Alteryx (NYSE:AYX) Beats Q3 Sales Targets, Stock Jumps 17.8%

Data analytics and automation platform Alteryx reported Q3 FY2023 results beating Wall Street analysts' expectations , with revenue up 7.6% year on year to $232 million. Revenue guidance for the full year also exceeded analysts' estimates but next quarter's guidance of $337 million was less impressive, coming in 0.1% below expectations. Turning to EPS, Alteryx made a non-GAAP profit of $0.29 per share, down from its profit of $1.04 per share in the same quarter last year.

Is now the time to buy Alteryx? Find out by accessing our full research report, it's free.

Alteryx (AYX) Q3 FY2023 Highlights:

Revenue: $232 million vs analyst estimates of $210.2 million (10.4% beat)

EPS (non-GAAP): $0.29 vs analyst estimates of -$0.06 ($0.35 beat)

Revenue Guidance for Q4 2023 is $337 million at the midpoint, roughly in line with what analysts were expecting

Free Cash Flow was -$62 million compared to -$38.8 million in the previous quarter

Net Revenue Retention Rate: 119%, in line with the previous quarter

Gross Margin (GAAP): 100%, up from 85.2% in the same quarter last year

"Alteryx delivered a solid Q3, with key growth and profitability metrics exceeding our prior outlook, driven by improved execution and cost discipline," said Mark Anderson, CEO of Alteryx,

Initially created as a way to organise census data for the government, Alteryx (NYSE:AYX) provides software that helps companies automate and analyse their internal data processes.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the silo-ed data.

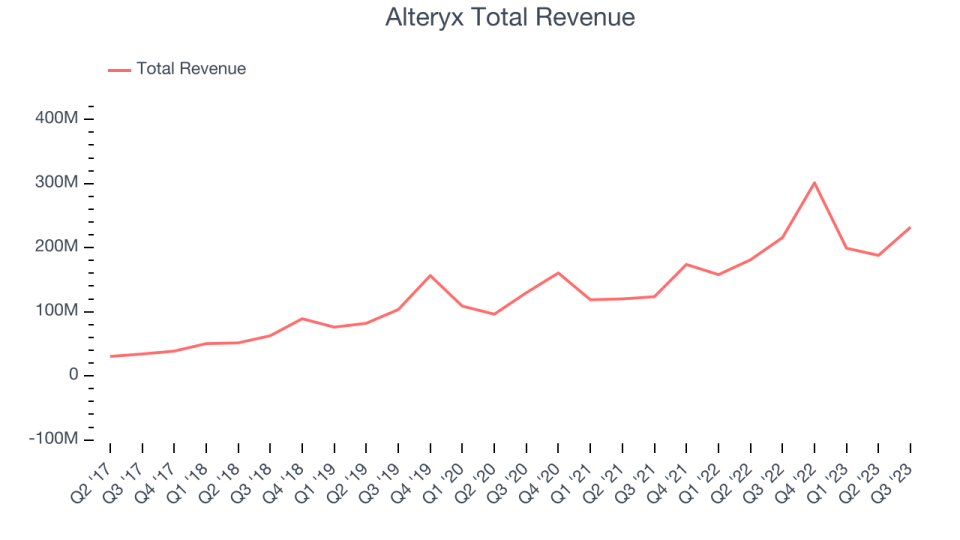

Sales Growth

As you can see below, Alteryx's revenue growth has been very strong over the last two years, growing from $123.5 million in Q3 FY2021 to $232 million this quarter.

Alteryx's quarterly revenue was only up 7.6% year on year, which might disappoint some shareholders. However, its revenue increased $44 million quarter on quarter, a strong improvement from the $11.1 million decrease in Q2 2023. This is a sign of re-acceleration of growth and very nice to see indeed.

Next quarter's guidance suggests that Alteryx is expecting revenue to grow 11.9% year on year to $337 million, slowing down from the 73.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 9.3% over the next 12 months before the earnings results announcement.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

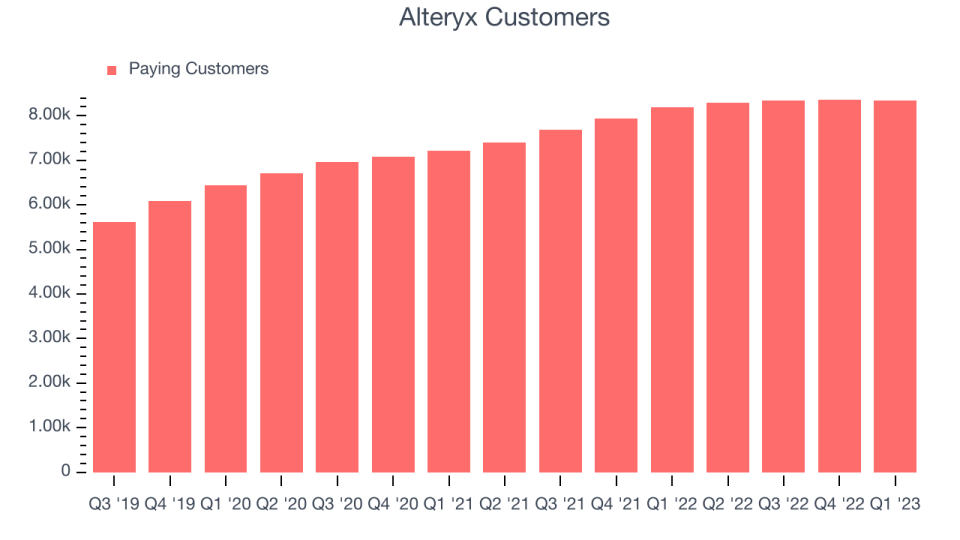

Customer Growth

Alteryx reported NaN customers at the end of the quarter, That's slower customer growth than what we've observed in past quarters, suggesting that the company's customer acquisition momentum is slowing.

Key Takeaways from Alteryx's Q3 Results

With a market capitalization of $2.3 billion, Alteryx is among smaller companies, but its more than $463 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

This was a classic "beat and raise" quarter for Alteryx. The company beat on key line items such as ARR (annual recurring revenue), revenue, and adjusted operating profit. The company largely raised its outlook for the full year as well. Overall, we think this was a strong quarter that should please most shareholders. The stock is up 16.9% after reporting and currently trades at $35.49 per share.

So should you invest in Alteryx right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.