Almost No Stock Spared as Semiconductor Rout Spreads

(Bloomberg) -- Computer sales are faltering, short sellers are ramping up bets against semiconductor stocks and the US is tightening export restrictions. For investors in the chip sector, the outlook just keeps getting darker.

Most Read from Bloomberg

Russia Privately Warns of Deep and Prolonged Economic Damage

Indian Billionaire Closes In on Bezos With 1,000% Stock Surge

Stocks End Well Off Lows With S&P 500 Above 3,900: Markets Wrap

Ukraine Latest: US Says Russia Seeks Munitions From North Korea

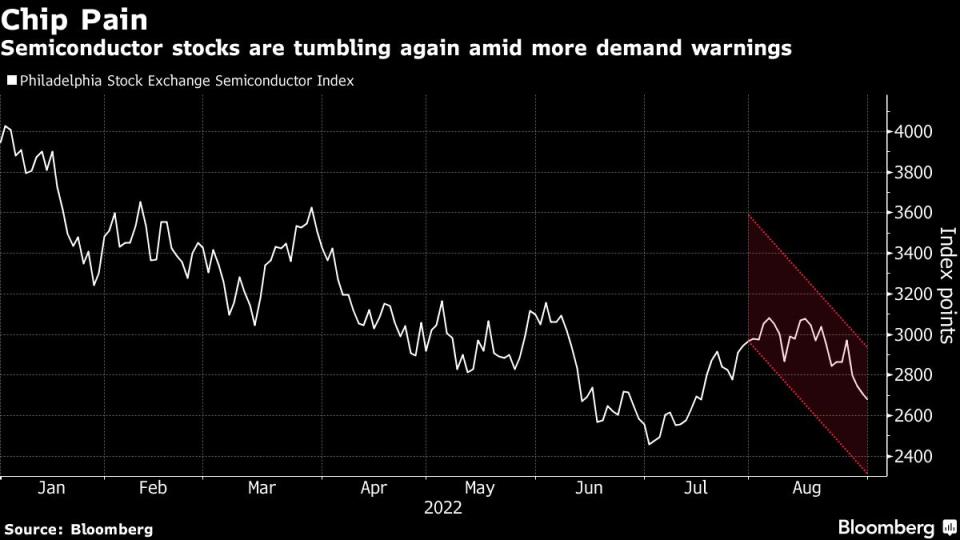

After rallying in July with the rest of tech, the shares of companies involved in the production of semiconductors are tumbling again amid a steady stream of warnings about slumping demand. The Philadelphia semiconductor index slumped almost 10% in August, about twice the loss for the tech-heavy Nasdaq 100 Index. And high flyers like Nvidia Corp. are back to flirting with lows reached two months ago.

With the Federal Reserve showing few signs of letting up on interest rate hikes, some on Wall Street are predicting the pain is just getting started as chipmakers are forced to rein in production following years of boom times. Citigroup Inc. analysts said this week they expect another 25% decline for the semiconductor index, with slowing demand spreading from personal computers and handsets to cars and industrial products.

“I think we’ll continue to see headwinds across the board through the fall,” said Michael Matousek, head trader at US Global Investors. “We may not see a turn in the cycle until the Fed starts reducing rates or at least keeping them steady.”

The chip index is down 34% from its record close on Dec. 27, with 29 of the benchmark’s 30 stocks falling in that time. Nvidia is the worst performer, losing more than half its value. Wolfspeed Inc., a maker of automotive and industrial chips, is the sole gainer, holding on to an advance of a fraction of 1%.

Seagate Technology Holdings Plc became the latest to sound the alarm on Wednesday. The biggest maker of computer hard drives cut its revenue forecast for the current quarter, citing deteriorating economic trends and “cautious buying behavior” from businesses around the world and cloud customers in the US. Dell Technologies Inc. last week gave a pessimistic outlook on the second half, warning of “more cautious customer behavior.”

Meanwhile, Nvidia pared some premarket losses on Thursday after saying it obtained licenses to provide support to US customers in China for its artificial intelligence chips, one day after disclosing it needs Washington’s approval to sell certain products to Chinese-based customers.

The pain should come as no surprise to Wall Street analysts, who have been slashing profit estimates in the sector for most of the year. Projections for 2023 earnings growth for semiconductor-related companies in the S&P 500 Index have fallen 10 percentage points since January, compared with a roughly 6-point decline for the broader tech sector, according to data compiled by Bloomberg Intelligence.

The gloom is welcome news for short sellers, who have added to bets against semiconductor stocks in recent months. Since the start of the third quarter, short interest in the US information technology sector is up $3.4 billion and about 80% of that increase is concentrated within chipmakers and equipment companies, according to data from S3 Partners.

Of course, there’s a case to be made that a lot of the bad news is already priced in to semiconductor stocks, which are approaching levels that have historically represented good buying opportunities. Priced at 15 times projected profits, the semiconductor index is below the average valuation over the past decade, according to data compiled by Bloomberg. Micron Technology Inc. and Qualcomm Inc. are among the cheapest, trading at about 10 times.

Those multiples may not be as cheap as they look, given that earnings estimates are still falling. The Citigroup analysts, Christopher Danely and Kelsey Chia, see the industry “entering the worst semiconductor downturn in a decade given the recession and inventory build.”

“We maintain our belief that every company/end market will correct and we expect the SOX index to hit new lows,” they wrote in a research note.

Tech Chart of the Day

The Citi analysts noted that estimates fell during the second-quarter earnings season for the first time since the pandemic. A 25% decline in the semiconductor index would wipe out all the gains made during the pandemic. The SOX has fallen 32% this year through Wednesday’s close, its biggest annual decline since 2008.

Top Tech Stories

Arm Ltd. sued Qualcomm for breach of contract and trademark infringement, setting up a legal showdown between the SoftBank Group Corp.-owned chip company and one of its biggest customers.

Nvidia fell in premarket trading after warning that new rules governing the export of artificial-intelligence chips to China may affect hundreds of millions of dollars in revenue.

Tencent Holdings Ltd. has set a soft target of divesting about 100 billion yuan ($14.5 billion) of its $88 billion listed equity portfolio this year as it shifts strategy, the Financial Times reported, citing two unidentified people familiar with the matter.

Rogers Communications Inc. succeeded in extending a deadline to buy back $9.33 billion of bonds, overcoming objections from some investors about terms of the deal.

Alibaba Group Holding Ltd.’s Lazada Group is preparing to make its maiden foray into Europe, building on its success in Southeast Asia to take on rivals such as Amazon.com Inc. and Zalando SE in one of the biggest online shopping markets.

The founder of Taiwanese chipmaker United Microelectronics Corp. outlined plans to fund military training for millions of “civilian warriors” in Taiwan to fight against any potential Chinese invasion.

Carro, one of Southeast Asia’s biggest online marketplaces for used cars, raised close to S$200 million ($143 million) in debt financing this year, as startups worldwide vie for increasingly scarce venture capital.

Uber Technologies Inc. will partner with a financial technology startup to boost the number of electric vehicles in London by an additional 10,000 over the next few years, according to a statement.

(Updates with Nvidia annoucement in paragraph seven.)

Most Read from Bloomberg Businessweek

Startup Wants to Chart Path to More Equitable Urban Development

Women Who Stay Single and Don’t Have Kids Are Getting Richer

Russia’s Conspiracy-Theory Factory Is Swaying a Brand-New Audience

A New Contaminant Found in Popular Drugs Could Cost Big Pharma Millions

©2022 Bloomberg L.P.