Alphatec Holdings Inc (ATEC) Reports Robust Revenue Growth and Margin Expansion in FY 2023

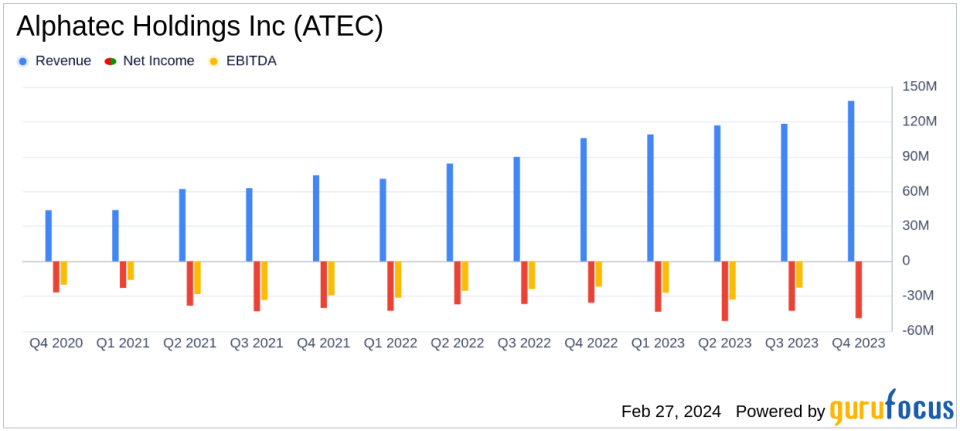

Full-Year Revenue Growth: ATEC's total revenue increased by 37% to $482 million in 2023.

Adjusted EBITDA Margin: Improved by approximately 890 basis points for the full year.

2024 Revenue Forecast: Expected to reach approximately $595 million, with an EBITDA margin expansion of around 560 basis points.

GAAP Net Loss: Reported a GAAP net loss of ($187) million for the full year.

Ending Cash Balance: ATEC concluded the year with a strong cash balance of $221 million.

Product Portfolio Expansion: Launched 15 new products and trained over 500 surgeons in 2023.

On February 27, 2024, Alphatec Holdings Inc (NASDAQ:ATEC), a medical technology company specializing in the design, development, and advancement of products for the surgical treatment of spinal disorders, released its 8-K filing, disclosing its fourth quarter and full-year 2023 financial results along with recent corporate highlights.

Financial Performance and Corporate Highlights

ATEC's full-year 2023 total revenue saw a significant increase to $482 million, a 37% growth compared to the previous year. The adjusted EBITDA margin also showed a substantial improvement of approximately 890 basis points. The company's GAAP gross margin stood at 64.3%, with non-GAAP gross margin reaching 69.8% based on the updated definition. Operating expenses were reported at $484 million on a GAAP basis and $387 million on a non-GAAP basis.

Despite the revenue growth, ATEC reported a GAAP net loss of ($187) million for the year. However, the company ended the year with a strong cash balance of $221 million, positioning it well for future operations and investments.

ATEC's portfolio expansion was a key highlight, with the full launch of Lateral TransPsoas (LTP) and Midline ALIF approaches, along with the Calibrate LTX, a lateral expandable implant. The company also launched 15 new products and line extensions in 2023, and trained over 500 surgeons, resulting in a 27% increase in surgeon users compared to 2022.

Management Commentary

Pat Miles, Chairman and Chief Executive Officer, commented on the company's aspirations and achievements, stating, "The success weve achieved to date is testament: ATEC lateral sophistication, alone, is capable of building a good, profitable company. But we aspire for much more. We are building a spine monster, and the informatics and procedural innovation that our 100% spine-focused knowhow will unleash in the years ahead will further our mission to truly revolutionize spine care. We are all systems go in the pursuit of ATECs best, which is yet to come."

Financial Outlook for 2024

Looking ahead, ATEC anticipates total revenue for the fiscal year ending December 31, 2024, to be approximately $595 million, reflecting a growth of about 23% compared to 2023. The company expects a non-GAAP adjusted EBITDA of approximately $22 million for the full year 2024, which would imply an improvement of 560 basis points in adjusted EBITDA margin compared to the full year 2023.

ATEC's focus on innovation and procedural sophistication, as well as its commitment to training and expanding its user base, are key factors in its financial performance and outlook. The company's strategic portfolio transformation and the inclusion of non-cash impact of the provision for excess and obsolete inventory in its non-GAAP financial measures reflect its ongoing efforts to provide a more accurate assessment of operating performance.

For more detailed information on ATEC's financial results and corporate updates, investors and interested parties are encouraged to access the full webcast and accompanying materials on the Investor Relations Section of ATECs Corporate Website.

Alphatec Holdings Inc (NASDAQ:ATEC) continues to demonstrate its commitment to revolutionizing spine surgery through innovation and strategic growth, setting the stage for continued success in the medical device industry.

Explore the complete 8-K earnings release (here) from Alphatec Holdings Inc for further details.

This article first appeared on GuruFocus.