Ally Financial Inc. (ALLY) Posts Full-Year and Q4 2023 Earnings

Full-Year Net Income: Reported at $1.0 billion with EPS of $2.98 and Adjusted EPS of $3.05.

Fourth Quarter Net Income: Totaled $76 million, with EPS of $0.16 and Adjusted EPS of $0.45.

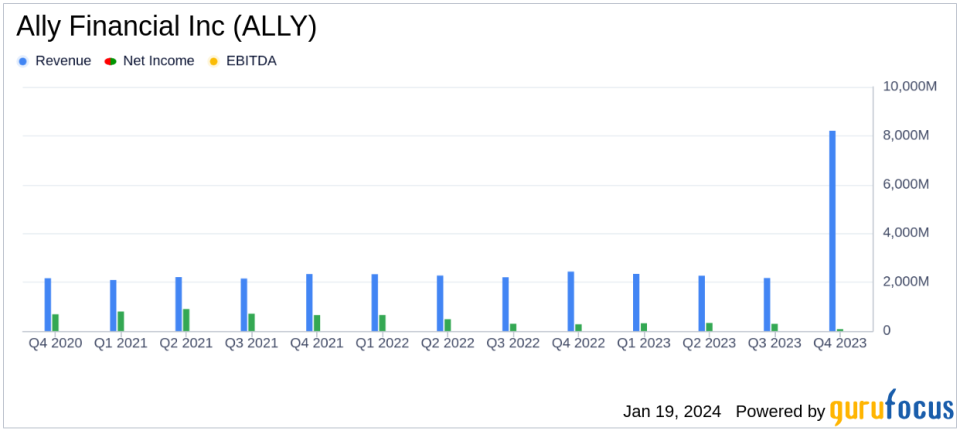

Total Net Revenue: Reached $8.2 billion for the full year, maintaining stability in financial performance.

Strategic Moves: Sale of Ally Lending and deconsolidation of seasoned retail auto loans to enhance capital position.

Cost Management: Realized $80 million in annualized expense savings following headcount reductions announced in Q3.

Auto Finance Leadership: Maintained strong origination volume at $40.0 billion with a focus on high credit quality.

Deposit Growth: Retail deposits grew to $142.3 billion, reflecting a robust digital-first banking platform.

On January 19, 2024, Ally Financial Inc (NYSE:ALLY) released its 8-K filing, detailing its financial results for the fourth quarter and the full year of 2023. The company, a leading entity in the consumer auto lending space and one of the largest all-digital banks in the nation, reported a net income of $1.0 billion for the year, translating to earnings per share (EPS) of $2.98 and an adjusted EPS of $3.05. For the fourth quarter, net income stood at $76 million, with EPS of $0.16 and adjusted EPS of $0.45.

Ally Financial, which began as the captive financial arm of General Motors and went public in 2014, has since diversified its business model. While over 70% of its loan book remains in consumer auto loans and dealer financing, the company also offers a suite of financial products including auto insurance, personal and commercial loans, credit cards, and a portfolio of mortgage debt, complemented by brokerage services.

Financial Performance and Strategic Highlights

The company's full-year pre-tax income was reported at $1.1 billion with a total net revenue of $8.2 billion, reflecting a return on common equity (ROCE) of 8.3% and a core return on tangible common equity (ROTCE) of 11.5%. The fourth quarter saw a pre-tax income of $64 million and a ROCE of 1.8%, with common shareholder equity at $37.83 per share. Adjusted tangible book value per share was $33.34.

Ally Financial's strategic decisions in 2023 included reaching an agreement to sell Ally Lending, which is expected to benefit CET1 by approximately 15 basis points upon closing in the first quarter of 2024, and be accretive to EPS and tangible book value. Additionally, the company deconsolidated $1.7 billion of seasoned retail auto loans, generating a CET1 benefit of 9 basis points. Cost management initiatives, including headcount reductions announced in the third quarter, have resulted in $80 million of annualized expense savings.

Operational Achievements and Industry Position

Ally Financial has established itself as a leader in dealer financial services, offering a comprehensive suite of auto finance and insurance products. The company processed 13.8 million consumer auto applications, driving an origination volume of $40.0 billion. The retail auto originated yield was 10.7%, with nearly 40% of originated volume within the highest credit quality tier. Full-year retail auto net charge-offs were 177 basis points, in line with guidance.

Insurance earned premiums reached $1.3 billion, marking the highest since the company's IPO. The digital-first Ally Bank platform generated strong growth across consumer and commercial product suites, with retail deposits totaling $142.3 billion from 3.0 million retail deposit customers and total deposits reaching $155 billion. The company also reported 1.2 million active credit cardholders and a corporate finance held-for-investment (HFI) loan portfolio of $10.9 billion, achieving a 25% ROE in 2023 with less than 1% of loans in nonaccrual status.

Ally Financial's performance in 2023 demonstrates its resilience and adaptability in a dynamic financial landscape. The company's focus on high credit quality in auto finance, strategic cost management, and growth in digital banking services positions it well for future challenges and opportunities. Investors and potential members of GuruFocus.com can find further details and insights into Ally Financial's financial health and strategic direction by examining the full 8-K filing.

Explore the complete 8-K earnings release (here) from Ally Financial Inc for further details.

This article first appeared on GuruFocus.