Alpine Income Property Trust Inc (PINE) Reports Mixed Results for Q4 and Full Year 2023

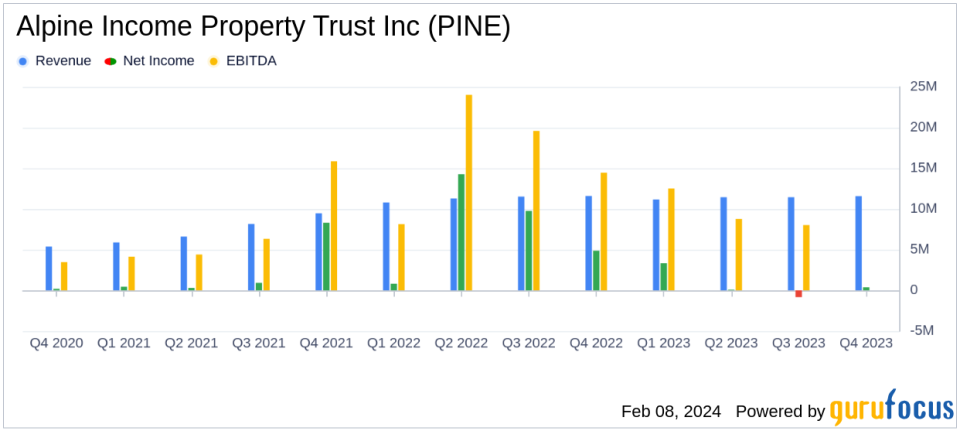

Total Revenues: Slight increase to $45.6 million in FY 2023 from $45.2 million in FY 2022.

Net Income: Significant decrease to $3.3 million in FY 2023 from $34.0 million in FY 2022.

FFO and AFFO: FFO per diluted share remained stable at $0.37 in Q4 2023, while AFFO per diluted share decreased by 7.3% to $0.38.

Dividends: Fourth quarter dividend maintained at $0.275 per share, with an annual increase to $1.10 per share in 2023.

Acquisitions and Dispositions: Acquired 14 properties and sold 24, with a focus on investment-grade tenants.

Debt Metrics: Net debt to Pro Forma EBITDA at 7.7 times, indicating leverage levels.

Alpine Income Property Trust Inc (NYSE:PINE), a real estate company specializing in single-tenant commercial properties, released its 8-K filing on February 8, 2024, detailing its financial performance for the fourth quarter and full fiscal year of 2023. The company's portfolio, primarily consisting of retail and office properties across the United States, has seen a year of strategic acquisitions and dispositions aimed at optimizing its asset base.

Financial Performance Overview

For the year ended December 31, 2023, Alpine Income Property Trust reported a marginal increase in total revenues, rising to $45.6 million from $45.2 million in the previous year. However, net income saw a drastic decline, plummeting by 90.4% to $3.3 million, down from $34.0 million in 2022. This stark decrease in net income was also reflected in the net income attributable to PINE, which dropped by 90.2% to $2.9 million.

The company's Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO) present a mixed picture. While FFO per diluted share remained unchanged at $0.37 for the fourth quarter, AFFO per diluted share decreased by 7.3% to $0.38. For the full year, FFO and AFFO per diluted share decreased by 15.0% and 15.8%, respectively.

Strategic Investments and Capital Allocation

Throughout 2023, Alpine Income Property Trust was active in the market, acquiring 14 properties for a total volume of $82.9 million, with a weighted average going-in cash cap rate of 7.4%. These acquisitions expanded the company's footprint across seven states and emphasized investment-grade credit tenants, which now represent 66% of annualized cash base rents. Additionally, the company disposed of 24 properties for a total of $108.3 million, realizing gains of $9.3 million.

Alpine Income Property Trust also originated three first mortgage investments totaling $38.6 million, with a weighted average initial yield of 9.1%, demonstrating a strategic diversification of income sources.

Portfolio and Balance Sheet Strength

The company's property portfolio remained robust, with an occupancy rate of 99.1% and a weighted average remaining lease term of 7.0 years. The portfolio is diversified across 35 states and is anchored by tenants with strong credit ratings, such as Walgreens and Lowes, which contribute significantly to annualized base rent.

On the balance sheet, Alpine Income Property Trust's net debt to Pro Forma EBITDA stood at 7.7 times, indicating a leveraged position. The company's fixed charge coverage ratio was 3.5 times, and the net debt to total enterprise value was 51.1%, reflecting a moderate level of debt in relation to the company's overall valuation.

Dividend Payout and Outlook

Alpine Income Property Trust maintained its quarterly dividend at $0.275 per share for the fourth quarter of 2023, with an annual increase to $1.10 per share, representing a modest increase from the previous year. The payout ratios for FFO and AFFO per diluted share were 74.3% and 72.4%, respectively, for the fourth quarter, and 74.8% and 73.8% for the full year.

The company's outlook for 2024 is cautiously optimistic, assuming stable or improving economic conditions and strong underlying business trends. Alpine Income Property Trust's strategic actions in 2023, including its property acquisitions, dispositions, and mortgage investments, are expected to position it for potential earnings growth in the coming year.

Value investors may find Alpine Income Property Trust's high dividend yield, strategic portfolio management, and focus on investment-grade tenants appealing, despite the significant drop in net income. The company's ability to maintain stable FFO and AFFO in a challenging environment may also be seen as a testament to its operational resilience.

For more detailed information and analysis on Alpine Income Property Trust Inc (NYSE:PINE)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Alpine Income Property Trust Inc for further details.

This article first appeared on GuruFocus.