Altair Engineering Inc (ALTR) Reports Record Revenue and Profit in Q4 and Full Year 2023

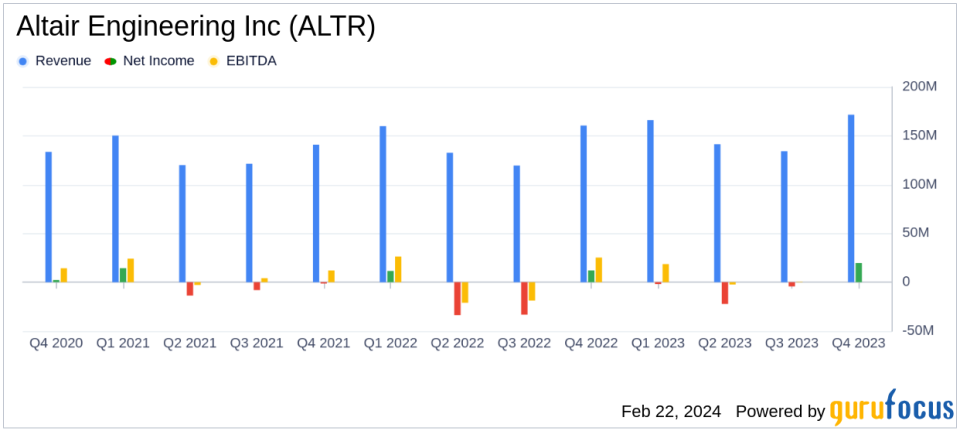

Software Product Revenue: Q4 saw a 7.6% increase year-over-year, reaching $155.9 million.

Total Revenue: Achieved $171.5 million in Q4, marking a 6.9% increase over the same period last year.

Net Income: Grew significantly to $19.7 million in Q4 from $12.1 million in the previous year.

Adjusted EBITDA: Increased by 38.3% to $53.6 million in Q4, with a margin of 31.2%.

Free Cash Flow: Improved to $19.3 million in Q4, nearly doubling from the prior year.

On February 22, 2024, Altair Engineering Inc (NASDAQ:ALTR) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a global leader in computational intelligence, reported record-high revenue and profit for both the quarter and the full year, demonstrating strong momentum across various verticals and significant growth in its software product revenue.

Altair Engineering Inc is known for its enterprise-class engineering software that supports the entire product lifecycle from concept design to in-service operation. The company's integrated suite of software optimizes design performance across multiple disciplines, including structures, motion, fluids, thermal management, system modeling, and embedded systems. Altair operates through two segments: Software and Client Engineering Services, with the majority of its revenue derived from the software segment.

The company's performance in the fourth quarter was particularly strong, with software product revenue increasing by 7.6% in reported currency to $155.9 million. Total revenue for the quarter reached $171.5 million, a 6.9% increase in reported currency. Net income for the quarter was $19.7 million, a substantial improvement from $12.1 million in the fourth quarter of 2022. The net income margin also increased to 11.5% from 7.5% in the previous year.

For the full year, software product revenue grew by 8.6% to $550.0 million, and total revenue increased by 7.1% to $612.7 million. Despite a net loss for the full year, the company saw a significant reduction in net loss from $(43.4) million in 2022 to $(8.9) million in 2023. Non-GAAP net income for the year rose by 30.6% to $98.8 million.

Adjusted EBITDA for the fourth quarter was $53.6 million, a 38.3% increase from the same period last year, with an adjusted EBITDA margin of 31.2%. Cash provided by operating activities was $21.7 million in the fourth quarter, and free cash flow was $19.3 million.

Altair's financial achievements are significant as they reflect the company's ability to grow its core software business and maintain profitability in a challenging macroeconomic environment. The strong performance in software product revenue underscores the increasing demand for computational intelligence solutions across various industries. The company's ability to exceed its profitability goals, particularly surpassing the 20% adjusted EBITDA margin target, highlights its operational efficiency and the strategic value of its software offerings.

CEO James R. Scapa expressed excitement about the company's recent and upcoming product releases, believing that Altair's investments in engineering AI are solidifying its position as a leader in this growing domain. CFO Matt Brown emphasized the company's success in exceeding profitability goals and the significant opportunity ahead as Altair continues to execute on its financial targets.

Looking ahead, Altair provided guidance for the first quarter and full year of 2024, projecting continued growth in software product revenue and total revenue. The company expects to achieve a software product revenue between $600 million and $610 million for the full year 2024, representing a growth rate of up to 10.9%.

Altair's robust financial performance and optimistic outlook for 2024 are likely to appeal to value investors seeking growth and stability in the software industry. The company's strategic focus on computational intelligence and engineering AI positions it well to capitalize on the increasing importance of these technologies in the global market.

For a detailed understanding of Altair's financials and future expectations, investors and interested parties are encouraged to review the full 8-K filing and listen to the earnings conference call.

Altair's commitment to innovation and customer success, combined with its strong financial results, positions the company for continued growth and makes it a compelling consideration for potential investors.

Explore the complete 8-K earnings release (here) from Altair Engineering Inc for further details.

This article first appeared on GuruFocus.