AMC Networks (NASDAQ:AMCX) Reports Q4 In Line With Expectations

Television broadcasting and production company AMC Networks (NASDAQ:AMCX) reported results in line with analysts' expectations in Q4 FY2023, with revenue down 29.6% year on year to $678.8 million. It made a non-GAAP profit of $0.72 per share, down from its profit of $2.52 per share in the same quarter last year.

Is now the time to buy AMC Networks? Find out by accessing our full research report, it's free.

AMC Networks (AMCX) Q4 FY2023 Highlights:

Revenue: $678.8 million vs analyst estimates of $674.3 million (small beat)

Adjusted operating profit: $100.3 million vs analyst estimates of $102.8 million (2.4% miss)

EPS (non-GAAP): $0.72 vs analyst expectations of $0.84 (14.2% miss)

Free Cash Flow of $65.97 million, down 33.5% from the previous quarter

Gross Margin (GAAP): 42%, up from 36.5% in the same quarter last year

Market Capitalization: $742.2 million

AMC Networks Chief Executive Officer Kristin Dolan said: "In the fourth quarter and across 2023, we continued to see success in the areas that will drive this company forward – programming, partnerships and profitability. I’m encouraged that this year we were able to grow streaming revenue and strengthen our subscriber base, expand our consolidated AOI(1) margin to 25%, and meaningfully grow our free cash flow. Nearly a year since joining AMC Networks as CEO, I am proud of the progress we have made in a fast-changing environment, and the new and innovative ways we are engaging with viewers and our commercial and creative partners."

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Sales Growth

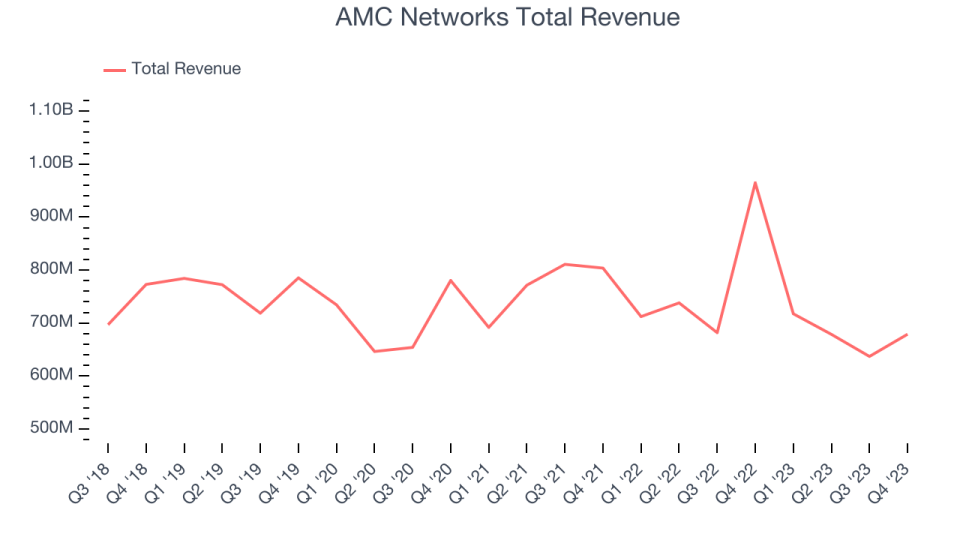

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. AMC Networks's revenue declined over the last 5 years, dropping 1.8% annually.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. AMC Networks's recent history shows its demand has decreased even further, as its revenue has shown annualized declines of 6.1% over the last 2 years.

This quarter, AMC Networks reported a rather uninspiring 29.6% year-on-year revenue decline to $678.8 million of revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to decline 1.1% over the next 12 months.

It’s not often you find a high-quality company at a significant discount to its historical P/E multiple, but that’s exactly what we found. Click here for your FREE report on this attractive Network Effect stock at a very silly price.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

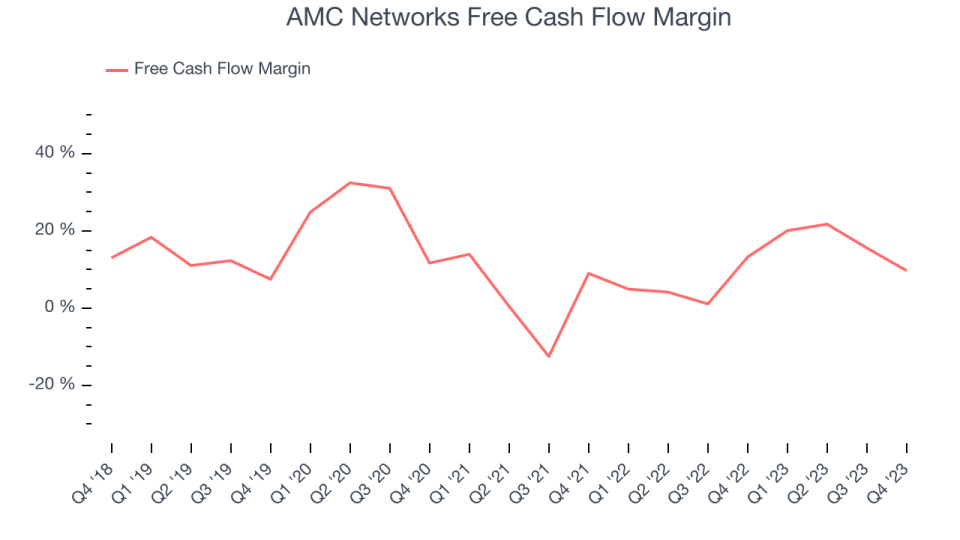

Over the last two years, AMC Networks has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 11.3%, slightly better than the broader consumer discretionary sector.

AMC Networks's free cash flow came in at $65.97 million in Q4, equivalent to a 9.7% margin, down 48.4% year on year. Over the next year, analysts predict AMC Networks's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 16.8% will decrease to 8%.

Key Takeaways from AMC Networks's Q4 Results

Revenue beat by a small amount, but both operating income and EPS missed. A bright spot was that free cash flow came in better than expected. From a product perspective, the company pointed out that AMC+ (the streaming platform) launched "an ad-supported tier in the third quarter, with strong new sign-up activity on available platforms since launch." Overall, this was a mixed quarter for AMC Networks. The stock is up 2.8% after reporting and currently trades at $17.5 per share.

AMC Networks may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.