Altus Power Inc (AMPS) Reports Mixed 2023 Financial Results Amidst Strong Revenue Growth

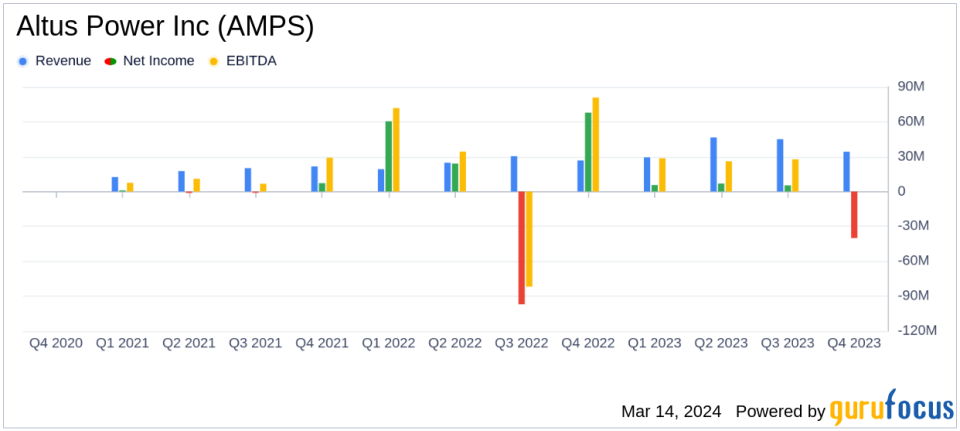

Revenue Growth: Altus Power Inc (NYSE:AMPS) achieved a significant 53% increase in full-year 2023 revenues, reaching $155.2 million.

Net Loss: Despite revenue growth, the company reported a GAAP net loss of $26.0 million for the full year 2023, contrasting with a net income of $52.2 million in 2022.

Adjusted EBITDA: The company saw a 59% increase in adjusted EBITDA, amounting to $93.1 million for the full year 2023.

Operating Cash Flow: Net cash provided by operating activities surged by 125% over the previous year to $79.4 million.

Customer and Asset Growth: Approximately 150 enterprise customers were added, and the portfolio size increased by 91% to 896 MW during 2023.

On March 14, 2024, Altus Power Inc (NYSE:AMPS), a leading renewable energy generation company specializing in solar power for commercial and industrial sectors, released its 8-K filing, disclosing its financial results for the fourth quarter and full year of 2023. The company, known for developing and operating large-scale photovoltaic and energy storage systems, as well as electric vehicle charging facilities, has reported a significant increase in revenue, though it faced a net loss over the fiscal year.

Financial Performance and Challenges

Altus Power's revenue growth is a testament to its expanding customer base and increased energy production. However, the net loss in 2023, primarily driven by non-cash losses from remeasurement of alignment shares, highlights the volatility and challenges within the renewable energy market. The company's adjusted EBITDA margin remained robust at 60%, indicating efficient operational management despite the net loss.

Strategic Growth and Market Leadership

The company's strategic acquisitions and customer growth have solidified its position as the largest owner of commercial scale solar assets in the US. Altus Power's expansion on the West Coast and the recent acquisition from Vitol in January 2024 demonstrate its commitment to scaling operations and maintaining market leadership.

Looking Ahead: 2024 Guidance

Altus Power anticipates continued growth in the coming year, with operating revenues expected to range between $200-222 million and adjusted EBITDA projected to be between $115-135 million. These forecasts represent significant growth over the previous year and reflect the company's positive outlook on its operational capabilities and market opportunities.

Financial Statements Overview

The company's balance sheet shows a year-ending cash balance of $219 million, which supports its financing plan for 2024 without the need for additional equity. The increase in operating revenues and cash flow from operations indicates a strong financial position to support ongoing growth initiatives.

"2023 was another record year for Altus on a number of fronts, with revenue, adjusted EBITDA, customer additions, and asset growth all reaching new highs," said Lars Norell, co-CEO of Altus Power. "We are building a different kind of power company. We are customer-centric and have growing annual recurring revenues which we expect will allow us to deliver our shareholders sustainable and profitable growth over time."

"As the largest player in commercial scale solar, the advantages of our category leadership are becoming ever more evident, and we are continuing to scale our platform in order to support our ongoing growth," added Gregg Felton, Co-CEO of Altus Power.

Altus Power's financial achievements and strategic growth initiatives position the company as a key player in the renewable energy sector. While the net loss presents a challenge, the company's revenue growth and operational efficiency offer a promising outlook for value investors interested in the renewable energy market.

For a more detailed analysis of Altus Power Inc (NYSE:AMPS)'s financial results, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Altus Power Inc for further details.

This article first appeared on GuruFocus.