Alnylam Pharmaceuticals Inc (ALNY) Reports Strong Growth in 2023, Aiming for Continued Success ...

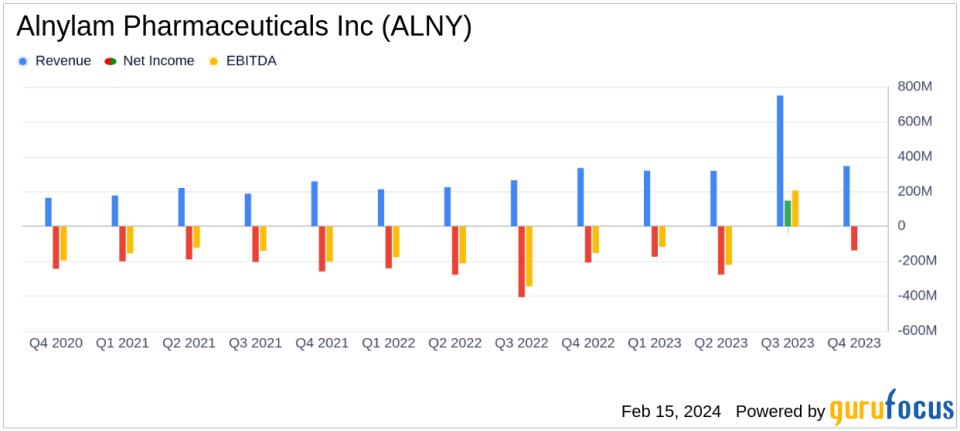

Revenue Growth: Alnylam Pharmaceuticals Inc (NASDAQ:ALNY) reported a 39% increase in annual global net product revenues, reaching $1.24 billion in 2023.

Net Income: Despite a GAAP net loss of $440.2 million for the year, the company has shown a significant reduction in losses compared to the previous year.

Earnings Per Share (EPS): GAAP net loss per share improved to $(3.52) in 2023 from $(9.30) in 2022.

Research and Development: R&D expenses increased to support the company's robust pipeline, including the KARDIA-1 and KARDIA-2 Phase 2 studies of zilebesiran.

Commercial Success: Over 5,000 patients are now being treated with Alnylam's commercial medicines, with significant growth in patient numbers for ONPATTRO and AMVUTTRA.

2024 Outlook: Alnylam provides revenue guidance of $1.4 to $1.5 billion for 2024, with key milestones anticipated across the pipeline.

On February 15, 2024, Alnylam Pharmaceuticals Inc (NASDAQ:ALNY) released its 8-K filing, detailing a year of substantial growth and strategic advancements. The company, a leader in RNA interference (RNAi) therapeutics, reported a 39% increase in global net product revenues, reaching $1.24 billion for the full year 2023. This growth is attributed to the strong performance of its four wholly-owned commercial medicines and the expansion of its patient base, now exceeding 5,000 individuals treated with Alnylam medicines.

Alnylam Pharmaceuticals Inc (NASDAQ:ALNY) is at the forefront of developing RNAi therapeutics, a cutting-edge approach to gene silencing that has the potential to treat a variety of diseases. The company's portfolio includes five marketed drugs and a robust pipeline with several clinical programs across different therapeutic areas.

Financial Performance and Challenges

The company's financial achievements in 2023 are particularly noteworthy in the biotechnology industry, where consistent revenue growth and patient reach are critical indicators of success. Alnylam's 39% annual revenue growth, driven by its TTR and Ultra-Rare franchises, underscores the company's ability to effectively commercialize its products and expand treatment to new patient populations.

However, Alnylam faced challenges, including a GAAP operating loss of $282.2 million and a GAAP net loss of $440.2 million for the year. These losses, while significant, represent a substantial improvement over the previous year's losses, reflecting the company's ongoing efforts to streamline operations and manage expenses. The company's non-GAAP operating loss, which excludes certain non-cash expenses, was considerably lower at $60.5 million for the year.

Key Financial Metrics and Commentary

Alnylam's financial performance is further illuminated by examining key metrics from its income statement and balance sheet. The company's cost of goods sold (COGS) as a percentage of net product revenues increased slightly, reflecting higher royalty rates and inventory adjustments. Research and development (R&D) expenses rose due to increased investment in the company's pipeline, including the KARDIA-1 and KARDIA-2 Phase 2 studies of zilebesiran. Selling, general, and administrative (SG&A) expenses also increased in support of the global launch of AMVUTTRA and strategic growth initiatives.

"2023 was a year of strong execution at Alnylam. We delivered robust product revenue growth across our four wholly-owned commercial medicines, with $1.24 billion in global net product revenues, and achieved over 5,000 patients now being treated with an Alnylam commercial medicine," said Yvonne Greenstreet, MBChB, Chief Executive Officer of Alnylam.

Alnylam's cash, cash equivalents, and marketable securities stood at $2.44 billion as of December 31, 2023, an increase from the previous year, bolstered by upfront payments from partnerships and employee stock option exercises.

2024 Financial Guidance and Strategic Outlook

Looking ahead, Alnylam has provided a revenue guidance range of $1.4 to $1.5 billion for 2024, alongside expectations for continued growth in collaboration and royalty revenue. The company anticipates several important milestones, including results from the HELIOS-B Phase 3 study of vutrisiran and the KARDIA-2 Phase 2 study of zilebesiran, with six clinical study starts planned for the year. These developments are expected to further cement Alnylam's position as a leader in RNAi therapeutics and contribute to its goal of becoming a top-tier biotech company.

For a detailed analysis of Alnylam Pharmaceuticals Inc (NASDAQ:ALNY)'s financial results and forward-looking strategies, investors and interested parties are encouraged to review the full 8-K filing. Stay informed on the latest financial news and insights by visiting GuruFocus.com.

Explore the complete 8-K earnings release (here) from Alnylam Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.