American Axle (AXL) Q2 Earnings Beat Estimates, Decline Y/Y

American Axle & Manufacturing Holdings AXL delivered earnings of 12 cents per share in second-quarter 2023, surpassing the Zacks Consensus Estimate of 8 cents. However, the bottom line fell from the 22 cents reported in the year-ago quarter.

The company generated quarterly revenues of $1,571 million, outpacing the Zacks Consensus Estimate of $1,565 million. Revenues increased 9% on a year-over-year basis, led by contributions from the Tekfor acquisition.

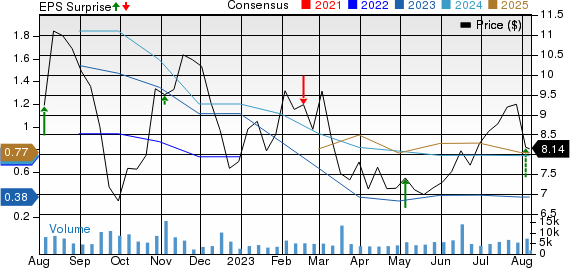

American Axle & Manufacturing Holdings, Inc. Price, Consensus and EPS Surprise

American Axle & Manufacturing Holdings, Inc. price-consensus-eps-surprise-chart | American Axle & Manufacturing Holdings, Inc. Quote

Segmental Performance

In the reported quarter, the Driveline segment recorded sales of $1,086.5 million, rising 6% year over year and surpassing our estimate of $1,084.3 million. The segment registered adjusted EBITDA of $152.1 million, up 5% on a year-over-year basis and beating our estimate of $135.3 million.

The company’s Metal Forming business generated revenues of $634.2 million during the quarter, up 13.7% from the year-ago figure and exceeding our estimate of $453.9 million. The segment witnessed an adjusted EBITDA of $39.5 million, falling 37% and lagging our estimate of $50.3 million.

Financial Position

American Axle’s second-quarter SG&A expenses totaled $91.1 million, up from $84.8 million incurred in the prior-year quarter.

Net cash provided by operating activities was $132.8 million, down from $146.7 million in the year-ago period. Capital spending in the quarter was $44.1 million, up from $42.6 million. In the three months ended Jun 30, 2023, the company posted an adjusted free cash flow of $95.8 million, down from $114.3 million recorded in the year-earlier period.

As of Jun 30, 2023, American Axle had cash and cash equivalents of $511.1 million compared with $511.5 million on Dec 31, 2022. Its net long-term debt was $2,853.9 million, up from $2,845.1 million as of Dec 31, 2022.

Reiterated 2023 Outlook

American Axle envisions revenues in the range of $5.95-$6.25 billion. The estimate for adjusted EBITDA is in the band of $725-$800 million. Adjusted FCF is expected to be in the range of $225-$300 million, considering capital spending between 3.5% and 4% of sales.

Zacks Rank & Key Picks

AXL currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Oshkosh Corporation OSK, Toyota Motor Corporation TM and PACCAR Inc. PCAR, sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for OSK’s 2023 sales and earnings implies year-over-year growth of 17.1% and 110%, respectively. The EPS estimate for 2023 has moved north by $1.28 in the past seven days. The 2024 EPS estimate has moved up by $1.14 in the past seven days.

The Zacks Consensus Estimate for TM’s 2023 sales and earnings implies year-over-year growth of 10.9% and 61.7%, respectively. The EPS estimate for 2023 has moved north by 21 cents in the past seven days. The 2024 EPS estimate has moved up by 20 cents in the past seven days.

The Zacks Consensus Estimate for PCAR’s 2023 sales and earnings implies year-over-year growth of 19.6% and 40.1%, respectively. The EPS estimate for 2023 has moved up by 71 cents in the past 30 days. The 2024 EPS estimate has moved north by 35 cents in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

American Axle & Manufacturing Holdings, Inc. (AXL) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report