Alta Equipment Group Inc (ALTG) Reports Revenue Surge Amidst Net Loss in Q4

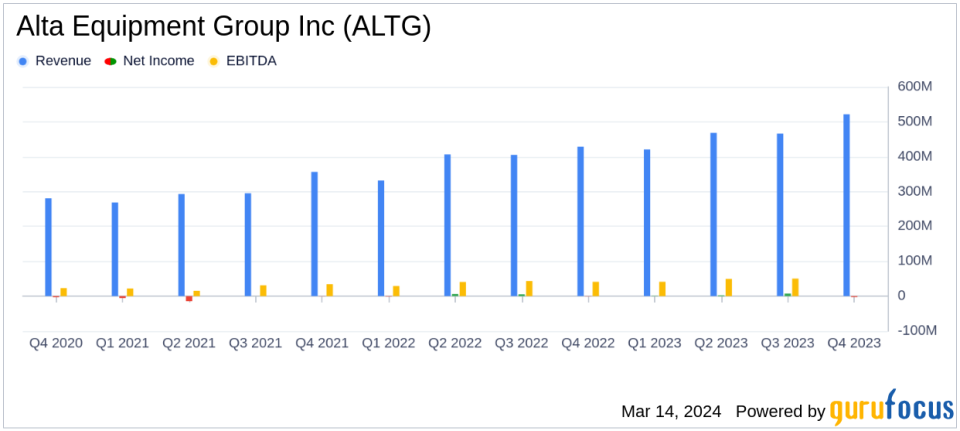

Total Revenue: Increased by 19.4% to $1.9 billion for the full year 2023.

Adjusted EBITDA: Grew 21.1% to $191.4 million for the full year, surpassing guidance.

Net Income: Reported at $5.9 million for the full year, a slight decrease from $6.3 million in 2022.

Q4 Performance: Q4 revenues up 21.7% year over year, but net loss widened to $(2.7) million.

Acquisitions: Completed acquisitions of Burris Equipment Company and Ault Industries Inc., contributing to growth.

2024 Outlook: Positive with Adjusted EBITDA guidance set between $207.5 million and $217.5 million.

On March 14, 2024, Alta Equipment Group Inc (NYSE:ALTG) released its 8-K filing, announcing the financial results for the fourth quarter and full year ended December 31, 2023. The company, a prominent integrated equipment dealership platform in the U.S., reported significant growth in total revenues, which increased by 19.4% to $1.9 billion for the full year. Despite this, the company experienced a net loss available to common stockholders of $(2.7) million in Q4, compared to $(1.5) million in the same period of the previous year.

Alta Equipment Group operates in two segments: Material Handling and Construction Equipment. The Material Handling segment saw a 19.4% increase in revenues to $681.5 million, while the Construction Equipment segment grew 12.9% to $1.1 billion for the year. The company's product support revenues also increased by 17.7%, with parts sales rising to $278.3 million and service revenues to $241.3 million.

Despite the revenue growth, the company's net income for the full year slightly decreased to $5.9 million from $6.3 million in 2022. Basic and diluted net income per share were reported at $0.18, compared to $0.20 in the previous year. However, the adjusted basic and diluted net income per share increased to $0.69 and $0.68, respectively, from $0.58 for both in 2022.

Alta's CEO, Ryan Greenawalt, expressed confidence in the company's diversified growth strategy and the momentum in their business, which led to record results in 2023. He highlighted the company's continued benefit from the strength in major end-user markets and the expansion of their field service population to over 1,300 skilled technicians.

"Our outlook for 2024 is positive as industry indicators support our expectations for continued growth this year," said Greenawalt. He cited forecasts for non-residential construction starts and lift truck deliveries, as well as higher state DOT budgets, as reasons for optimism.

For the 2024 fiscal year, Alta Equipment Group expects to report Adjusted EBITDA between $207.5 million and $217.5 million. The company's focus remains on growth and operating leverage to improve shareholder value.

Alta's balance sheet as of December 31, 2023, shows a strong position with $31.0 million in cash, an increase from $2.7 million the previous year. Total assets were reported at $1.57 billion, up from $1.29 billion in 2022. The company's total liabilities also increased to $1.42 billion from $1.15 billion.

Alta Equipment Group's performance in 2023 demonstrates its ability to grow revenues and Adjusted EBITDA despite a challenging environment. The company's strategic acquisitions and focus on high-margin parts and service business have contributed to its financial achievements. As Alta looks forward to 2024 with a positive outlook, investors may find the company's growth strategy and market position appealing.

For more detailed information, investors and interested parties can access the full earnings press release and join the earnings call and webcast as detailed in the company's announcement.

Explore the complete 8-K earnings release (here) from Alta Equipment Group Inc for further details.

This article first appeared on GuruFocus.