Amarin (AMRN) Q3 Earnings and Revenues Surpass Estimates

Amarin Corporation plc AMRN reported break-even quarterly earnings for third-quarter 2023 against the Zacks Consensus Estimate of a loss of 2 cents per share. The company had recorded adjusted earnings of 2 cents per share in the year-ago quarter.

Adjusted earnings exclude non-cash stock-based compensation, restructuring inventory and other restructuring expenses.

Total revenues were $66.1 million, which comprehensively beat the Zacks Consensus Estimate of $58 million. However, revenues were down 26.5% from the year-ago quarter, owing to lower product revenues.

Net product revenues in the third quarter were $64.9 million, reflecting a decrease of 27.2% year over year. Licensing and royalty revenues, comprising royalties from partners in Canada, the China region and the Middle East, came in at $1.2 million.

Shares of Amarin have plunged 42.5% in the year-to-date period compared with the industry’s 24.6% decline.

Image Source: Zacks Investment Research

Quarter in Details

U.S. product revenues from Vascepa, the company’s sole marketed drug, totaled $62.4 million, down 29% from the year-ago quarter’s level and 3% sequentially as rising generic competition hurt sales volumes in the United States.

However, the drug’s U.S. sales beat our model estimate of $52.9 million.

Product revenues from Vazkepa (Vascepa’s brand name in Europe) in the European market totaled $0.8 million compared with $0.6 million in the previous quarter. Early launches are currently underway in several European countries, including the United Kingdom, Spain and the Netherlands.

Licensing and royalty revenues totaled $1.2 million in the third quarter compared with $0.7 million in the year-ago period. The figure missed our model estimate of $2.5 million.

Adjusted selling, general and administrative expenses (SG&A), excluding non-cash stock-based compensation, totaled $41.8 million, down almost 23% year over year.

Adjusted research and development (R&D) expenses (excluding non-cash stock-based compensation) amounted to $4.1 million, down almost 19.6% year over year. The declines in adjusted SG&A and R&D expenses were due to the company’s cost reduction and restructuring plans.

We note that in July 2023, Amarin implemented an organizational restructuring plan to strengthen its existing cash runway and curb cash burn. It reduced its current workforce by 30% in non-sales positions. It plans to save around $40 million annually in operating expenses through restructuring.

Amarin ended the third quarter with cash and investments of $321 million compared with $313 million as of Jun 30, 2023.

The company believes that its current cash is enough to fund the ongoing operations and support launch activities in Europe.

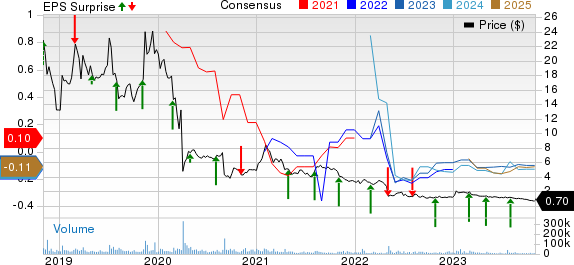

Amarin Corporation PLC Price, Consensus and EPS Surprise

Amarin Corporation PLC price-consensus-eps-surprise-chart | Amarin Corporation PLC Quote

Zacks Rank & Stocks to Consider

Amarin currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Dynavax Technologies Corporation DVAX, MEI Pharma, Inc. MEIP and Arvinas, Inc. ARVN, sporting a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Dynavax Technologies’ 2023 loss per share have narrowed from 24 cents to 22 cents. Meanwhile, during the same period, earnings per share estimates for 2024 have improved from 2 cents to 8 cents. Year to date, shares of DVAX have rallied 33.6%.

Earnings of Dynavax Technologies beat estimates in two of the last four quarters while missing the same on the remaining two occasions. DVAX delivered a four-quarter average earnings surprise of 25.78%.

In the past 60 days, estimates for MEI Pharma’s 2023 loss per share have improved from $6.54 to $4.89. During the same period, loss per share estimates for 2024 have narrowed from $5.14 to $4.02. Year to date, shares of MEIP have rallied 40%.

Earnings of MEI Pharma beat estimates in three of the trailing four quarters and met the same on the other occasion. On average, MEIP came up with a four-quarter earnings surprise of 53.58%.

In the past 60 days, estimates for Arvinas’ 2023 loss per share have improved from $6.14 to $6.05. During the same period, loss per share estimates for 2024 have narrowed from $7.91 to $7.84. Year to date, shares of ARVN have lost 52.9%.

Earnings of Arvinas beat estimates in one of the trailing four quarters and missed the same on the remaining three occasions. On average, ARVN came up with a four-quarter negative earnings surprise of 14.22%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Amarin Corporation PLC (AMRN) : Free Stock Analysis Report

MEI Pharma, Inc. (MEIP) : Free Stock Analysis Report

Arvinas, Inc. (ARVN) : Free Stock Analysis Report