Ameresco Inc (AMRC) Posts Record Backlog and Robust Q4 Growth

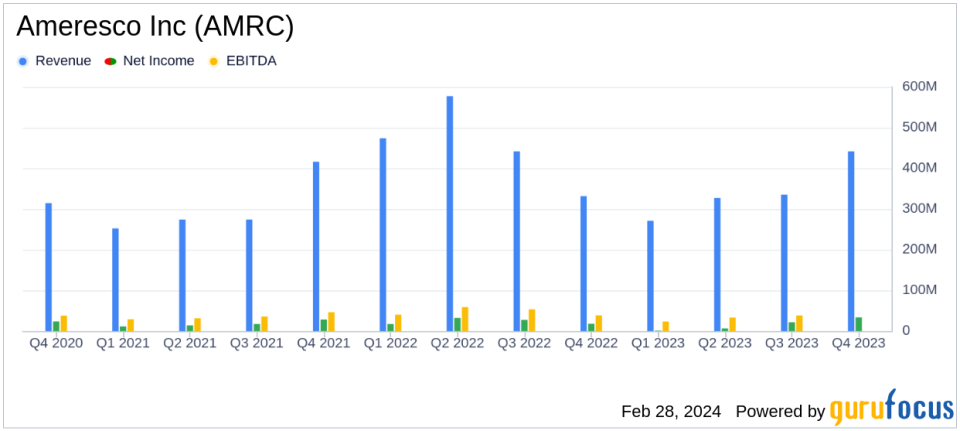

Revenue: Full year revenue of $1.374 billion and Q4 revenue of $441.4 million, marking a 33% increase in Q4.

Net Income: Net income attributable to common shareholders reached $62.5 million for the year and $33.7 million for Q4.

Adjusted EBITDA: Achieved $163.0 million for the full year and $54.9 million for Q4, with guidance to 38% growth at the midpoint for 2024.

GAAP and Non-GAAP EPS: GAAP EPS of $1.17 and Non-GAAP EPS of $1.26 for the full year; Q4 GAAP EPS of $0.64 and Non-GAAP EPS of $0.69.

Backlog: Record total project backlog nearing $4 billion, with $520 million in new awards in Q4.

Energy Assets: 717 MWe of assets in development, with 63 MWe placed into operation in Q4.

Guidance: 2024 revenue expected between $1.60 billion and $1.70 billion, with adjusted EBITDA between $210 million and $240 million.

Ameresco Inc (NYSE:AMRC), a leader in energy efficiency and renewable energy solutions, announced its financial results for the fourth quarter and full year of 2023 on February 28, 2024. The company released its 8-K filing, showcasing a strong finish to a challenging year with significant growth in revenue and profit.

Ameresco specializes in delivering comprehensive energy solutions, including energy efficiency, infrastructure upgrades, and renewable energy projects across North America and Europe. The company's services cater to a wide range of clients, including governmental, educational, utility, healthcare, and commercial entities.

Financial Performance and Challenges

The fourth quarter results demonstrated Ameresco's resilience and ability to execute on its growth strategy. Despite industry headwinds such as supply chain issues and administrative bottlenecks, the company managed to convert and execute on several delayed projects, contributing to a 40% increase in fourth quarter project revenues. Ameresco's CEO, George Sakellaris, highlighted the company's success in growing its total project backlog by nearly 50%, ending the year with a record $3.9 billion, and growing its assets in development by 35% to 717 MWe.

However, Ameresco faced challenges, including the impact of larger, lower margin contracts on gross margin, which declined to 16.8%. The company also navigated a complex tax landscape, benefiting from clean energy tax incentives under the Inflation Reduction Act, which resulted in a larger than expected effective tax rate benefit of (67.0%).

Financial Achievements and Industry Significance

Ameresco's financial achievements are particularly significant in the construction industry, where project backlog and asset development are critical indicators of future growth. The company's record backlog and asset pipeline metrics underscore its market positioning and ability to achieve substantial long-term growth in revenues and profitability. The doubling of new awards in 2023 to approximately $2.2 billion, compared to the previous year's $1.1 billion, and the continued high level of proposal activity, are testament to Ameresco's strong market demand.

Key Financial Metrics

Key financial details from Ameresco's income statement, balance sheet, and cash flow statement include:

Financial Metric | Q4 2023 | Full Year 2023 |

|---|---|---|

Total Revenue | $441.4 million | $1.374 billion |

Net Income Attributable to Common Shareholders | $33.7 million | $62.5 million |

Adjusted EBITDA | $54.9 million | $163.0 million |

GAAP EPS | $0.64 | $1.17 |

Non-GAAP EPS | $0.69 | $1.26 |

These metrics are important as they provide insights into the company's profitability, operational efficiency, and overall financial health. Adjusted EBITDA and EPS (both GAAP and Non-GAAP) are particularly useful for investors to assess Ameresco's core operational performance and to make comparisons with peers in the industry.

"Fourth quarter results represented a strong finish to a challenging year, demonstrating positive momentum that supports Amerescos long term growth trajectory," said CEO George Sakellaris.

Analysis and Outlook

Ameresco's performance in Q4 and the full year of 2023 reflects the company's strategic focus on project execution and growth in its energy assets portfolio. The company's guidance for 2024 suggests continued confidence in its business model, with expected revenue growth of 20% and adjusted EBITDA growth of 38% at the midpoints. The planned capex of $350 million to $400 million, primarily funded through project financing, indicates Ameresco's commitment to investing in its future growth.

For value investors and potential GuruFocus.com members, Ameresco's latest earnings report presents a company with a solid foundation for future growth, backed by a record project backlog and a strong pipeline of energy assets. The company's ability to navigate industry challenges and capitalize on market opportunities makes it a noteworthy consideration for investment portfolios focused on the construction and clean energy sectors.

For more detailed analysis and updates on Ameresco Inc (NYSE:AMRC) and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Ameresco Inc for further details.

This article first appeared on GuruFocus.