Altria (MO) Gains on Pricing Power & Smoke-Free Strength

Altria Group, Inc. MO has been navigating market uncertainties with the support of its pricing power and focus on smoke-free products. These upsides have been working well for the tobacco giant amid soft cigarette volumes.

Pricing Power

Altria has been benefiting from its strong pricing power, which has helped the company stay firm amid challenges. Though higher pricing might lead to a possible decline in cigarette consumption, it is seen that smokers tend to absorb price increases due to the addictive quality of cigarettes.

In the fourth quarter of 2023, higher pricing aided revenues across the Smokeable Products and Oral Tobacco categories, which were otherwise hurt by lower volumes. Higher pricing also offered respite to the adjusted operating companies income (OCI) in both segments.

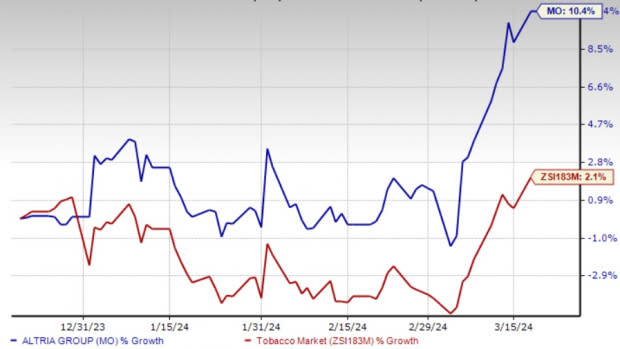

Image Source: Zacks Investment Research

Strength in Smoke-Free Products

In response to the evolving market dynamics, Altria has adapted its strategy by introducing various oral tobacco, e-vapor and heated tobacco offerings. The company, through its subsidiary Helix Innovations, holds full global ownership of on!, a widely embraced tobacco-derived nicotine (TDN) pouch product. on! is a valuable addition to the company's smoke-free product portfolio, particularly given the growing popularity of oral TDN products in the United States, where they are marketed as low-risk options.

The significant strategic agreement between Altria and JT Group (announced in October 2022), which comprises a joint venture for the commercialization of heated tobacco stick products in the United States, also deserves attention. Net revenues in the Oral Tobacco Products segment saw a 6.6% increase to $674 million in the fourth quarter of 2023, driven by enhanced pricing strategies and a reduction in promotional investments. During the quarter, reported shipment volumes of on! jumped roughly 33% year over year.

Core Challenges

The overall cigarette industry has been bearing the brunt of the inflationary environment, which has affected Adult Tobacco Consumers’ (“ATC”) spending patterns. On its fourth-quarter earnings call, management stated that industry cigarette volumes tumbled by an estimated 8% last year due to a historical rate of decline, the increased use of illicit vapor products and persistent macroeconomic pressure on smokers.

In the Smokeable Products segment, net revenues decreased 3.3% year over year to $5,274 million in the fourth quarter due to the reduced shipment volume and increased promotional investments, partly compensated by greater pricing. Domestic cigarette shipment volumes tumbled 7.6%, mainly due to the industry’s decline rate and retail share losses, partly compensated by trade inventory movements. The industry’s decline was a result of macroeconomic pressure on ATC disposable income and increases in illegitimate e-vapor products.

Wrapping Up

As the external landscape remains dynamic, Altria continues assessing economic factors like inflation, ATC dynamics (such as purchasing patterns and the adoption of smoke-free products), illegal e-vapor enforcement and regulatory developments. However, the abovementioned upsides are likely to help Altria counter the obstacles on its way.

Moreover, the company recently concluded the divestiture of a portion of its stake in Anheuser-Busch InBev SA/NA. Concurrently, MO expanded its share repurchase program. Taking these into account, the company raised its bottom-line view for 2024. Altria now envisions adjusted earnings per share (EPS) in the range of $5.00-$5.17, which indicates growth of 2-4.5% from $4.95 reported in the year-ago period.

Shares of this Zacks Rank #3 (Hold) company have rallied 10.4% in the past three months compared with the industry’s growth of 2.1%.

Solid Staple Picks

The Chef’s Warehouse CHEF, which engages in the distribution of specialty food products, currently carries a Zacks Rank #2 (Buy). CHEF has a trailing four-quarter earnings surprise of 3.2%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal-year sales and earnings suggests growth of 8.7% and 4.7%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank #2. VITL has a trailing four-quarter average earnings surprise of 155.4%.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 20.2% and 28.8%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks, currently carrying a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2.6%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 19.3% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altria Group, Inc. (MO) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report