AMC Networks Inc (AMCX) Reports Mixed Results Amidst Industry Shifts

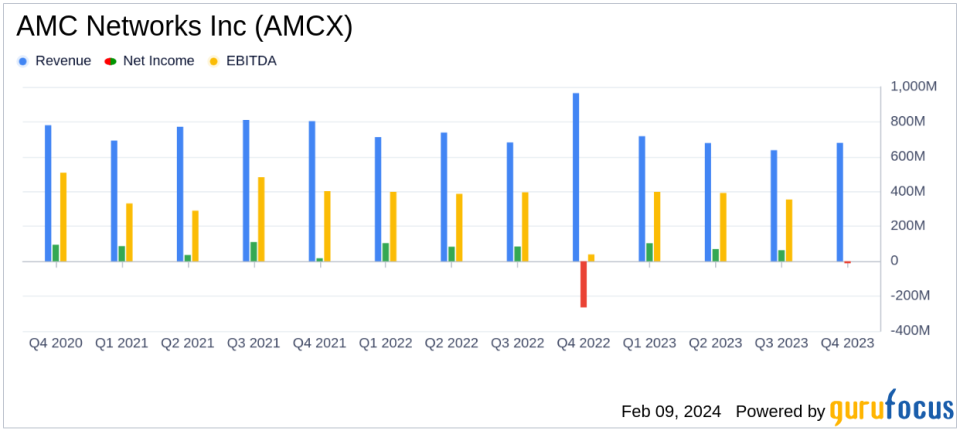

Net Revenues: Full year net revenues decreased by 12.4% to $2.71 billion, while Q4 saw a 29.6% drop to $678.8 million.

Operating Income: Full year operating income significantly improved to $388.4 million, a notable recovery from a loss in the prior year.

Adjusted Operating Income: Decreased by 9.2% year-over-year to $670.1 million for the full year, and by 27% to $100.3 million for Q4.

Earnings Per Share (EPS): Diluted EPS for the full year was $4.90, compared to $0.17 in the prior year; Q4 saw a loss per share of $0.50.

Free Cash Flow: Increased by 22.6% to $168.7 million for the full year, despite a 50.9% decrease to $66 million in Q4.

Streaming Growth: Streaming revenues grew by 13% to $566 million, ending the year with 11.4 million subscribers.

On February 9, 2024, AMC Networks Inc (NASDAQ:AMCX) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its cable networks including AMC, WE tv, BBC America, IFC, and SundanceTV, as well as its streaming platforms like AMC+, Acorn, and Shudder, faced a challenging year with significant shifts in the media landscape.

Year of Transition and Strategic Moves

AMC Networks' CEO Kristin Dolan highlighted the company's focus on programming, partnerships, and profitability. Despite a decrease in net revenues, AMC Networks saw growth in streaming revenue and subscriber base, expanded its Adjusted Operating Income (AOI) margin to 25%, and grew its free cash flow. The company also engaged in significant affiliate renewal activity, including with major domestic partners Charter and Dish/Sling, and expanded the addressable market of AMC+ through the launch of an ad-supported tier.

AMC Networks delighted fans with a deep slate of original programming across its networks and services, including "Anne Rices Mayfair Witches" and "The Walking Dead: Dead City." The company's content strategy and innovative packaging arrangements, such as the collaboration with Philo, demonstrate its adaptability in a fast-evolving media environment.

Financial Performance Analysis

The company's financial achievements are particularly important given the industry's ongoing transition towards streaming and digital platforms. AMC Networks' ability to grow its streaming revenue and subscriber base in the face of declining linear TV viewership is a testament to its strategic focus and the strength of its content offerings.

However, the company did not escape the broader industry challenges. Net revenues for the full year decreased by 12.4% to $2.71 billion, and the fourth quarter saw a sharper decline of 29.6% to $678.8 million. The operating loss of $11.4 million in the fourth quarter was a significant improvement from the prior year's loss, reflecting the company's cost management measures and operational efficiencies.

Adjusted Operating Income (AOI) for the full year was $670.1 million, down 9.2% from the previous year, with the fourth quarter contributing $100.3 million, a 27% decrease. The diluted earnings per share (EPS) for the full year was $4.90, a substantial increase from the prior year's $0.17, while the fourth quarter saw a loss per share of $0.50.

Free Cash Flow for the full year was a bright spot, increasing by 22.6% to $168.7 million. This growth was despite a 50.9% decrease to $66 million in the fourth quarter, highlighting the company's ability to generate cash amidst revenue pressures.

AMC Networks' financial tables reveal a mixed picture, with some segments like streaming showing resilience and growth, while others, such as domestic operations and international segments, faced declines in both revenue and operating income.

Looking Ahead

AMC Networks' performance in 2023 reflects a company in transition, navigating the challenges of a shifting media landscape. The company's focus on streaming growth and content curation, coupled with strategic partnerships and cost management, positions it to adapt to the evolving demands of the industry. As AMC Networks continues to leverage its strong content slate and expand its digital footprint, investors will be watching closely to see how these strategies translate into financial performance in the coming year.

For more detailed information, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from AMC Networks Inc for further details.

This article first appeared on GuruFocus.