Altium Capital Management LP Acquires New Stake in Alimera Sciences Inc

Altium Capital Management LP, a New York-based investment firm, recently made a significant move in the stock market by acquiring a new stake in Alimera Sciences Inc. This article provides an in-depth analysis of the transaction, the profiles of both entities, and the potential implications of this strategic move.

Details of the Transaction

On August 15, 2023, Altium Capital Management LP purchased 2,984,803 shares of Alimera Sciences Inc at a price of $3.57 per share. This acquisition had a 7.46% impact on the firm's portfolio, making it a significant transaction. Following this purchase, Altium Capital Management LP now holds a total of 2,984,803 shares in Alimera Sciences Inc, representing 5.70% of the company's total shares.

Profile of Altium Capital Management LP

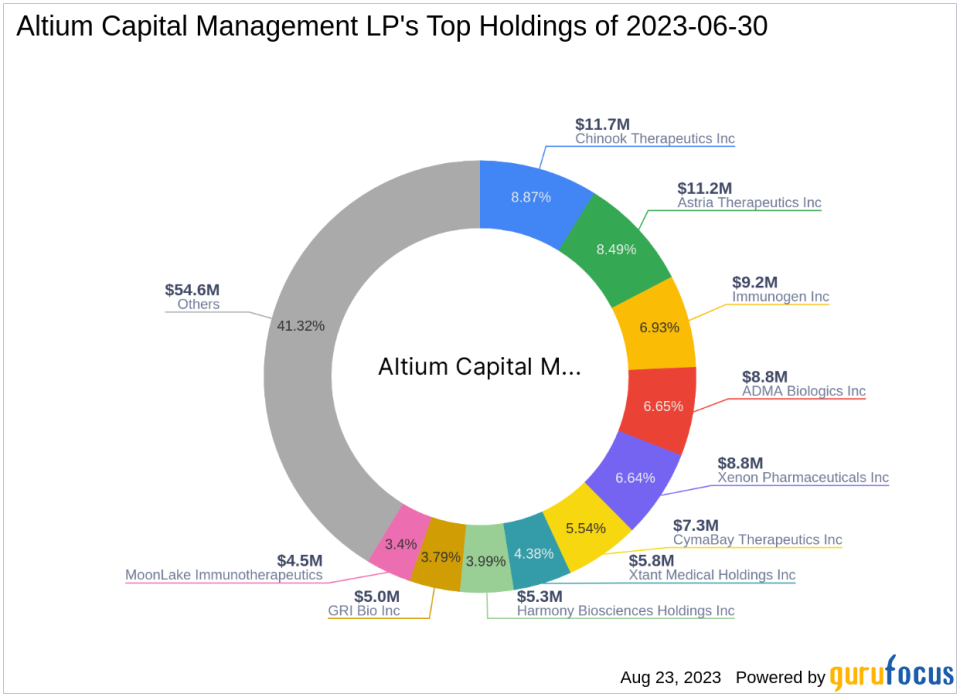

Altium Capital Management LP is an investment firm located at 152 W 57 St Fl20, New York, NY 10019. The firm manages a portfolio of 68 stocks, primarily in the healthcare and financial services sectors. Its top holdings include ADMA Biologics Inc (NASDAQ:ADMA), Astria Therapeutics Inc (NASDAQ:ATXS), Immunogen Inc (NASDAQ:IMGN), Xenon Pharmaceuticals Inc (NASDAQ:XENE), and Chinook Therapeutics Inc (NASDAQ:KDNY). The firm's total equity stands at $132 million.

Overview of Alimera Sciences Inc

Alimera Sciences Inc, trading under the symbol ALIM, is a commercial-stage pharmaceutical company based in the USA. The company, which went public on April 22, 2010, specializes in the development and commercialization of ILUVIEN for the treatment of diabetic macular edema (DME) and non-infectious uveitis affecting the posterior segment of the eye (NIU-PS). Alimera Sciences Inc operates in a single segment and has a market capitalization of $183.466 million. The company's stock is currently priced at $3.5.

Analysis of Alimera Sciences Inc's Stock

Alimera Sciences Inc's stock is modestly undervalued according to GuruFocus's GF Valuation, with a GF Value of $4.62 and a price to GF Value ratio of 0.76. The stock has experienced a -1.96% decline since the transaction and a -97.88% decline since its IPO. However, the stock has seen a year-to-date gain of 17.06%. The company's GF Score is 62/100, indicating a poor future performance potential.

Evaluation of Alimera Sciences Inc's Financial Health

Alimera Sciences Inc's financial health is evaluated using several metrics. The company's Financial Strength is ranked 3/10, its Profitability Rank is 2/10, and its Growth Rank is 2/10. The company's Piotroski F-Score is 3, indicating a poor financial situation. Its Altman Z score is -2.50, suggesting potential financial distress, and its cash to debt ratio is 0.29.

Analysis of Alimera Sciences Inc's Performance in the Drug Manufacturers Industry

In the Drug Manufacturers industry, Alimera Sciences Inc's performance is evaluated using several metrics. The company's Return on Equity (ROE) is 0.00%, and its Return on Assets (ROA) is -35.68%. The company's gross margin growth is -1.10%, and its operating margin growth is 42.20%. Over the past three years, the company's revenue growth is -11.90%, its EBITDA growth is -33.50%, and its earning growth is -5.80%.

Conclusion

In conclusion, Altium Capital Management LP's recent acquisition of a new stake in Alimera Sciences Inc is a significant move that could have potential implications for both entities. While Alimera Sciences Inc's financial health and performance in the Drug Manufacturers industry raise some concerns, the firm's investment could be a strategic move based on future growth potential. However, only time will tell the true impact of this transaction on both Altium Capital Management LP's portfolio and Alimera Sciences Inc's stock performance.

This article first appeared on GuruFocus.