Altice (ATUS) Beats on Q3 Earnings Despite Lower Revenues

Altice USA, Inc.’s ATUS third-quarter 2023 bottom and top line beat the respective Zacks Consensus Estimate. However, both metrics declined year over year due to a challenging macroeconomic environment. Nevertheless, the company has been accelerating the pace of network rollouts with an improvement in broadband subscribers, mobile net additions and fiber customer growth.

Quarter Details

Net income in the quarter declined to $66.8 million or 15 cents per share from $84.9 million or 19 cents per share in the prior-year quarter, primarily due to top-line contraction. The bottom line, however, beat the Zacks Consensus Estimate by 6 cents.

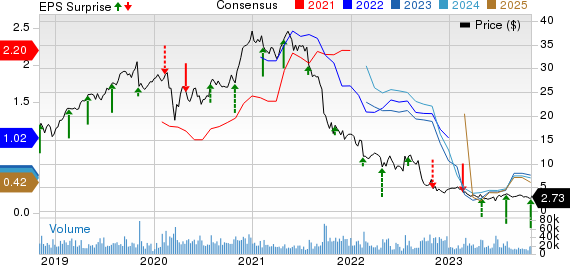

Altice USA, Inc. Price, Consensus and EPS Surprise

Altice USA, Inc. price-consensus-eps-surprise-chart | Altice USA, Inc. Quote

Quarterly total revenues slipped to $2,317.2 million from $2,393.6 million in the prior year, owing to lower contributions from residential and advertising businesses due to macroeconomic uncertainty. The top line beat the consensus estimate of $2,295 million.

The company made progress in its growth strategies by accelerating network enhancement and customer experience. At the quarter-end, Altice had 2.72 million FTTH (Fiber to the home) passings, about 60,700 of which were added in the July-September period. Broadband-only customer usage averaged 659 GB per month.

FTTH broadband net additions were more than 45,000 in the quarter, led by increased migration of existing customers and higher fiber gross additions. Total fiber broadband customers reached 295,000 by the end of the quarter. Residential revenue per customer relationship declined 0.6% year over year to $138.42 due to the loss of higher ARPU video customers.

Residential revenues (which include Broadband, Video and Telephony) were $1,831.5 million, down 3.4% year over year due to a loss in unique residential customers. Business services and wholesale revenues remained flat at $366.8 million. News and Advertising revenues were $107.5 million, down 10.8% due to lower contributions from both political campaigns.

Other Quarterly Details

Operating income improved to $492.6 million from $467.3 million in the year-ago quarter. Adjusted EBITDA was $915.5 million compared with $954.4 million in the prior-year quarter. Optimum Mobile witnessed healthy subscriber growth during the quarter, reaching 288,000 customers, representing a 6.3% penetration of the residential customer base.

Altice has been accelerating the pace of its network extension and remains well on track to reach more than 150,000 passings in 2023. The company is witnessing solid customer penetration, typically reaching approximately 40% within a year of rollout in new-build areas.

Cash Flow & Liquidity

Altice generated $1,330.2 million of cash from operating activities in the first nine months of 2023 compared with $1,905.7 million in the year-ago period. As of Sep 30, 2023, the company’s net debt was $24,910 million.

Zacks Rank & Stocks to Consider

Altice currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 18.7% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Bandwidth Inc. BAND, carrying a Zacks Rank #2, is another key pick from the broader industry. It delivered an earnings surprise of 372.9%, on average, in the trailing four quarters.

Headquartered in Raleigh, NC, Bandwidth operates as a Communications Platform-as-a-Service provider, offering avant-garde software application programming interfaces for voice and messaging services. It is the only application programming interface platform provider that owns a Tier 1 network with enhanced network capacity, primarily catering to business enterprises.

United States Cellular Corporation USM, carrying a Zacks Rank #2, is the fourth largest full-service wireless carrier in the United States. The company provides a range of wireless products and services, and a high-quality network to increase the competitiveness of local businesses and improve efficiency of government operations.

U.S. Cellular has taken concrete steps to accelerate subscriber additions and improve churn management. The company aims to offer the best wireless experience to customers by providing superior quality network and national coverage. It is well-positioned to support the investment required for network enhancements, including the deployment of 5G technology. The company is well-positioned for continued demand for broadband.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Cellular Corporation (USM) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Altice USA, Inc. (ATUS) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report