Amazon and 4 Other Stocks to Buy in E-commerce Space

Amazon AMZN has been dominating the e-commerce domain with its aggressive retail strategy. Expanding seller base, distribution strength, strategic acquisitions and partnerships have helped the company sustain its market share despite intensifying competition.

The company is well poised to leverage e-commerce sector’s growth potential. According to data from Statista, revenues in this sector are expected to hit $1.7 trillion in 2018 and $2.5 trillion in 2022 by growing at a CAGR of 9.6% between 2018 and 2022.

The e-commerce sector continues to gather steam due to an explosion in internet usage, particularly in emerging economies like China and India. Online retail sales and emerging m-commerce has also witnessed significant growth due to increased penetration of internet and smartphone use.

These factors bode well for Amazon as well as other players like Groupon GRPN, Expedia EXPE, TripAdvisor TRIP and PetMed Express PETS.

Prime, Whole Foods Acquisition Makes Amazon a Buy

Amazon’s strong focus toward enhancing Prime service with the help of exciting discounts, expanding free two-hour delivery facilities, growing movies and video portfolio, and many more are helping the company to bolster its presence in the retail sector.

Additionally, the acquisition of Whole Foods Market has helped the company to strengthen its footprint in the grocery retail market.

Recently, the company has also announced the availability of Prime Whole Foods discount at 121 Whole Foods Market stores located across 12 U.S. states. This move is in sync with its focus to strengthen presence in the retail sector.

Moreover, the launch of AmazonFresh Pickup that enables the customers to order online and collect them from a store nearby store is expected to aid growth.

Further, Amazon’s strong focus on global expansion is a major positive. Recent partnership with Monoprix, a French grocer, has bolstered its presence in France.

The company is striving hard to penetrate emerging markets like India, which holds great potential for growth in the online retail market. Amazon’s e-commerce platform in the country has been a big success and is expected to continue to boost the top-line growth.

According to a survey by the market research firm, Forrester, out of 2000 respondents, 80% shopped on Amazon India, while 65% preferred buying on Flipkart, the company’s biggest competitor in India.

Moreover, Amazon has a favorable combination of Zacks Rank #1 (Strong Buy) and a Momentum Score of A, which indicates that it is the right time to invest in this stock. Back-tested results show that this combination handily outperforms other stocks. You can see the complete list of today’s Zacks #1 Rank stocks here.

Further, Amazon’s current year earnings growth rate is projected at 181.76%.

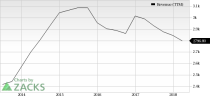

Amazon.com, Inc. Revenue (TTM)

Amazon.com, Inc. Revenue (TTM) | Amazon.com, Inc. Quote

Other Key Picks

However, Amazon is not the only stock that can benefit from the immense growth opportunities in the e-commerce market. Here we pick four stocks that are sure winners right now.

The first choice is daily discount deal provider Groupon, which is benefiting from strategic partnerships with the likes of Grubhub, ParkWhiz and Comcast. These are helping it to enhance product features. Moreover, the company’s tie-up with Gold Star, Expedia, Live Nation, Viator and Fanxchange remain catalysts for its growing penetration in the market.

Groupon also has a favorable combination of Zacks Rank #1 and a Momentum Score of B. Its earnings growth for the current year is pegged at 109.09%.

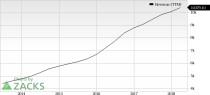

Groupon, Inc. Revenue (TTM)

Groupon, Inc. Revenue (TTM) | Groupon, Inc. Quote

Our next pick is online travel companies Expedia. Growth across most of the segments namely HomeAway, Core OTA, Brand Expedia, Hotels.com, Expedia Partner Solutions and Egencia has been aiding the company’s gross bookings and stayed room night’s growth.

Further, Expedia’s expanding global lodging portfolio and offering of discounts in its chain hotels are strengthening business in many geographic regions. Recently, the company selected American International Group for providing travel insurance to global customers.

All these endeavors will continue to attract customers to its platform which will further drive top-line growth.

At present, Expedia has a Zacks Rank #2 (Buy) and a Momentum score of B. Further, the company’s earnings growth rate for the current year is pegged at 21.86%.

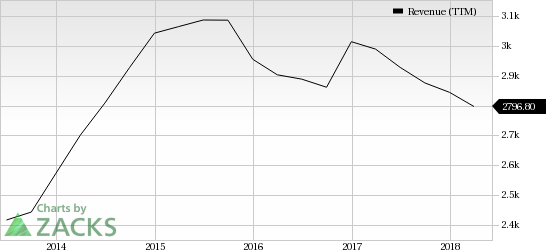

Expedia, Inc. Revenue (TTM)

Expedia, Inc. Revenue (TTM) | Expedia, Inc. Quote

TripAdvisor is benefiting from growing expansion in international restaurant reservation space is likely to help it sustain momentum in the market. The company’s strong focus toward advancement of Meta search, Instant Booking and mobile products will continue to improve its user base.

Currently, TripAdvisor has a Zacks Rank #2 and a Momentum score of A. Its earnings are expected to surge by 30.39% in the current year.

TripAdvisor, Inc. Revenue (TTM)

TripAdvisor, Inc. Revenue (TTM) | TripAdvisor, Inc. Quote

Another company that is on our radar is PetMed Express, a leading online pet pharmacy. The company’s expanding portfolio of medicines remains positive for the company’s growth prospects. Its increasing customer base continues to drive top-line growth.

Further, PetMed’s strategy of marketing its products under the renowned medicine brands like Frontline Plus, K9 Advantix, Advantage, Heartgard Plus, Sentinel and Interceptor will continue to drive its sales numbers.

The company has a Zacks Rank #2 and a Momentum score of A. Its earnings are expected to grow at the rate of 25.27% in the current year.

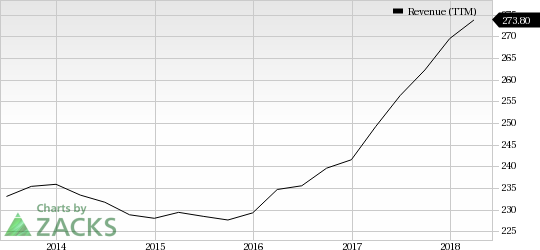

PetMed Express, Inc. Revenue (TTM)

PetMed Express, Inc. Revenue (TTM) | PetMed Express, Inc. Quote

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PetMed Express, Inc. (PETS) : Free Stock Analysis Report

Expedia, Inc. (EXPE) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Groupon, Inc. (GRPN) : Free Stock Analysis Report

TripAdvisor, Inc. (TRIP) : Free Stock Analysis Report

To read this article on Zacks.com click here.