Alpine Immune Sciences Inc (ALPN) Reports Full Year 2023 Financial Results

Financial Position: Alpine ended 2023 with a strong cash position of $368.2 million, anticipating funding into 2026.

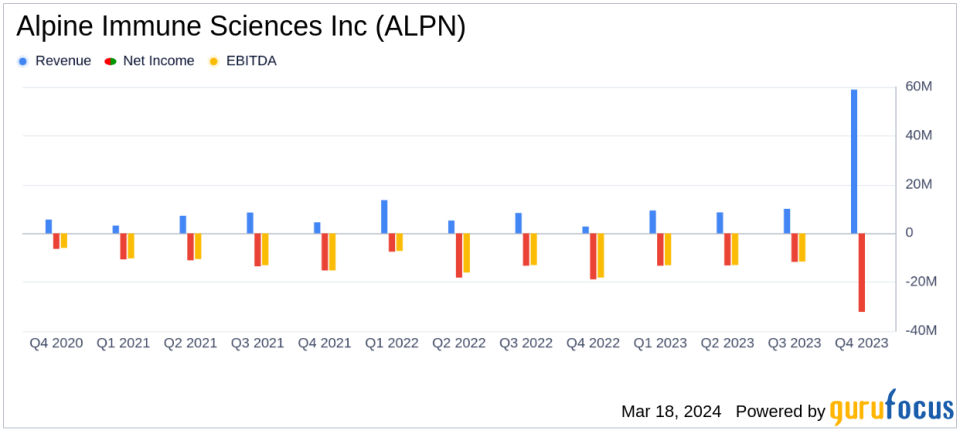

Collaboration Revenue: Yearly collaboration revenue increased to $58.9 million in 2023, up from $30.1 million in 2022.

Research and Development: R&D expenses rose to $80.9 million, reflecting a focus on clinical trials and product development.

Net Loss: Alpine reported a net loss of $32.2 million for 2023, an improvement from a $57.8 million loss in 2022.

Clinical Updates: Povetacicept showed promising results in IgA nephropathy trials and is progressing towards phase 3 and phase 2 trials.

On March 18, 2024, Alpine Immune Sciences Inc (NASDAQ:ALPN) released its 8-K filing, detailing the company's financial performance for the full year ended December 31, 2023. Alpine, a clinical-stage biopharmaceutical company, is at the forefront of developing protein-based immunotherapies for autoimmune and inflammatory diseases, leveraging its proprietary scientific platform.

Alpine's Executive Chairman and CEO, Dr. Mitchell H. Gold, highlighted 2023 as a transformational year, with significant clinical advancements for its lead candidate, povetacicept. The company is preparing for pivotal phase 3 trials in IgA nephropathy and phase 2 trials in systemic lupus erythematosus, with a strong balance sheet to support these initiatives.

Financial Highlights and Clinical Progress

Alpine's financial results reflect a solid year of progress, with a substantial increase in collaboration revenue to $58.9 million, driven by a $24.9 million increase in AbbVie revenue and a $4.5 million increase in Amgen revenue. This growth in collaboration revenue is a testament to the company's valuable partnerships and the potential of its scientific platform.

Research and development expenses saw an uptick to $80.9 million, up from $70.2 million in the previous year. This increase is attributed to the advancement of povetacicept in clinical trials, underscoring Alpine's commitment to bringing innovative treatments to market. Despite the rise in expenses, the company managed to reduce its net loss to $32.2 million, compared to a $57.8 million loss in 2022, indicating improved financial management and potential for future growth.

Alpine's cash and investments totaled $368.2 million, a significant increase from the previous year's $273.4 million. This financial strength positions the company to fund its planned operations well into 2026, providing a runway for continued research and development efforts.

Operational and Clinical Developments

Throughout 2023, Alpine presented multiple oral and poster presentations on povetacicept at scientific conferences, showcasing the drug's potential in treating autoimmune diseases. The company also reported favorable clinical data in IgA nephropathy, with povetacicept demonstrating a reduction in proteinuria and stable renal function.

Alpine's pipeline advancements are particularly noteworthy in the biotechnology industry, where the development of novel therapeutics is both time-intensive and costly. The company's ability to progress povetacicept through clinical trials and towards commercialization could represent a significant breakthrough for patients with autoimmune and inflammatory diseases.

"Looking ahead, Alpine is well positioned for a year of meaningful catalysts, with multiple updates for povetacicept in IgAN and other indications," said Dr. Gold, emphasizing the company's forward momentum.

Alpine's strategic collaborations and robust pipeline are indicative of its potential to become a leader in the immunotherapy space. The company's focus on developing first- or best-in-class multifunctional immunotherapies could significantly impact patient care and drive long-term value for shareholders.

For more detailed insights into Alpine Immune Sciences Inc (NASDAQ:ALPN)'s financial performance and clinical developments, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Alpine Immune Sciences Inc for further details.

This article first appeared on GuruFocus.