Alnylam (ALNY), Roche's Blood Pressure Drug Meets Study Goal

Alnylam Pharmaceuticals ALNY and partner Roche RHHBY announced positive results from the phase II KARDIA-2 study evaluating their investigational RNAi therapeutic zilebesiran in adults with hypertension (or high blood pressure).

The KARDIA-2 study enrolled 672 adults with mild-to-moderate hypertension who were randomized to receive either a 600-mg dose of zilebesiran or placebo on top of one of three approved hypertension medications, namely olmesartan, amlodipine or indapamide.

Study participants who received zilebesiran added to one of the above hypertension medications achieved the study’s primary endpoint of a clinically and statistically significant reduction in systolic blood pressure (SBP) at month three. This endpoint was assessed by 24-hour ambulatory blood pressure monitoring (ABPM).

Per the companies, zilebesiran demonstrated an encouraging safety and tolerability profile when added to standard of care first-line antihypertensive medications.

However, neither Roche nor Alnylam shared any numerical data/figures alongside the results. The companies plan to present full results from the KARDIA-2 study at the 2024 American College of Cardiology Annual Scientific Session on April 7.

Alongside the results, Alnylam/Roche also announced that they have initiated the phase II KARDIA03 study to evaluate the efficacy of zilebesiran when added to two or more hypertension medications in people with uncontrolled hypertension who are at high cardiovascular risk.

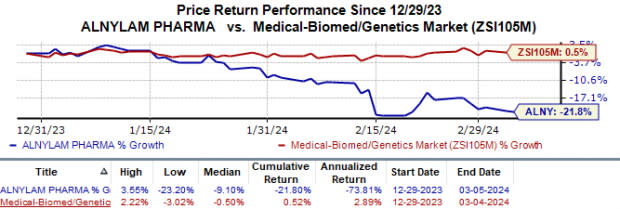

Shares of Alnylam have declined 21.8% in the year-to-date period against the industry’s 0.5% rise.

Image Source: Zacks Investment Research

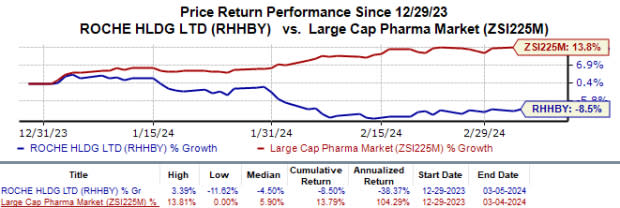

During the same period, Roche’s shares lost 8.5% against the industry’s 13.8% growth.

Image Source: Zacks Investment Research

In September, Alnylam and Roche reported topline data from the phase II KARDIA-1 study, which evaluated zilebesiran monotherapy in people with mild to moderate hypertension. The study met its primary endpoint, demonstrating that treatment with both 300mg and 600mg doses of zilebesiran achieved greater than 15 mmHg reduction of SBP following three months of treatment.

In July last year, Alnylam signed a deal with Roche to jointly develop and market zilebesiran for the treatment of hypertension. Per the terms of agreement, both companies will co-commercialize zilebesiran in the United States, while Roche will acquire exclusive rights to market the drug in ex-U.S. markets.

In return for granting these rights, Roche made an upfront payment of $310 million to Alnylam. In addition, Alnylam is also eligible to receive milestone payments of up to $2.8 billion, an equal share in profits and losses in the United States and royalties on net sales outside the country.

Roche retains the option to lead the development of the drug for any future indications beyond hypertension.

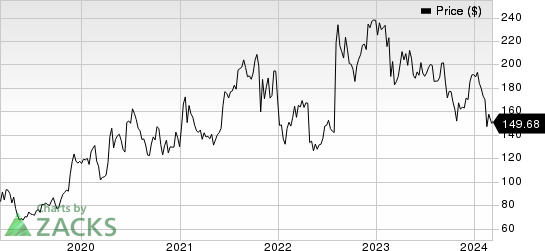

Alnylam Pharmaceuticals, Inc. Price

Alnylam Pharmaceuticals, Inc. price | Alnylam Pharmaceuticals, Inc. Quote

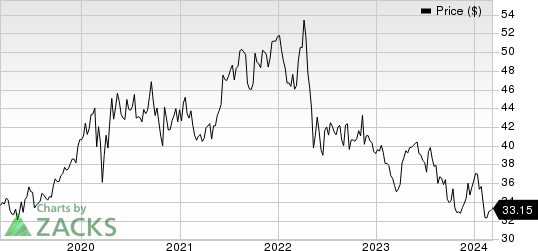

Roche Holding AG Price

Roche Holding AG price | Roche Holding AG Quote

Zacks Rank & Key Picks

Currently, Alnylam carries a Zacks Rank #3 (Hold), while Roche holds a Zacks Rank #4 (Sell). A couple of better-ranked stocks in the overall healthcare sector include ADMA Biologics ADMA and GSK plc GSK, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 18 cents to 30 cents. Meanwhile, during the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have risen 28.3%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for GSK’s 2024 EPS have risen from $3.87 to $4.04. Meanwhile, during the same period, EPS estimates for 2025 have improved from $4.20 to $4.38. Year to date, shares of GSK have risen 15.0%.

GSK's earnings beat estimates in three of the trailing four quarters while missing the mark on one occasion. On average, GSK’s four-quarter earnings surprise was 7.59%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report