Amarin Corp PLC (AMRN) Faces Revenue Decline Amidst Generic Competition

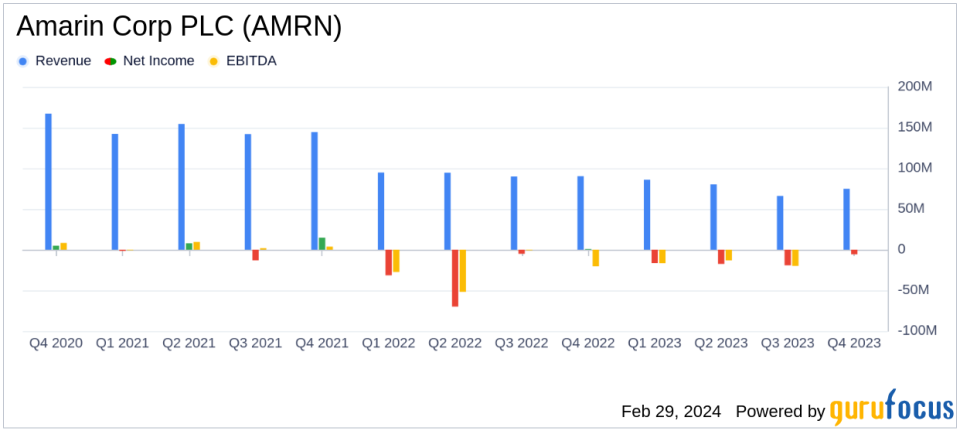

Total Revenue: Q4 revenue decreased by 17% year-over-year to $75 million.

Net Loss: Reported a net loss of $5.8 million in Q4, a shift from a net income of $0.9 million in the same period last year.

Operating Expenses: Q4 operating expenses were reduced to $50 million from $73.2 million year-over-year.

Gross Margin: Gross margin declined to 58% in Q4 from 70% in the prior year's quarter.

Cash Position: Year-end cash and investments stood at $321 million with a positive cash flow of $10 million for the full year.

Share Repurchase Program: Initiated a process for shareholder approval to execute a share repurchase program of up to $50 million.

Amarin Corp PLC (NASDAQ:AMRN) released its 8-K filing on February 29, 2024, disclosing its fourth quarter and full-year financial results for 2023. The biopharmaceutical company, known for its cardiovascular health product Vascepa, faced a challenging year with a significant decrease in revenue and a shift from net income to net loss in the fourth quarter. Despite these challenges, the company has reaffirmed its strong cash position and has initiated a share repurchase program to build momentum for the future.

Financial Performance and Challenges

Amarin's total net revenue for the fourth quarter of 2023 was $74.7 million, a 17% decrease from the $90.2 million reported in the same period of 2022. This decline was primarily due to a decrease in volume of Vascepa sales in the United States, which has been adversely impacted by the availability of generic alternatives. The company's U.S. net product revenue fell to $64.9 million in Q4 2023 from $88.0 million in the previous year. European and Rest of World (RoW) revenues showed modest contributions, with licensing and royalty revenue increasing from the prior year.

The company's gross margin also saw a decline, dropping to 58% in Q4 2023 from 70% in the corresponding period of 2022, reflecting the increased competitive pressures in the market. Selling, general, and administrative expenses decreased significantly due to cost reduction efforts, including the elimination of the U.S. sales force.

Despite the revenue decline, Amarin ended the year with a strong cash and investment position of $321 million, which includes a positive cash flow of $10 million for the full year. This financial stability has allowed the company to initiate a shareholder approval process for a share repurchase program of up to $50 million, signaling confidence in its long-term value proposition.

Strategic Focus and Outlook

Patrick Holt, President & CEO of Amarin, highlighted the operational momentum and early signs of progress in Europe, particularly in Spain and the U.K., as well as continued leadership in the U.S. IPE market. The company is focused on reducing operating expenses and managing cash efficiently, with a commitment to delivering $40 million of annual savings following a reduction in force announced in July 2023.

Amarin's strategic focus remains on cash preservation and investing in opportunities that add value, aiming to continue its leadership in cardiovascular disease management. The company's outlook for 2024 includes ongoing efforts to expand access and reimbursement for Vascepa across global markets.

Conference Call and Further Information

Amarin will host a conference call to discuss the earnings report and provide further details on its business operations and outlook. Investors and interested parties can access the call through the investor relations section of the company's website or by dialing in directly.

For a more detailed analysis of Amarin Corp PLC's financial results, including the full income statement and balance sheet data, please visit the 8-K filing. This comprehensive report offers insights into the company's performance and strategic direction, which are crucial for investors and stakeholders.

For further information on Amarin's leading product, Vascepa, and its indications, safety information, and global availability, please refer to the official product websites and regulatory disclosures.

Amarin's commitment to transparency and communication with investors is reflected in its active engagement through various channels, including its website, investor relations site, SEC filings, and public conference calls. Stakeholders are encouraged to stay informed by regularly reviewing these resources.

Investor and media inquiries can be directed to Mark Marmur at Amarin Corporation plc, ensuring open lines of communication for additional questions or clarifications.

Value investors and potential GuruFocus.com members interested in the biopharmaceutical sector and Amarin Corp PLC's financial journey are invited to explore the detailed earnings report and consider the implications for their investment strategies.

Explore the complete 8-K earnings release (here) from Amarin Corp PLC for further details.

This article first appeared on GuruFocus.