AMC Entertainment Holdings Inc (AMC) Posts Revenue Growth Amid Industry Challenges

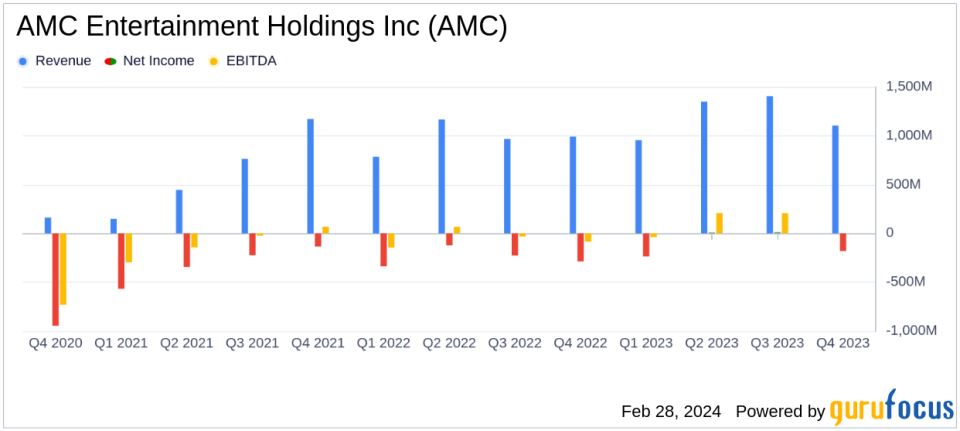

Revenue Growth: AMC's full year 2023 revenues increased by 23% over 2022, reaching $4.812.6 million.

Adjusted EBITDA Surge: Full year Adjusted EBITDA grew ninefold from $46.6 million in 2022 to $425.8 million in 2023.

Debt Reduction: AMC reduced the principal balance of its debt by $448.1 million during 2023.

Liquidity Enhancement: The company raised $865 million of gross cash proceeds through the sale of equity, ending the year with $884.3 million in cash reserves.

Net Loss Improvement: Net loss narrowed significantly from $(973.6) million in 2022 to $(396.6) million in 2023.

Attendance Uptick: Total attendance increased by 19.2% year-over-year, with U.S. markets attendance up by 19.8%.

On February 28, 2024, AMC Entertainment Holdings Inc (NYSE:AMC) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leader in the theatrical exhibition business with a presence in the United States and Europe, reported a significant recovery from the pandemic's impact, with revenue and Adjusted EBITDA reaching their highest levels since 2019.

AMC's revenue growth was particularly notable in the context of industry-wide challenges, including a diminished box office and the impact of strikes in Hollywood. The company's strategic distribution of concert movies, such as TAYLOR SWIFT | THE ERAS TOUR and RENAISSANCE: A FILM BY BEYONCE, played a pivotal role in this success, contributing to an 11.5% revenue increase in the fourth quarter compared to the same period in the previous year.

AMC's financial achievements are critical in the Media - Diversified industry, where the ability to adapt to changing consumer preferences and industry dynamics is key. The company's focus on innovative distribution strategies and cost management has allowed it to navigate a challenging environment effectively.

Key financial details from the Income Statement, Balance Sheet, and Cash Flow Statement underscore the importance of AMC's performance metrics. The company's efforts to reduce debt, bolster cash reserves, and manage costs have positioned it to tackle future challenges and capitalize on growth opportunities.

"AMC reported strong results for both the fourth quarter and full year of 2023, once again exceeding Wall Streets consensus expectations," said Adam Aron, AMC Entertainment Chairman and CEO. "It was another full year of continued meaningful recovery from the aftermath of the 2020 pandemic."

AMC's management has emphasized the temporary nature of the challenges posed by the writers and actors strikes of 2023, expressing optimism for the box office's recovery in the medium term. The company's proactive measures, including operating hour adjustments, cost mitigation, and portfolio right-sizing, have been implemented to navigate these temporary setbacks and maintain a trajectory of recovery.

In conclusion, AMC's performance in 2023 demonstrates resilience and strategic agility in the face of industry headwinds. The company's ability to deliver strong financial results, reduce debt, and increase liquidity bodes well for its future prospects, despite the ongoing challenges in the theatrical exhibition market.

For more detailed information on AMC's financial performance, including full financial tables and metrics, please refer to the company's 8-K filing.

Explore the complete 8-K earnings release (here) from AMC Entertainment Holdings Inc for further details.

This article first appeared on GuruFocus.