns for HWC.

The PNC Financial Services Group, Inc.’s PNC fourth-quarter 2022 adjusted earnings per share of $3.49 lagged the Zacks Consensus Estimate of $3.95. Also, the bottom line declined 5.2% year over year.

PNC’s results were primarily hurt by a decline in non-interest income and higher provisions. However, an increase in net interest income, supported by higher rates and loan growth, and a decline in expenses were tailwinds for PNC.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report