Amedisys Inc (AMED) Reports Mixed Results Amidst Merger Transactions

Net Service Revenue: Increased by $8.8 million in Q4 and $13.2 million year-over-year.

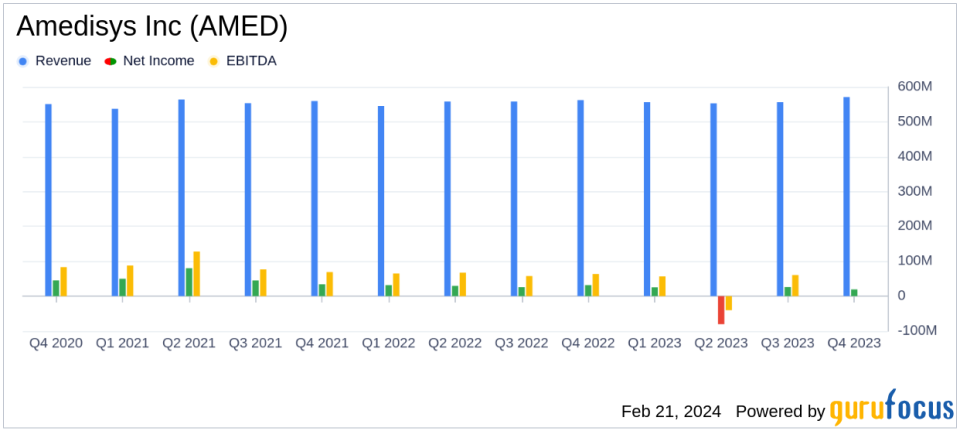

Net Income: Q4 net income was $19.3 million, down from $31.7 million in the prior year. Full-year net loss of $9.7 million compared to net income of $118.6 million in 2022.

Adjusted EBITDA: Q4 adjusted EBITDA decreased to $56.7 million from $59.9 million in 2022. Full-year adjusted EBITDA was $247.0 million, down from $262.1 million.

Diluted EPS: Q4 adjusted diluted EPS was $0.94, down from $1.16 in 2022. Full-year adjusted diluted EPS was $4.30, down from $5.01.

Divestiture Impact: The divestiture of the personal care business impacted revenue comparisons year-over-year.

Amedisys Inc (NASDAQ:AMED) released its 8-K filing on February 21, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a leading provider of home healthcare services in the United States, reported a mixed set of results, with an increase in net service revenue but a decrease in net income, primarily due to costs associated with merger transactions.

Company Overview

Amedisys Inc is a healthcare services company that operates across the United States, delivering personalized home health, hospice, high acuity care services, and previously personal care services. The company's Home Health segment, which generates the majority of its revenue, provides skilled nurses, therapists, and aids to patients' homes. The Hospice segment operates centers designed for terminally ill patients, while the High Acuity Care segment delivers inpatient hospital, SNF care, and palliative care to patients in their homes.

Financial Performance and Challenges

The company's net service revenue saw a modest increase in both the fourth quarter and the full year, despite the divestiture of its personal care business in early 2023. However, net income for the fourth quarter was $19.3 million, a decrease from $31.7 million in the prior year, reflecting $11.5 million in costs related to merger transactions. The full-year results showed a net loss of $9.7 million, which included $142.7 million in merger-related costs, compared to a net income of $118.6 million in 2022.

Adjusted EBITDA and adjusted net income also experienced declines, indicating the financial impact of the merger expenses. Adjusted net service revenue remained relatively stable, with the divested personal care business contributing to the year-over-year comparison.

Importance of Financial Achievements

For a healthcare services company like Amedisys, maintaining and growing revenue is crucial for sustaining operations and investing in quality care. The increase in net service revenue suggests resilience in the company's core services despite external challenges. However, the net loss and decrease in adjusted EBITDA highlight the significant costs associated with strategic transactions, which can affect short-term profitability but may be necessary for long-term growth and competitiveness in the healthcare industry.

Analysis and Outlook

The financial results of Amedisys Inc reflect a period of transition, marked by strategic mergers and divestitures. While the company's revenue growth demonstrates the underlying demand for its services, the costs associated with these transactions have weighed on profitability. As the company moves forward with its merger with UnitedHealth Group Incorporated, investors will be watching closely to see how these strategic moves will position Amedisys for future growth and profitability in the evolving healthcare landscape.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and consider the company's performance in the context of the broader healthcare services industry.

Explore the complete 8-K earnings release (here) from Amedisys Inc for further details.

This article first appeared on GuruFocus.