Altria (MO) Q3 Earnings Top, Revenues Gain on Strong Pricing

Altria Group Inc.’s MO third-quarter 2018 results reflect consistent strength in the bottom line. This marks the company’s fifth consecutive earnings beat. The quarterly performance gained from revenue growth in the smokeless and smokeable categories. These segments were predominantly aided by strong pricing.

Consistent bottom-line performance along with advancements in the smokeless category and gains from pricing strategies have raised investors’ optimism in the stock. Evidently, the stock has gained 12.6% in the past three months compared with the industry’s 1.2% rise.

Quarter in Details

Adjusted earnings of $1.08 per share came ahead of the Zacks Consensus Estimate of $1.07. Earnings improved 20% year over year on the back of lower outstanding shares and reduced income taxes.

Net revenues of this Zacks Rank #3 (Hold) company inched up 1.6% year over year to $6,837 million. Top-line growth was backed by improved revenues in the smokeable and smokeless segments, which benefited from strong pricing. Revenues net of excise taxes advanced 3.3% to $5,292 million. The Zacks Consensus Estimate was pegged at $5,218 million.

Also, in the quarter under review, gross profit improved 2.6% from the prior-year quarter’s tally to $3,255 million.

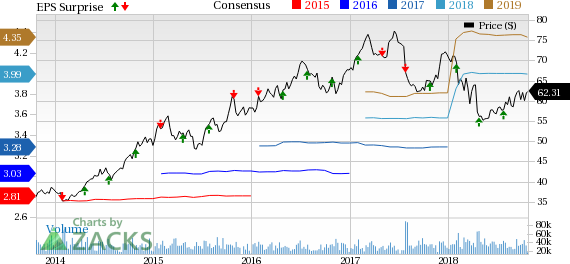

Altria Group, Inc. Price, Consensus and EPS Surprise

Altria Group, Inc. Price, Consensus and EPS Surprise | Altria Group, Inc. Quote

Segment Details

Smokeable Products Segment: Net revenues in the category inched up 1% year over year to $6,035 million, driven by higher pricing and lower promotional investments. These were partially offset by reduced volumes. Revenues net of excise taxes also expanded 2.7% year over year to $4,530 million.

Total shipment volume in the category fell 3.5% from the prior-year quarter’s tally. Also, domestic cigarette shipment volumes dropped 3.7% year over year owing to lower cigarette industry volumes, decline in retail share and unfavorable trade inventory movements. During the quarter, the company’s total cigarette retail share declined to 50.1%, representing a 0.5 percentage point slip.

Adjusted OCI in the segment inched down 0.2% to $2,281 million due to lower cigarette volumes, higher costs and resolution expenses. These were partially made up for by higher pricing and lower promotional spending. Adjusted OCI margins went down 1.4 percentage points to 50.4%.

Smokeless Products: Net revenues in the segment rose 6.5% from the year-ago quarter’s figure to $586 million, owing to improved pricing. Also, revenues net of excise taxes advanced 7.2% to $552 million in the quarter.

Domestic shipment volumes in the category increased 0.4%. Also, total smokeless products retail share moved up 0.1 percentage points to 54.1% in the quarter.

Adjusted OCI rose 7% to $383 million owing to higher pricing, partially countered by higher costs. However, adjusted OCI margin contracted 0.1 percentage points to 69.4%.

Wine: Net revenues in the wine category were flat year over year at $181 million, as gains from premium mix and higher pricing were offset by lower volumes. The segment’s revenues, net of excise taxes, were unchanged at $175 million. Wine shipment volume declined 3.5% to 2.2 million cases.

Adjusted OCI in the category declined 19.4% to $29 million as a result of higher costs and reduced volumes, partially countered by favorable premium mix. Adjusted OCI margin contracted 4 percentage point to 16.6%.

Financial Updates

Altria ended the quarter with cash and cash equivalents of $2,393 million, long-term debt of $11,896 million and total stockholders’ equity of $15,496 million, as of Sep 30, 2018.

During the third quarter, the company paid dividends worth more than $1.3 billion. The company’s annualized dividend rate is currently pegged at $3.20 per share. Further, management is on track to maintain a payout ratio of 80% of the bottom line.

Further, the company repurchased 6.2 million shares for approximately $367 million in the quarter. As of Sep 30, 2018, Altria had around $700 million remaining under the share repurchase program of $2 billion, which is expected to be completed by end of second-quarter 2019.

Other Developments

During September, the FDA undertook several moves to curb e-cigarette consumption among the youth. To comply with such directives, Altria has announced the removal of certain e-cigarette products such as MarkTen Elite, until they receive clearance from the FDA. Moreover, certain flavored e-cigarette products under the Nu Mark brand will be discontinued until they receive clearance.

Outlook

Management revised the guidance for 2018 and currently expects adjusted earnings in the range of $3.95-$4.03 compared with the previous projection of $3.94-$4.03. The revised guidance reflects year-over-year growth of 16.5-19%. Further, the company continues to expect 2018 adjusted effective tax rate of 23-24%.

Greedy for Consumer Staples Stocks? Check These

The Chefs' Warehouse, Inc CHEF, with long-term EPS growth rate of 19%, flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here

Sysco Corporation SYY has long-term EPS growth rate of 10.6% and a Zacks Rank #2 (Buy).

Ollie’s Bargain Outlet OLLI, a Zacks Rank #2 stock, has delivered positive earnings surprises in the past four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Altria Group, Inc. (MO) : Free Stock Analysis Report

To read this article on Zacks.com click here.