Altimmune Inc (ALT) Reports Q4 and Full Year 2023 Financial Results, Highlighting Pemvidutide's ...

Estimated Earnings Per Share: Reported at -$0.54, aligning with analyst projections of -$0.4254.

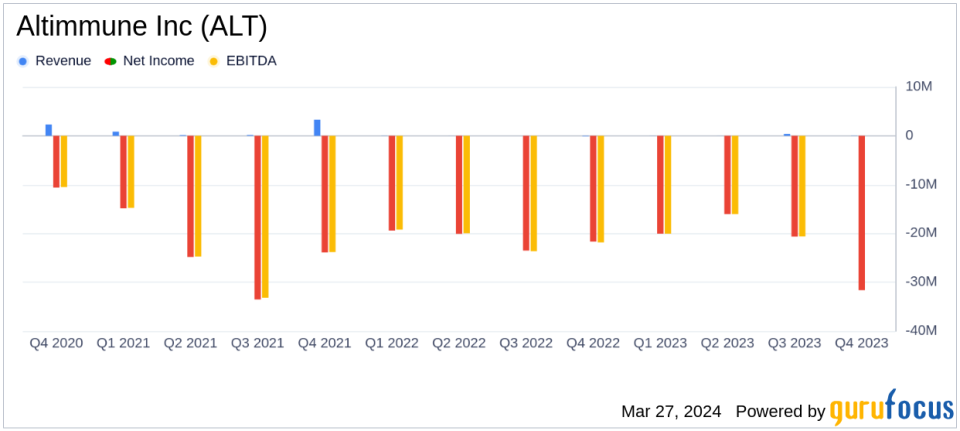

Estimated Net Income: Net loss reported at -$31.641 million, compared to analyst estimates of -$22.9755 million.

Revenue: Revenue reported at $37 thousand, with no analyst estimates available for comparison.

Cash Reserves: Cash, cash equivalents, and short-term investments reported at $198.0 million.

Research and Development: R&D expenses accounted for $65.799 million for the full year.

Operational Highlights: Positive data from obesity trial and ongoing Phase 2b MASH trial with topline data expected in Q1 2025.

On March 27, 2024, Altimmune Inc (NASDAQ:ALT) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The clinical-stage biopharmaceutical company, which is engaged in developing treatments for obesity and liver diseases, reported an alignment with analyst projections for earnings per share (EPS) but a wider net loss than anticipated.

Company Overview

Altimmune Inc is at the forefront of developing next-generation peptide therapeutics for obesity and non-alcoholic steatohepatitis (NASH), including pemvidutide, formerly known as ALT-801. The company also focuses on treatments for chronic hepatitis B (HepTcell). Altimmune operates as a single business entity dedicated to the research and development of treatments for various diseases and disorders, as well as vaccines.

Financial Performance and Challenges

Altimmune's financial results highlight a net loss of $31.641 million for the quarter, which is greater than the estimated net loss of $22.9755 million. This discrepancy underscores the challenges faced by the company in a competitive biotechnology landscape where R&D costs are significant, and revenue streams are often uncertain until treatments are fully developed and approved.

The importance of these financial results lies in the company's ability to sustain its operations and continue funding its research pipeline. The reported cash reserves of $198.0 million provide a cushion for ongoing clinical trials and development efforts. However, the cessation of further development of HepTcell due to insufficient trial outcomes reflects the inherent risks of drug development in the biotechnology industry.

Financial Achievements and Industry Relevance

Despite the reported net loss, Altimmune's financial achievements include the preservation of a strong cash position, which is crucial for the company's long-term research initiatives. The positive data from the body composition analysis of the MOMENTUM 48-week Phase 2 obesity trial of pemvidutide is a significant milestone. The company's ability to demonstrate lean mass preservation during weight loss is particularly relevant in the biotechnology sector, where the efficacy and safety profiles of treatments can set a company apart from its competitors.

Key Financial Metrics

Altimmune's financial health can be further assessed by examining the key details from the consolidated balance sheets and statements of operations:

"Cash and cash equivalents of $135.117 million and short-term investments of $62.698 million as of December 31, 2023, reflect the company's solid liquidity position. Research and development expenses for the year amounted to $65.799 million, underscoring the company's commitment to advancing its clinical programs. The net loss per share for the year stood at $1.66, which aligns with the EPS estimate of -$0.4254 for the quarter."

The company's financial tables further reveal that the total operating expenses for the year were $96.355 million, with a significant portion allocated to research and development, highlighting the company's focus on advancing its therapeutic pipeline.

Analysis of Company's Performance

Altimmune's commitment to its clinical programs, especially pemvidutide, is evident in the substantial investment in research and development. The positive data on lean mass preservation and the anticipation of topline data from the ongoing Phase 2b MASH trial in Q1 2025 are promising signs for the company's future. However, the discontinuation of HepTcell's development reminds investors of the risks associated with the biotech industry.

Overall, Altimmune's financial results reflect a company in the midst of critical development phases for its lead candidates, with a keen eye on both the scientific and financial aspects necessary to bring innovative treatments to market.

For more detailed information and analysis, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive financial data and investment insights.

Explore the complete 8-K earnings release (here) from Altimmune Inc for further details.

This article first appeared on GuruFocus.