Amazon's Sharp Portfolio Reduction Headlines Caxton Associates' Q3 Moves

Insight into Caxton Associates (Trades, Portfolio)' Latest 13F Filings and Strategic Adjustments

Caxton Associates (Trades, Portfolio), the renowned global macro hedge fund established by Bruce Kovner, has disclosed its 13F holdings for the third quarter of 2023. Known for its strategy of capitalizing on macroeconomic trends across various asset classes, Caxton Associates (Trades, Portfolio) is particularly recognized for its short-term trading approach and preference for low-volatility sectors. The latest report reveals significant portfolio adjustments, including new acquisitions, increased stakes, complete exits, and reduced positions in key companies.

New Additions to the Portfolio

Caxton Associates (Trades, Portfolio) has expanded its portfolio with 167 new stocks. Noteworthy additions include:

Alphabet Inc (NASDAQ:GOOGL), with 150,797 shares, making up 2.72% of the portfolio and valued at $197.33 million.

INVESCO QQQ Trust (NASDAQ:QQQ), comprising 42,500 shares, which is about 2.1% of the portfolio, totaling $15.23 million.

iShares 7-10 Year Treasury Bond ETF (NASDAQ:IEF), with 117,533 shares, accounting for 1.48% of the portfolio and valued at $10.76 million.

Key Position Increases

The fund also raised its stakes in 117 stocks, with significant increases in:

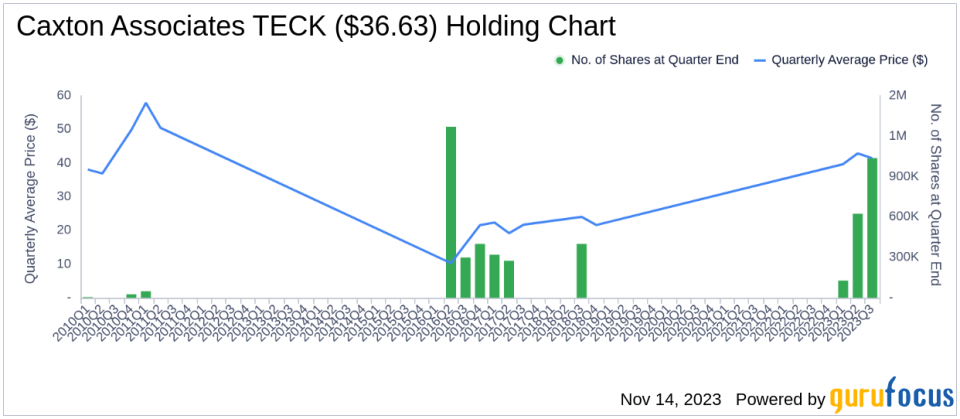

Teck Resources Ltd (NYSE:TECK), adding 412,204 shares for a total of 1,037,211 shares, marking a 65.95% increase and impacting the portfolio by 2.44%, valued at $44.69 million.

Netflix Inc (NASDAQ:NFLX), with an additional 41,184 shares, bringing the total to 42,537 shares, a staggering 3,043.9% increase, valued at $16.06 million.

Complete Exits from Holdings

Caxton Associates (Trades, Portfolio) has exited 253 positions in the third quarter of 2023, including:

NetEase Inc (NASDAQ:NTES), selling all 91,013 shares, which had a -1.3% impact on the portfolio.

ServiceNow Inc (NYSE:NOW), liquidating all 15,571 shares, causing a -1.29% impact on the portfolio.

Significant Reductions in Key Stocks

The fund reduced its positions in 80 stocks, with the most notable reductions in:

Amazon.com Inc (NASDAQ:AMZN), cutting 296,495 shares, a -89.44% decrease, affecting the portfolio by -5.72%. The stock traded at an average price of $134 during the quarter and has seen a 3.72% return over the past three months and 73.57% year-to-date.

NVIDIA Corp (NASDAQ:NVDA), reducing 81,091 shares, a -75.28% decrease, with a -5.07% impact on the portfolio. The stock's average trading price was $448.03 during the quarter, with returns of 13.50% over the past three months and 239.90% year-to-date.

Portfolio Overview

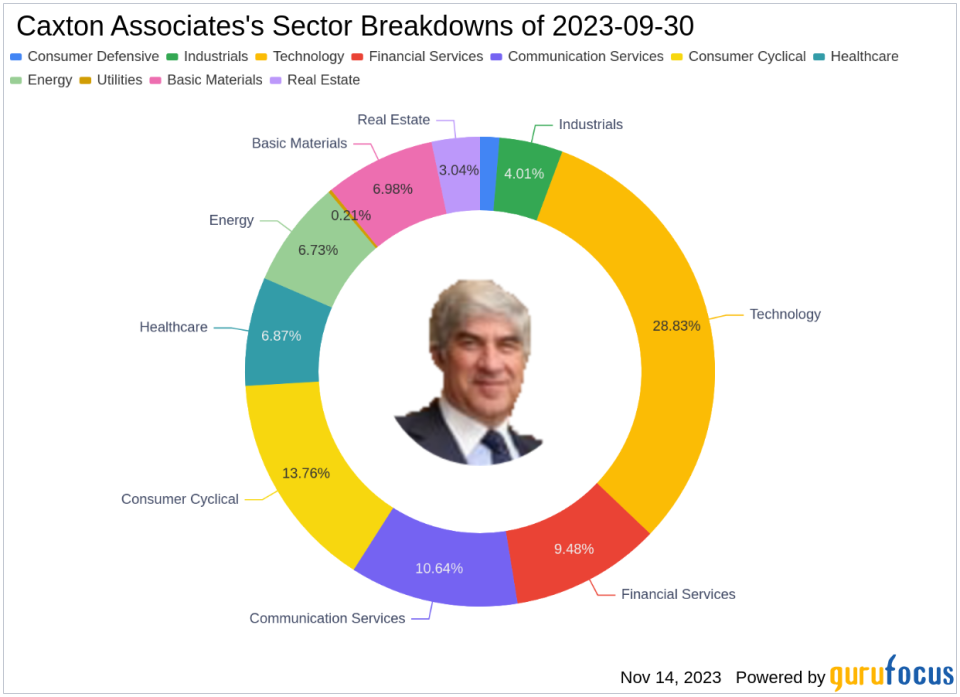

As of the third quarter of 2023, Caxton Associates (Trades, Portfolio)' portfolio consists of 389 stocks. The top holdings include 6.15% in Teck Resources Ltd (NYSE:TECK), 5.81% in Microsoft Corp (NASDAQ:MSFT), 4.11% in Autoliv Inc (NYSE:ALV), 3.27% in Adobe Inc (NASDAQ:ADBE), and 2.72% in Alphabet Inc (NASDAQ:GOOGL). The investments are predominantly concentrated across 11 industries, with Technology, Consumer Cyclical, and Communication Services leading the sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.