AMD Acquires Pensando to Build Leading-Edge Data Center

Advanced Micro Devices AMD recently announced that it has entered a definitive agreement to acquire Pensando for approximately $1.9 billion before working capital and other adjustments on Apr 4. The two companies expect to close the deal by the second quarter of 2022.

Pensando, which was founded in 2017, makes products to accelerate networking, security, storage and other services for cloud, enterprise and edge applications.

AMD has made this strategic deal to strengthen its technology portfolio and expand its rapidly growing data center business amid strong competition.

Following the announcement, AMD’s shares surged on Apr 4 and closed the day with a 2.16% gain.

In the year-to-date period, the Zacks Rank #3 (Hold) company’s shares have fallen 23.1% compared with the Zacks Electronics-Semiconductors industry’s and the Zacks Computer and Technology sector’s decline of 15.1% and 10.9%, respectively. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

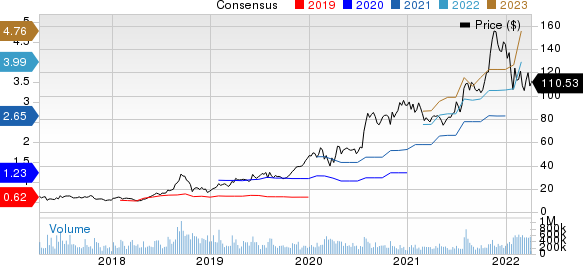

Advanced Micro Devices, Inc. Price and Consensus

Advanced Micro Devices, Inc. price-consensus-chart | Advanced Micro Devices, Inc. Quote

AMD’s Acquisition Strategy: A Key to Win Market Share

AMD decided to buy Pensando to build a leading-edge data center cost-effectively without compromising on security to provide the best performance to customers and intensify competition amid the industry peers.

However, with expected revenues of $5 billion, an acquisition of $1.9 billion appears to be a costly affair. The company also completed the acquisition of Xilinx in an all-stock deal worth $35 billion. As of Dec 25, 2021, AMD had cash and cash equivalents (including marketable securities) of $3.61 billion as opposed to a total debt (long-term plus short-term) of $313 million.

Together AMD and Xilinx will cater to some of the most important growth segments for the industry, including data center, gaming, PCs, communications, automotive, industrial and aerospace and defense.

NVIDIA Corporation NVDA is one of its major competitors of AMD. The competition between the two companies has only intensified of late.

NVIDIA is a dominant name in the data center, professional visualization and gaming markets where the company peers are playing a catch-up role. NVIDIA is a major competitor of AMD in the GPU market, and competition in the mobile segment has been intensifying following NVIDIA’s acquisition of ARM Holdings.

Intel INTC recently completed the first phase of the sale of its manufacturing facility in China in sync with its long-term strategic goals. The company is gradually reducing its dependence on the PC-centric business by transitioning to data-centric businesses such as AI and autonomous driving.

Intel's acquisition of Israel-based Mobileye, an autonomous vehicle technology provider, is positive. The buyout will help the company rapidly penetrate the autonomous car technology market that is currently dominated by NVIDIA.

Another Stock to Consider

While AMD is a good stock to hold in your portfolio here is another better ranked stock in the broader computer and technology sector to consider in your portfolio.

ASGN ASGN carries a Zacks Rank #2 (Buy).

ASGN shares have fallen 5.4% in the year-to-date period, compared with the Zacks Computers - IT Services industry’s decline of 14.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

ASGN Incorporated (ASGN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research