Amcor (AMCR) Q4 Earnings Beat, Decline Y/Y on Low Volumes

Amcor Plc AMCR reported fourth-quarter fiscal 2023 (ended Jun 30, 2023) adjusted earnings per share (EPS) of 19 cents, which beat the Zacks Consensus Estimate of adjusted EPS of 18 cents. The bottom line declined 21% from the prior-year quarter’s EPS of 24 cents due to lower volumes, This was partially offset by price/mix benefits.

Including special items, the company reported EPS of 12 cents, up 76% from the prior-year quarter’s EPS of 7 cents.

Total revenues for the quarter were $3,673 million, which missed the Zacks Consensus Estimate of $3,866 million. Revenues were down 6% in comparison with the year-ago quarter which included an unfavorable impact of approximately 2% related to items affecting comparability and price increases of 1%. Movements in foreign exchange rates had no material impact on the quarter’s net sales.

Net sales on a comparable constant currency basis were 5% down year over year. Volumes were down 7%. This was somewhat offset by price/mix benefits of approximately 2%.

The volume decline witnessed in the reported quarter was lower than our projection of a 5% decline. The weaker-than-expected performance was mainly due to soft demand as well as customer destocking in both segments. Realized price/mix benefits were also lower than our expectation of 4.5% growth for the quarter.

Amcor PLC Price, Consensus and EPS Surprise

Amcor PLC price-consensus-eps-surprise-chart | Amcor PLC Quote

Costs and Margins

The cost of sales decreased 5% year over year to $2,951 million. Gross profit dipped 9% year over year to $722 million. The gross margin was 19.7% for the quarter under review, a contraction from 20.3% reported in the prior-year quarter.

SG&A expenses declined 4% year on year to $329 million from $342 million in the prior-year quarter. Adjusted operating income in the quarter under review was $436 million, down 13.7% from $505 million in the prior-year quarter. The adjusted operating margin was 11.9%, compared with 12.9% in the prior-year quarter.

Adjusted EBITDA in the quarter was $540 million in the fourth quarter of fiscal 2023, compared with $609 million in the fourth quarter of fiscal 2022. Adjusted EBITDA margin was 14.7% in the quarter under review, a 90 basis point contraction year over year.

Segment Performances

The Flexibles segment’s net sales decreased 6% year over year to $2,777 million. The decline included a favorable impact of approximately 1% related to movements in foreign exchange rates, an unfavorable 3% impact from items affecting comparability and price increases of 1%. On a comparable constant currency basis, net sales declined 5% year over year on 7% lower volumes, partly offset by price/mix benefits of 2%.

Our model projected the segment’s volumes to decline 4.7% while price/mix was expected to be a favorable 5%.

The Rigid Packaging segment’s net sales were $897 million in the quarter under review, down 5% from the prior-year quarter. This included an unfavorable impact of 1% related to movements in foreign exchange rates. On a comparable constant currency basis, net sales were down 4% from the last year quarter due to 6% lower volumes, partly offset by price/mix benefits of approximately 2%.

Our model had projected a 6.2% drop in volumes and a price/mix gain of 2.8% for the segment

The Flexibles segment’s adjusted operating profit was $387 million, marking an 14% decline from the prior-year quarter’s figure. Adjusted operating profit for the Rigid Packaging segment declined 24% year over year to $73 million.

Operating profit of both segments bore the impact of low volumes, increased volatility in customer order patterns, unfavorable mix trends and cost inflation. However, improved pricing and savings from cost-reduction initiatives had somewhat dampened the impact.

Financial Updates

As of the end of fiscal 2023, Amcor had $689 million of cash and cash equivalents, compared with $775 million at fiscal 2022 end. The company generated $1,261 million in cash from operating activities in fiscal 2023, compared with $1,526 million in the prior fiscal.

AMCR reported an adjusted free cash outflow of $848 million in fiscal 2023 against $1,066 million in the last fiscal year. As of Jun 30, 2023, Amcor’s net debt totaled $6,057 million.

Amcor returned $1.2 billion to shareholders through fiscal 2023 as dividends and share repurchases. The company repurchased 41 million shares for $431 million in fiscal 2023. AMCR has targeted total share repurchases of $70 million for fiscal 2024. The company raised its quarterly dividend to 12.25 cents per share from the prior 12 cents per share.

Fiscal 2023 Performance

Amcor reported adjusted EPS of 73 cents in fiscal 2023, surpassing the Zacks Consensus Estimate of EPS of 72 cents. Earnings came within the company’s guidance of 72-74 cents per share. The bottom line declined 9% year over year.

Including special items, AMCR reported EPS of 71 cents, compared with EPS of 53 cents in fiscal 2022.

Total revenues improved 1% year over year to $14.7 billion but missed the consensus estimate of $14.8 billion. On a comparable constant currency basis, net sales were in line with the prior fiscal, reflecting price/mix benefits of approximately 3% while volumes were down 3%.

Our projection was a price/mix gain of 3.8% and a volume decline of 2.8% for fiscal 2023.

Fiscal 2024 Guidance

Adjusted EPS for fiscal 2024 is expected to be in the band of 67-71 cents. The company projects adjusted free cash flow of $850-$950 million in fiscal 2024.

Share Price Performance

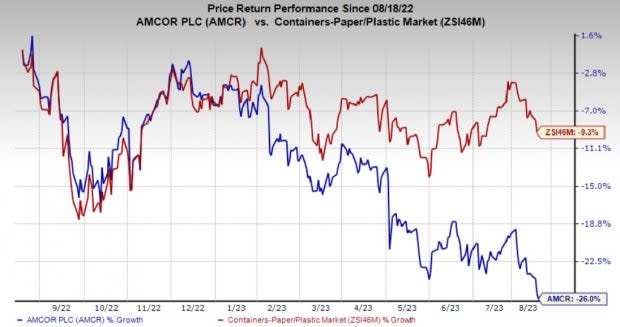

Over the past year, Amcor’s shares have fallen 26%, compared with the industry’s 9.3% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Amcor currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Industrial Products sector are Astec Industries ASTE, Caterpillar CAT and Terex Corporation TEX. Each of these stocks sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Astec has an average trailing four-quarter earnings surprise of 19.95%. The Zacks Consensus Estimate for ASTE’s fiscal 2023 earnings is pegged at $3.11 per share. The consensus estimate for 2023 earnings has moved 14% north in the past 30 days and indicates year-over-year growth of 153%. Its shares have gained 17.4% in the last year.

The Zacks Consensus Estimate for CAT’s 2023 EPS is pegged at $19.25. The estimates have been revised upward 7% over the last 30 days. The fiscal 2023 earnings estimate projects year-over-year growth of 39%. It has a trailing four-quarter average earnings surprise of 18.5%. CAT’s shares have gained 40% in the last year.

Terex has an average trailing four-quarter earnings surprise of 32.8%. The Zacks Consensus Estimate for TEX’s 2023 earnings is pegged at $6.70 per share. The consensus estimate for 2023 earnings has moved 55% north in the past 30 days. The estimate suggests year-over-year growth of 55%. TEX’s shares have gained 60% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Terex Corporation (TEX) : Free Stock Analysis Report

Amcor PLC (AMCR) : Free Stock Analysis Report