Alphabet (GOOGL) Introduces AML AI, Expands Reach to Banks

Alphabet’s GOOGL Google is leaving no stone unturned to explore uncharted territories on the back of its strong AI capabilities.

This is evident from the latest introduction of an anti-money laundering tool, namely Anti-Money Laundering AI (AML AI), by Google Cloud.

Notably, Google has set AML AI apart from the existing anti-money laundering tools that rely on manually defined rules written from experience. Due to this, these tools often tend to generate high alert rates but low yields in terms of accuracy. Moreover, human-defined rules are easier for money launderers to learn.

Nevertheless, AML AI provides a consolidated risk score as an alternative to a rule-based alert by deploying Machine Learning (ML) models using the vast databases of financial institutions.

These models direct users to money laundering risks by examining transaction, account, customer relationship and Know Your Customer (KYC) data. This way, AML AI determines patterns, instances, groups, anomalies and networks for retail and commercial banks.

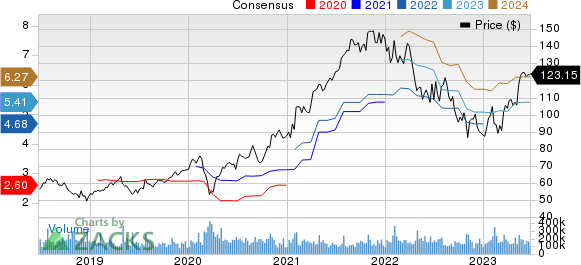

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Growth Prospects

We believe Google remains well-poised to gain momentum among financial institutions on the back of its latest launch.

Companies like HSBC, Banco Bradesco and Lunar have already shown interest in using the new tool.

Moreover, the AML AI introduction is likely to aid Google’s presence in the booming anti-money laundering software market.

Per a report from Fortune Business Insights, the global anti-money laundering software market is expected to reach $4.3 billion by 2029, witnessing a CAGR of 13% between 2022 and 2029.

A Precedence Research report indicates that the market is likely to hit $7.4 billion by 2030, seeing a CAGR of 11.4% between 2022 and 2030.

We believe Alphabet’s solid prospects in this promising market are expected to aid it in winning investors’ confidence in the near term.

Notably, GOOGL has gained 39.6% on a year-to-date basis.

Google’s Aggressive Stance on AI Usage

The latest move is in sync with Google’s growing efforts toward harnessing the power of AI across various aspects of its overall business.

Apart from the launch of AML AI, the company recently announced a generative AI-backed online shopping feature that lets users try on clothes virtually, based on Google’s new image-based AI model.

With the new feature, a wide range of customers will be able to understand how an apparel item will look on them, as it will allow them to try clothes ranging from XXS to 4XL sizes.

In addition, Google launched two new AI-backed features to boost automation in its advertisement business, which will help advertisers achieve specific goals for their ads.

One of the features called Demand Gen is designed to take care of the placement of ads, thus automating the process that advertisers were previously required to think about. The feature would place the photo and video ads of an advertiser across Gmail, YouTube feed and Shorts.

Meanwhile, another feature is designed to increase the views of an advertiser’s video ads by ensuring their right placement.

Furthermore, Google is reportedly developing an AI-backed tool that can create realistic selfies of a user based on real images of that person.

Zacks Rank & Stocks to Consider

Currently, Alphabet carries a Zacks Rank #3 (Hold).

Some top-ranked stocks in the broader technology sector are Palo Alto Networks PANW, NVIDIA NVDA and AMETEK AME. While Palo Alto Networks and NVIDIA sport a Zacks Rank #1 (Strong Buy), AME carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Palo Alto Networks shares have gained 76.7% in the year-to-date period. The long-term earnings growth rate for PANW is currently projected at 31.5%.

NVIDIA shares rallied 192.2% in the year-to-date period. Its long-term earnings growth rate is presently projected at 23.02%.

AMETEK shares have increased 12% in the year-to-date period. The long-term earnings growth rate for AME is currently projected at 8.95%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report